Market News

Trade setup for Jan 30: NIFTY50 uptrend hinges on close above the resistance zone of 23,350

.png)

4 min read | Updated on January 30, 2025, 07:20 IST

SUMMARY

The options data of NIFTY50’s January 30’s expiry saw significant put open interest build-up at 23,000 strike, suggesting support for the index around this zone. Meanwhile, traders can monitor the resistance zone of 23,350 to 23,400. A close above this zone will provide further directional clues.

Stock list

The NIFTY50 continued its upward momentum for the second straight session on January 29, closing above the previous session's high. | Image: Shutterstock

Asian markets @ 7 am

- GIFT NIFTY: 23,146 (-0.03%)

- Nikkei 225: 39,456 (+0.14%)

- Hang Seng: Closed

U.S. market update

- Dow Jones: 44,713 (▼0.3%)

- S&P 500: 6,039 (▼0.4%)

- Nasdaq Composite: 19,632 (▼0.5%)

U.S. stocks closed lower on Wednesday after the Federal Reserve kept interest rates unchanged, marking the first pause since its initial rate cut in September. Notably, the Fed dropped language from its December statement about progress toward 2% inflation, instead stating that "inflation remains somewhat elevated."

The Fed Chaimanr Jerome Powell downplayed the shift, calling it merely a "language cleanup" rather than a signal of policy change. However, markets reacted cautiously, with investors weighing the Fed’s stance on future rate moves.

NIFTY50

- January Futures: 23,148 (▲0.8%)

- Open interest: 2,54,718 (▼29.0%)

The NIFTY50 continued its upward momentum for the second straight session on January 29, closing above the previous session's high—a sign of positive breadth. However, it is important to note that the broader trend of the index remains weak as it is currently trading below all its key exponential moving averages (EMAs) like 21, 50 and 200.

As per the hourly chart, the index is currently consolidating within the range of 23,400 and 22,700. Positional traders can monitor this range as a break above these zones on a closing basis will provide further clues.

The open interest (OI) data for the 30 January expiry saw a significant put base at 23,000 strike, suggesting support for the index around this zone. Meanwhile, the call OI base was seen at 23,500 strike with relatively low volume suggesting immediate resistance for the index around this zone.

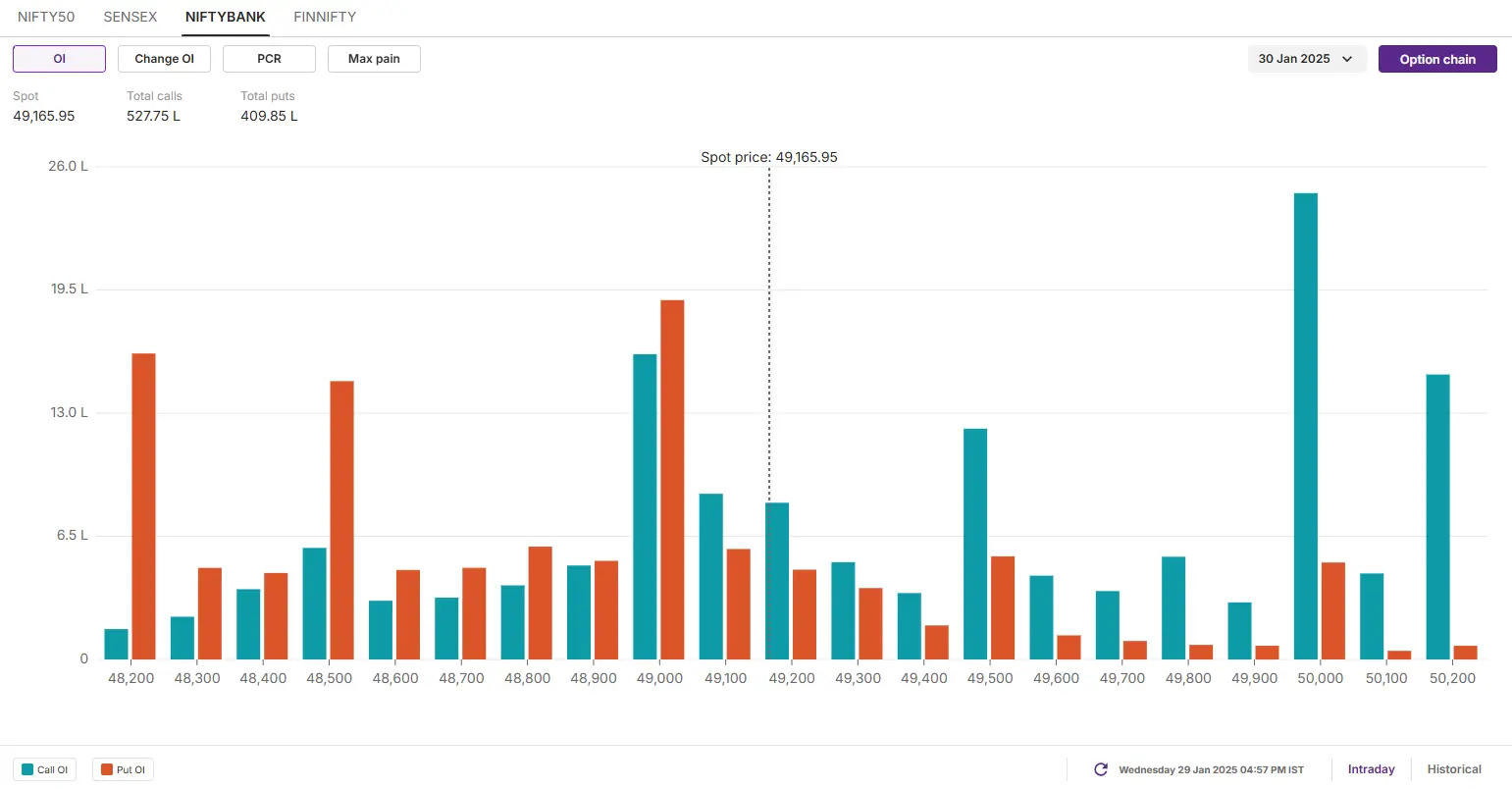

BANK NIFTY

- January Futures: 49,082 (▲0.5%)

- Open interest: 68,571 (▼30.7%)

The BANK NIFTY also sustained its previous day’s gains and extended the consolidation for the 12th session in a row, ending Wednesday’s session up 0.6% at 49,165. The index approached its 21-day exponential moving average on the daily chart and a close above or rejection from the crucial level will provide further directional clues.

As per the hourly chart, the BANK NIFTY is currently consolidating broadly within a 1700 point range with upside resistance around the 49,700 and support around the 48,000 zone. A decisive close and break above this zone will provide further directional clues to the traders.

The open interest (OI) data for the 30 January expiry saw significant call OI base at 50,000 strike, suggesting resistance for the index around this level. On the flip side, the put OI base was observed at 48,000, hinting at support for the index around this zone. Additionally, the 49,000 strike remains as the base strike with index maintaining significant call and put base accumulated at this strike.

FII-DII activity

Stock scanner

- Long build-up: Computer Age Management Services, Manappuram Finance, Indian Bank, IEX and Metropolis

- Short build-up: JSW Energy and Bosch

- Under F&O ban: Nil

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story