Market News

Trade Setup for Nov 21: NIFTY50 faces hurdle at 23,800, all eyes on 200 EMA

.png)

4 min read | Updated on November 21, 2024, 07:15 IST

SUMMARY

Despite a positive start and a strong up move, the NIFTY50 index failed to sustain its gains and ended Tuesday’s session marginally higher. Unless the index breaks the 23,800 zone with a strong candle, the trend may remain weak.

Stock list

The NIFTY50 index snapped a seven-day losing streak and ended Tuesday's session in green, tad below its 200 day exponential moving average (EMA).

Asian markets @ 7 am

- GIFT NIFTY: 23,577 (-0.39%)

- Nikkei 225: 38,030 (-0.84%)

- Hang Seng: 19,646 (-0.30%)

U.S. market update

- Dow Jones: 43,408 (▲0.3%)

- S&P 500: 5,917 (▲0.0%)

- Nasdaq Composite: 18,966 (▼0.1%)

U.S. indices ended Wednesday's volatile session on a mixed note ahead of AI chip maker Nvidia’s earnings. All the three indices recovered nearly 1% from the day’s low, ending the flat-to-positive.

Meanwhile, the indices will react to the third quarter earnings of the Nvidia today as the results were announced after the market hours. The earnings and the top line both were above the street expectations. Additionally, the company provided revenue guidance of $37.5 billion, plus or minus 2%, which was above the expectation of $37 billion. However, the stock fell after the market hour as the profit margins dipped sequentially in Q3 to 74.6% from 75.1% in the previous quarter.

NIFTY50

- November Futures: 23,513 (▼0.3%)

- Open Interest: 4,85,176 (▼1.0%)

The NIFTY50 index snapped a seven-day losing streak and ended Tuesday's session in green, tad below its 200 day exponential moving average (EMA). Despite a positive start, the index surrendered all its gains during the last hour of the session.

The technical structure of the index on the daily chart looks range-bound between 23,800 and 23,000 zones. Additionally, as the index took support around 200 EMA the volatility spiked and it witnessed sharp swings in both the directions. For today’s expiry, traders should monitor the immediate support around 23,350 and resistance level of 23,800. Unless the index breaks this range on a closing basis, the trend may remain sideways. However, a break above this range may provide further directional clues.

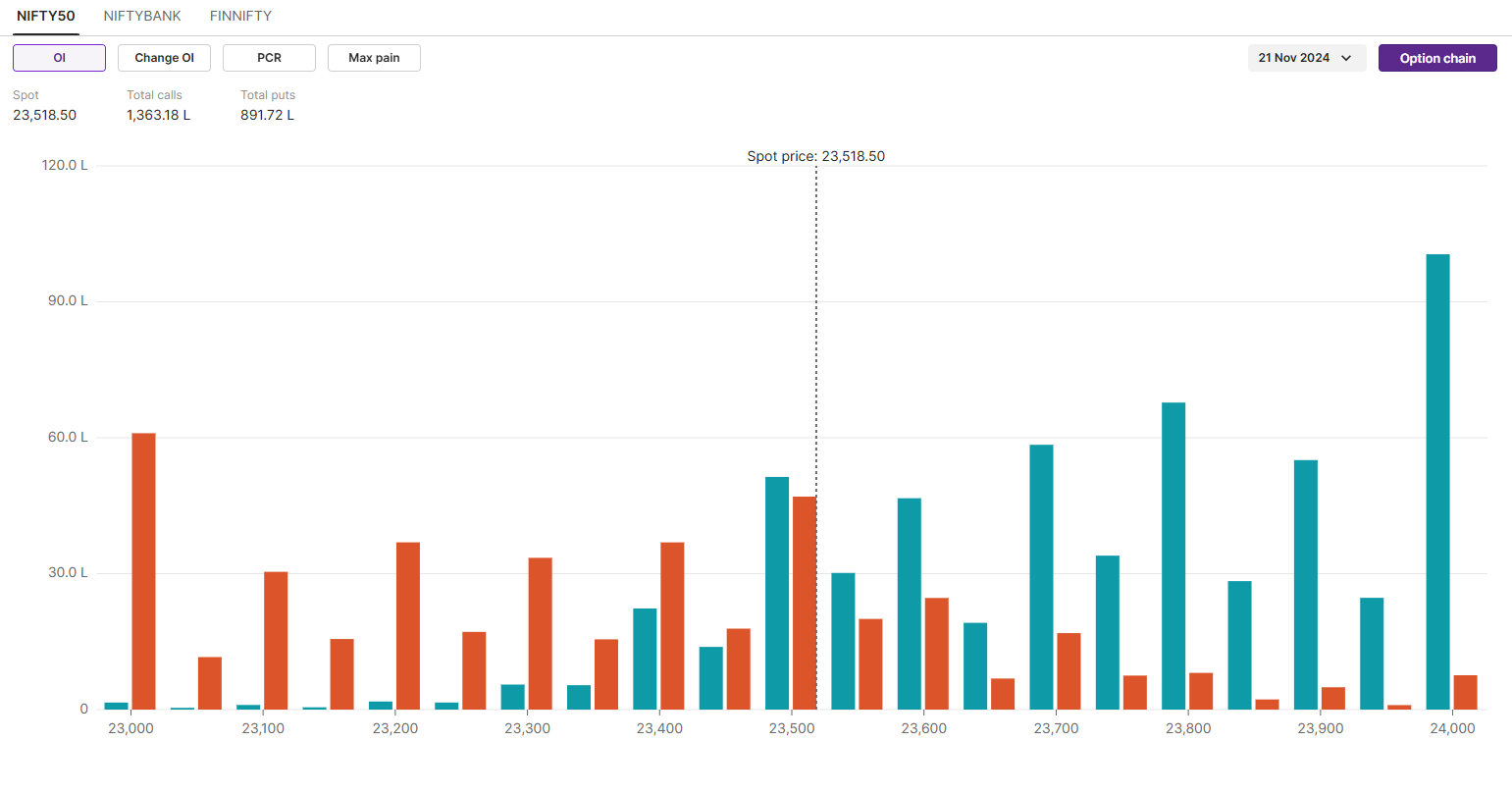

Meanwhile, the open interest data for today’s expiry remains evenly balanced with significant call open interest at 23,800 strike and put base at 23,000 strikes. Moreover, the index also witnessed significant addition of call and put options around 23,500 strike, suggesting a range-bound activity around this level.

