Market News

Trade Setup for June 11: NIFTY50 consolidates at the resistance level — breakout or reversal?

.png)

3 min read | Updated on June 11, 2025, 07:33 IST

SUMMARY

NIFTY50 opened with a gap-up but faced intraday selling pressure at the resistance level. Hustle between profit booking in sectors that rallied earlier and a surge in Dollar-driven sectors kept the index on the edge. The resistance, support, and indecisiveness are maintained for now.

NIFTY50 index opened with a gap-up on June 10 but witnessed selling pressure at the beginning itself. | Image: Shutterstock

Asian markets @ 7 am

- GIFT NIFTY: 25,185 (+0.16%)

- Nikkei 225: 38,399 (+0.49%)

- Hang Seng: 24,312 (+0.62%)

U.S. market update

Dow Jones: 42,866 (+0.25%) S&P 500: 6,038 (+0.55%) Nasdaq Composite: 19,714 (+0.63%)

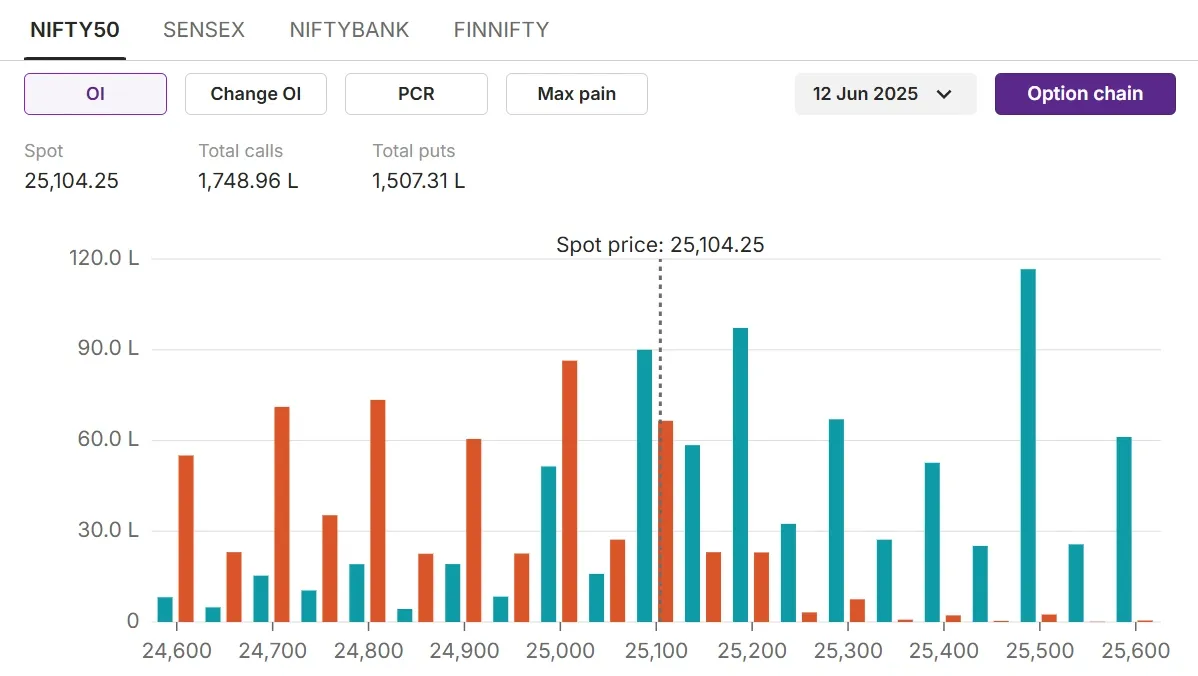

NIFTY50

- Max call OI: 25,500

- Max put OI: 25,000

- (Ten strikes to ATM, 12th June expiry)

NIFTY50 index opened with a gap-up on June 10 but witnessed selling pressure at the beginning itself. The index shed early gains but closed flat. Investors locked gains in most sectors, which had been rallying consistently in June. On th contrary, strong dollar benefited export-driven sectors. All-in-all, NIFTY50 closed flat at 25104.

