Market News

Trade setup for June 6: Will NIFTY50 breach major resistance zone of 24,850-24,900 and head higher?

.png)

4 min read | Updated on June 08, 2025, 14:21 IST

SUMMARY

NIFTY50 opened higher, buoyed by the strengthening Rupee and hopes of foreign investors turning net buyers again. However, caution ahead of the RBI rate decision and mixed performances from global peers kept investors on edge. 24,850-24,900 is the crucial resistance zone that needs to be breached for further upside.

NIFTY50 index continued the previous day’s optimism and opened the 5th June’s session with a slight gap-up. | Image: Shutterstock

Asian markets @ 7 am

- GIFT NIFTY: 24,843 (-0.05%)

- Nikkei 225: 37,723 (+0.45%)

- Hang Seng: 23,831 (-0.31%)

U.S. market update

- Dow Jones: 42,319 (-0.25%)

- S&P 500: 5,939 (-0.53%)

- Nasdaq Composite: 19,298 (-0.83%)

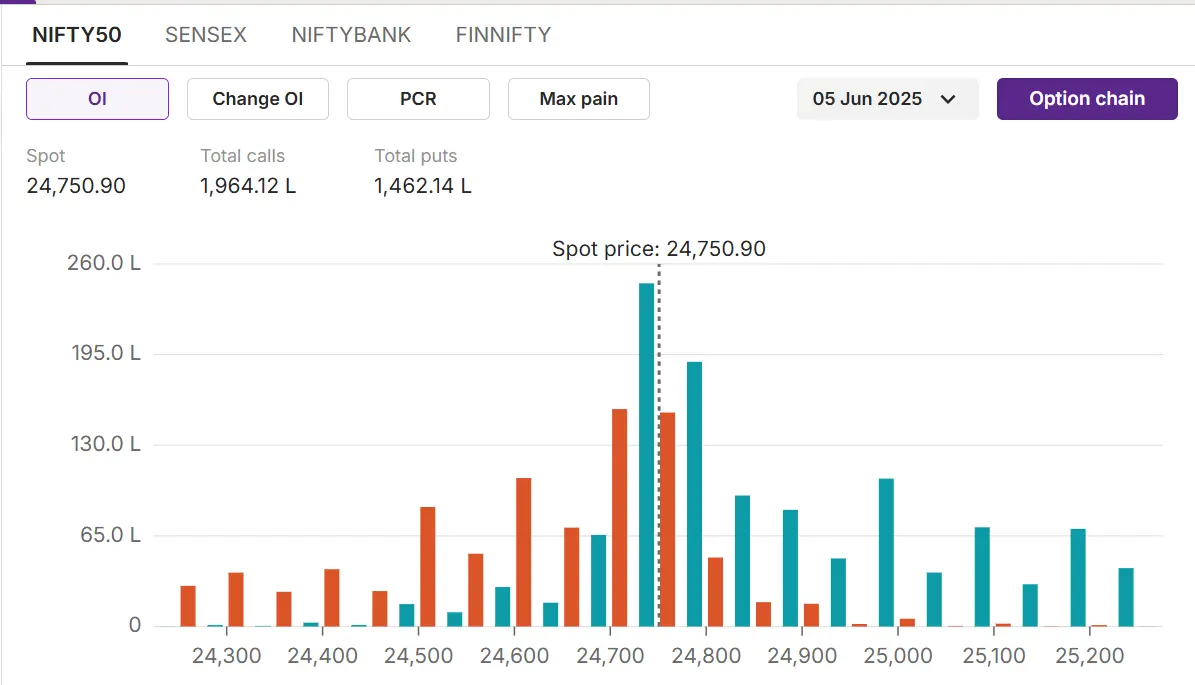

NIFTY50

- Max call OI: 24,750

- Max put OI: 24,700

- (Ten strikes to ATM, 12th June expiry)

NIFTY50 index continued the previous day’s optimism and opened the 5th June’s session with a slight gap-up. Hopes for a 25 or 50 bps rate cut from the RBI's policy decision led to optimism, despite mixed performances from the US and Asian major indices. Moreover, Indian stock market sentiments strengthened due to the weakness in the Dollar and declining US bond yields amid a gradual slowdown in the US economy attracting foreign investors yet again to the emerging markets.

However, cautiousness ahead of the RBI’s decision due on 6th June kept the investors bewildered. Hence, NIFTY50 witnessed a volatile trade with a jump in the morning trade, followed by some profit booking and again a surge to close half a percent up.