SENSEX

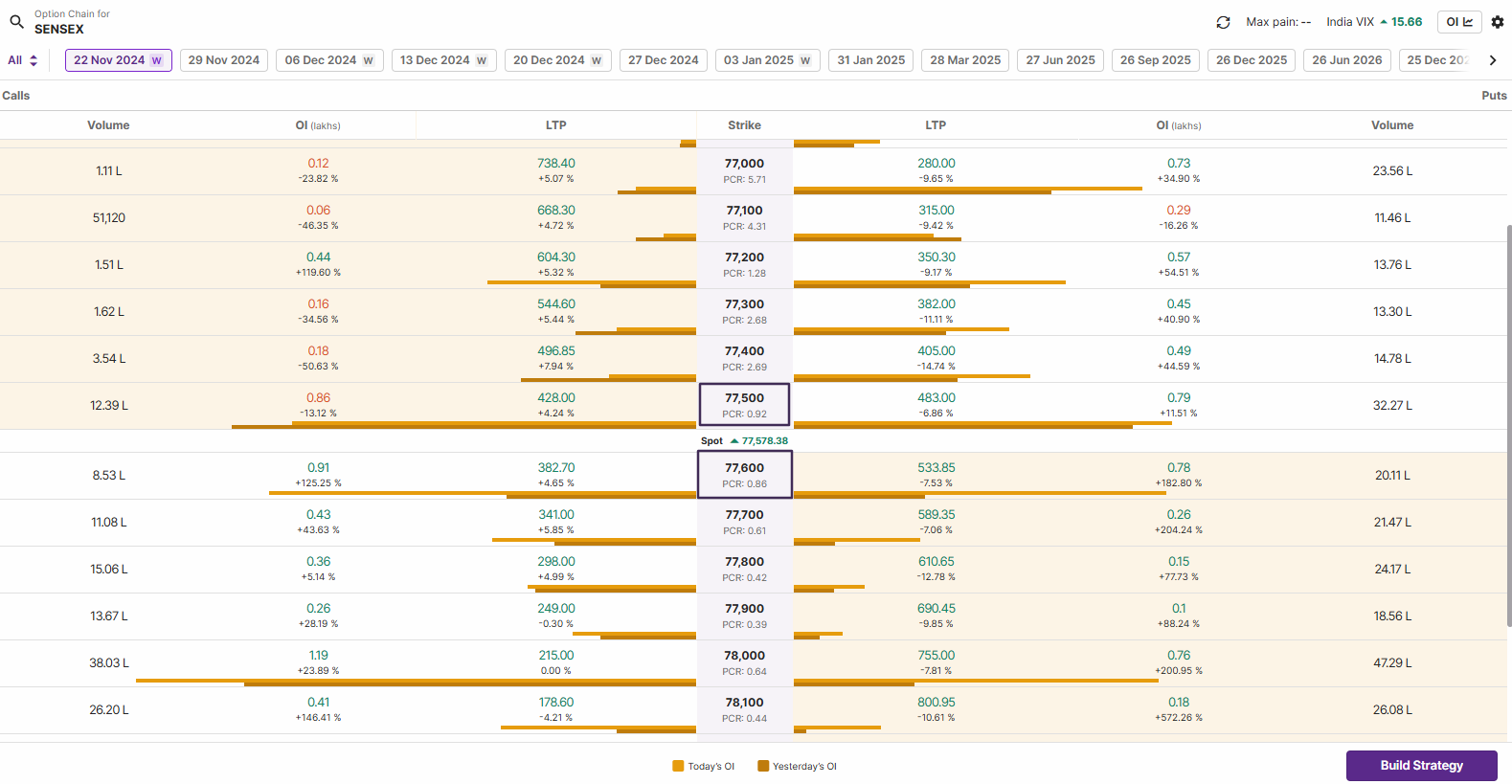

- Max call OI: 80,000

- Max put OI: 75,000

The SENSEX also ended the seven day losing spree and ended Tuesday's session in the green, above the psychologically crucial 200 EMA. However, the index also failed to protect its intraday gains and formed a bearish candle on the daily chart, similar to the Gravestone doji pattern.

A gravestone doji is a candlestick pattern with a long upper shadow, little to no lower shadow, and a close near the open. It indicates potential reversal or bearish sentiment. Meanwhile, for further directional clues, traders can monitor the high (78,451) of the doji pattern and 18 November low (76,965). A break of this range with a strong candle will provide directional clues.

The open interest data for the 22 November expiry has significant call and put base at 77,500 and 77,600 strikes, suggesting potential range-bound movement around these strikes. Additionally, the index also has a strong call base at 78,000 and put base at 77,000 strikes.

FII-DII activity

Stock scanner

Under F&O ban: Aarti Industries, Aditya Birla Fashion and Retail, Gujarat Narmada Valley Fertilisers & Chemicals (GNFC), Granules India, Hindustan Copper and Indraprastha Gas

Added under F&O ban: Indraprastha Gas

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story