NIFTY50 yet again witnessed open and high as the same on June 10 and thereby witnessed selling pressure on intraday terms. However, NIFTY50 sustains above 25100 on closing basis. Hence, the resistance is maintained i.e. once 25,120 is breached, chart shows that 25,230 would act as immediate resistance for now. On the downside, if the gap is filled at 25,030, 24,900 would act as the immediate support.

On the options data front, the 25,500 calls hold the highest open interest for the 12th June expiry, indicating a strong resistance at these levels. On the downside, the index holds the highest open interest at 25,000 puts, indicating strong support at these levels.

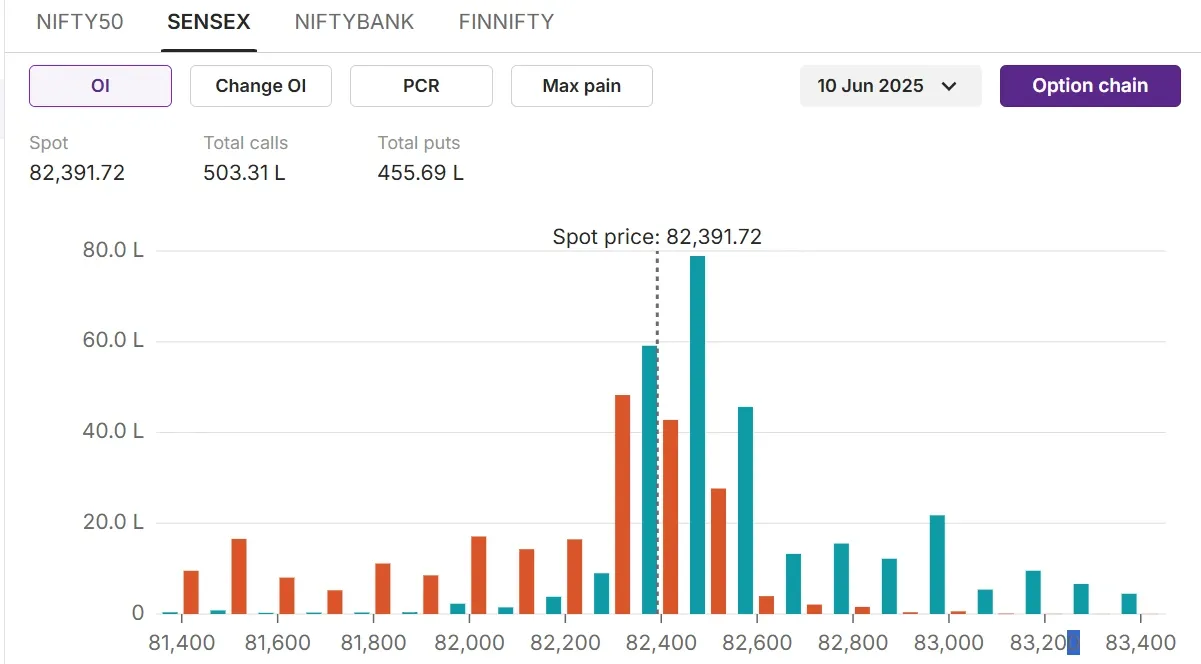

SENSEX

- Max call OI: 82,500

- Max put OI: 82,300

- (Ten strikes to ATM, 17th June expiry)

SENSEX too opened on a positive note but witnessed profit booking at the higher level and closed near its previous close at 82392. Thereby, SENSEX is seen struggling at its multiple resistance zone of 82,500-82,700. So its a wait-n-watch for the SENSEX too where, 84100 is seen as the medium-term resistance. On the downside, after filling a gap at 82,300, the support zone is placed at 81,900 and 81,400.

On the options data front, the index continued to face heavy resistance at the 82,500 levels on the expiry day. On the downside, the 82,300 puts hold the highest open interest, indicating strong support for the current weekly expiry.

Stock scanner

- Long buildup: GRASIM, DRREDDY, TECHM

- Top traded futures contracts: ICICIBANK FUT, HDFCBANK FUT

- Top traded options contracts: INFY 1649CE, SBIN 850CE

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

Related News

About The Author

Next Story