NIFTY50 hit its resistance at its prior swing high of 24,850 but could not sustain on closing basis. Hence, 24,850 to 24,900 would still act as a major resistance zone for now. On the downside, 24,500 remains the crucial support level for the NIFTY50.

On the options data front, the 24,750 calls hold the highest open interest for the 12th June expiry, indicating a strong resistance at these levels. On the downside, the index holds the highest open interest at 24,700 puts, indicating strong support at these levels.

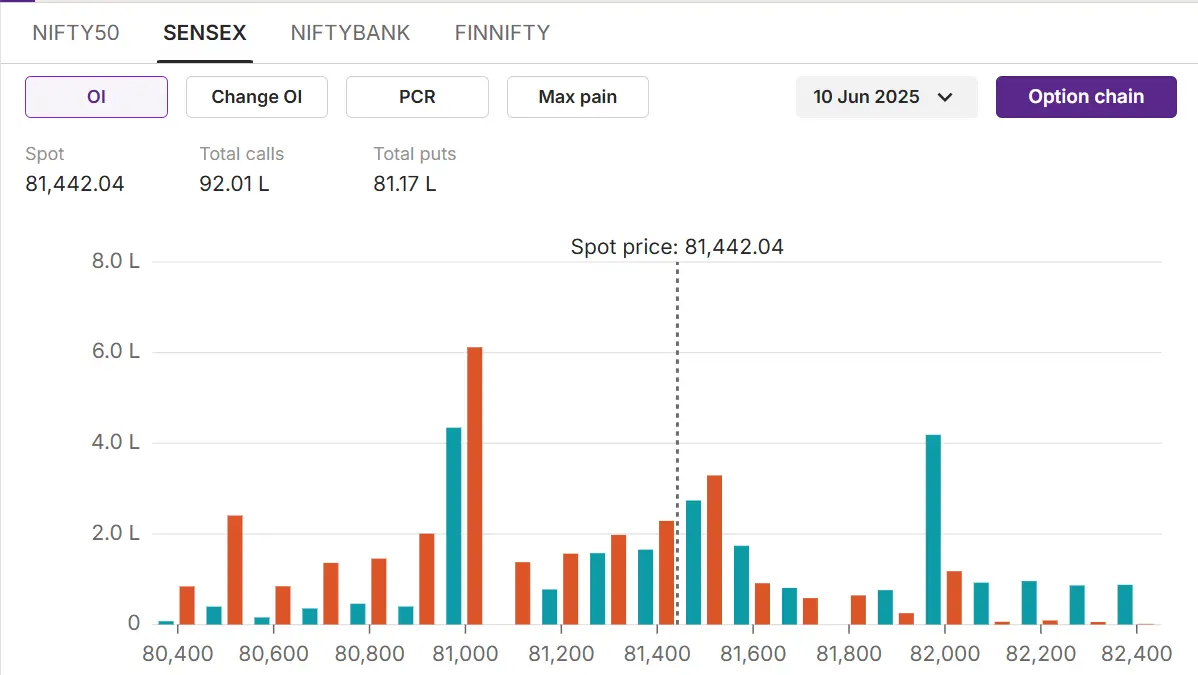

SENSEX

- Max call OI: 82,000

- Max put OI: 81,000

- (Ten strikes to ATM, 10th June expiry)

SENSEX too opened on a positive note and traded with a positive bias but with slight volatility. Taking cues from the positive closing in the previous session and the strong Rupee led to optimism, but caution ahead of RBI policy decision led to some volatility. Finally, SENSEX too closed the session in green with 0.6% gains.

SENSEX surged above the resistance level of 81,800 but somehow witnessed profit booking and closed below the level. Hence, once 81,800 is taken out the daily charts show 82, 500 as the next resistance for the SENSEX. On the downside, support zone is maintained at 80,500-80,700.

On the options data front, the index continued to face heavy resistance at the 82,000 levels due to the highest open interest on the call side. On the downside, the 81,000 puts hold the highest open interest, indicating strong support for the current weekly expiry.

Stock scanner

- Long buildup: ETERNAL, TRENT, DRREDDY

- Top traded futures contracts: ETERNAL FUT, RELIANCE FUT, BSE FUT

- Top traded options contracts: RELIANCE 1500CE

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

Related News

About The Author

Next Story