Market News

Trade setup for Feb 5: NIFTY50 reclaims 50 and 200-day EMA, FIIs turn net buyers after 23 sessions

.png)

4 min read | Updated on February 05, 2025, 07:47 IST

SUMMARY

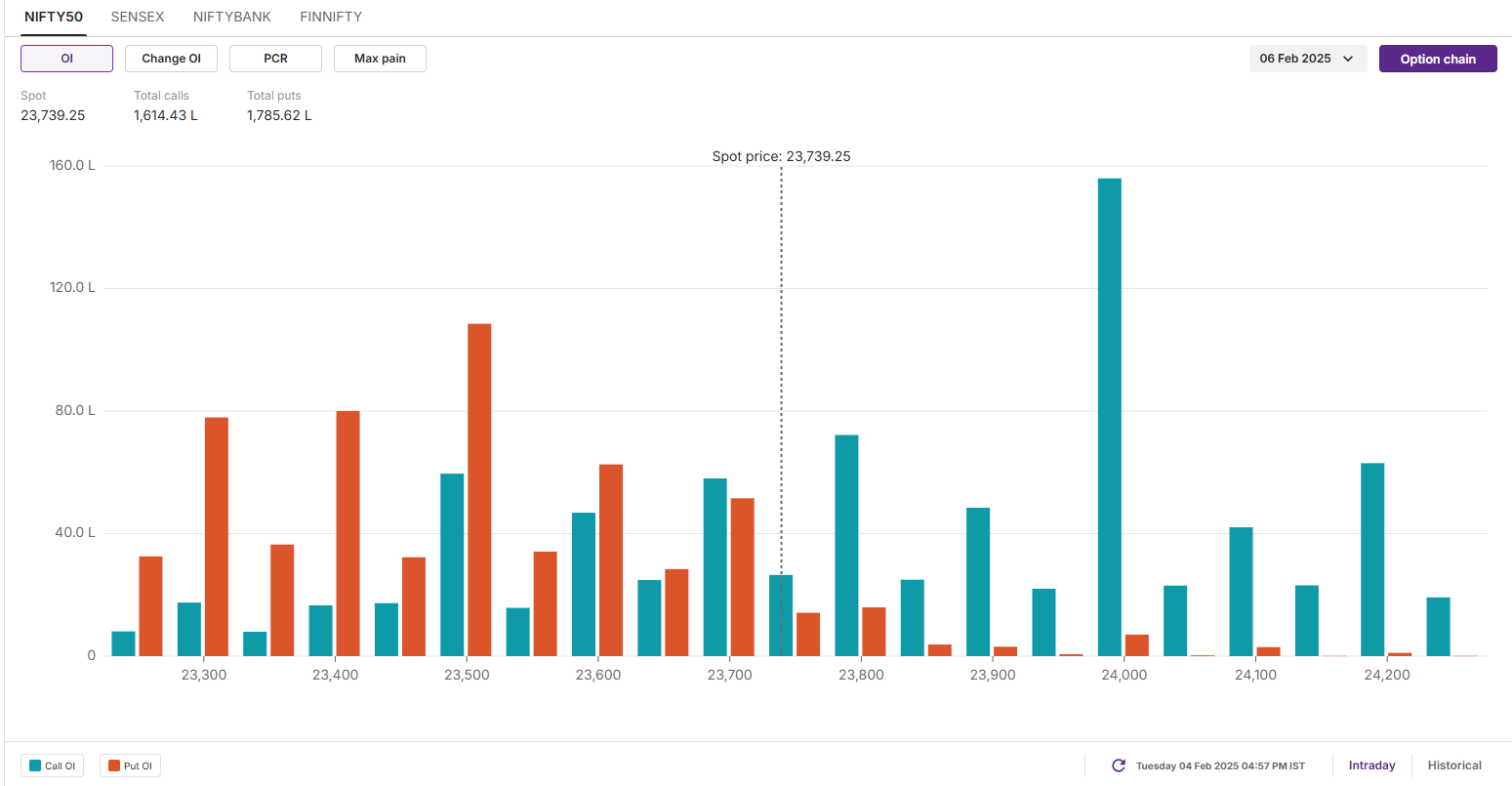

The NIFTY50 reclaimed its 50-day EMA after nearly two months, forming a bullish candle on the daily chart. Notably, the 23,500 strike saw significant call unwinding and a surge in put open interest, establishing it as the index's immediate support zone.

Stock list

The NIFTY50 index opened strong on Tuesday, reclaiming the key 50-day and 200-day exponential moving averages (EMAs) resistance levels. | Image: PTI

Asian markets @ 7 am

- GIFT NIFTY: 23,841.5 (+0.29%)

- Nikkei 225: 38,840.6 (+0.11%)

- Hang Seng: 20,588.7 (-1.11%)

U.S. market update

- Dow Jones: 44,556 (▲0.3%)

- S&P 500: 6,037 (▲0.7%)

- Nasdaq Composite: 19,654 (▲1.3%)

U.S. indices rebounded on Tuesday, with the S&P 500 recovering most of its losses from the previous session’s tariff-driven decline. Tech stocks led the rally as the Palantir Technologies surged over 24% after exceeding Wall Street expectations, reinforcing optimism around software-driven AI beneficiaries.

On the global front, trade tensions escalated as China swiftly responded to the latest U.S. tariffs. Following the implementation of a 10% levy on Chinese imports at midnight, China retaliated with new tariffs of up to 15% on U.S. coal and liquefied natural gas, set to take effect on February 10. Additional 10% duties were also imposed on crude oil, farm equipment, and select automobiles.

NIFTY50

- February Futures: 23,422 (▲1.4%)

- Open interest: 2,22,632 (▼2.5%)

The NIFTY50 index opened strong on Tuesday, reclaiming the key 50-day and 200-day exponential moving averages (EMAs) resistance levels. A broad-based sectoral rally propelled the index to its highest close in a month.

On the daily chart, the index closed above the high of the doji candlestick pattern formed on 1 February, signalling continuation of the positive momentum. For the upcoming sessions, the immediate support for the index is between 23,500 and 23,600 zone. Unless the index slips below this zone on closing basis, the trend may remain bullish. Meanwhile, the ressistance for the index remains around 24,200 zone.

Open interest data for the 6 February expiry showed strong put additions at the 23,500 strike, signaling emerging support in this zone. Meanwhile, significant call unwinding at 23,500 suggests a shift, with the key resistance now at the 24,000 strike.

SENSEX

- Max call OI: 80,000

- Max put OI: 78,000

- (30 Strikes from ATM, Expiry: 11 Feb)

The SENSEX also started on the positive note on the weekly expiry of its options contracts and reclaimed its 50-day and 200-day EMA. The index formed a strong bullish candle on the daily chart, closing at one month high.

Positionally, the index also closed above the high of the doji candlestick pattern formed on the announcement of the union Budget. This indicates continuation of the ongoing positive trend. For the upcoming sessions, the immediate support for the index will be around the 77,500 zone. On the other hand, the resiatance is visible at 80,000 mark.

FII-DII activity

Stock scanner

- Long build-up: Kalyan Jewellers, Manappuram Finance, Angel One, Laurus Labs and Indian Bank

- Short build-up: Trent, Tata Chemicals, Torrent Pharma and Page Industries

- Top traded futures contracts: HDFC Bank, Reliance Industries, Asian Paints, ICICI Bank and Trent

- Top traded options contracts: Asian Paints 2,400 CE, Divi’s Labs 6200 CE, HDFC Bank 1700 CE, Bajaj Finance 8500 CE and ABB 5500 CE

- Under F&O ban: Nil

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story