Market News

Trade Setup for August 30: Will NIFTY50 secure a monthly close above 25,000?

.png)

5 min read | Updated on August 30, 2024, 07:45 IST

SUMMARY

After closing above the previous all-time high on August 29, the broader trend of the NIFTY50 index remains positive. Traders should closely monitor both the monthly and weekly closes. A monthly close above 25,000 would signal continuation of the current bullish trend.

Stock list

In a highly volatile session, driven by the Annual General Meeting of Reliance Industries, the NIFTY50 experienced sharp swings in both directions.

Asian markets update at 7 am

The GIFT NIFTY is up 0.5%, suggesting a gap-up and a positive start for the NIFTY50 today. Sentiment across major Asian markets remains upbeat, with Japan’s Nikkei 225 rising 0.4% and Hong Kong’s Hang Seng index up 0.5%.

U.S. market update

- Dow Jones: 41,335 (▲0.5%)

- S&P 500: 5,591 (▼0.0%)

- Nasdaq Composite: 17,516 (▼0.2%)

U.S. indices ended Thursday's session on a mixed note, with the Dow Jones Industrial Average hitting a new record high. The Street assessed the results of chipmaker Nvidia, whose shares fell more than 6%. The company's revenue and profit guidance beat estimates, but the size of the beat fell short of high hopes.

Meanwhile, economic data releases supported the markets. The U.S. economy grew better than expected in the last quarter, with GDP rising 3% in Q2, beating the estimate of 2.8%, according to data released on 29 August. In addition, initial jobless claims came in at 231,000, slightly below the expected 232,000, further easing recession concerns.

NIFTY50

- September Futures: 25,265 (▲0.4%)

- Open Interest: 5,29,728 (▲51.3%)

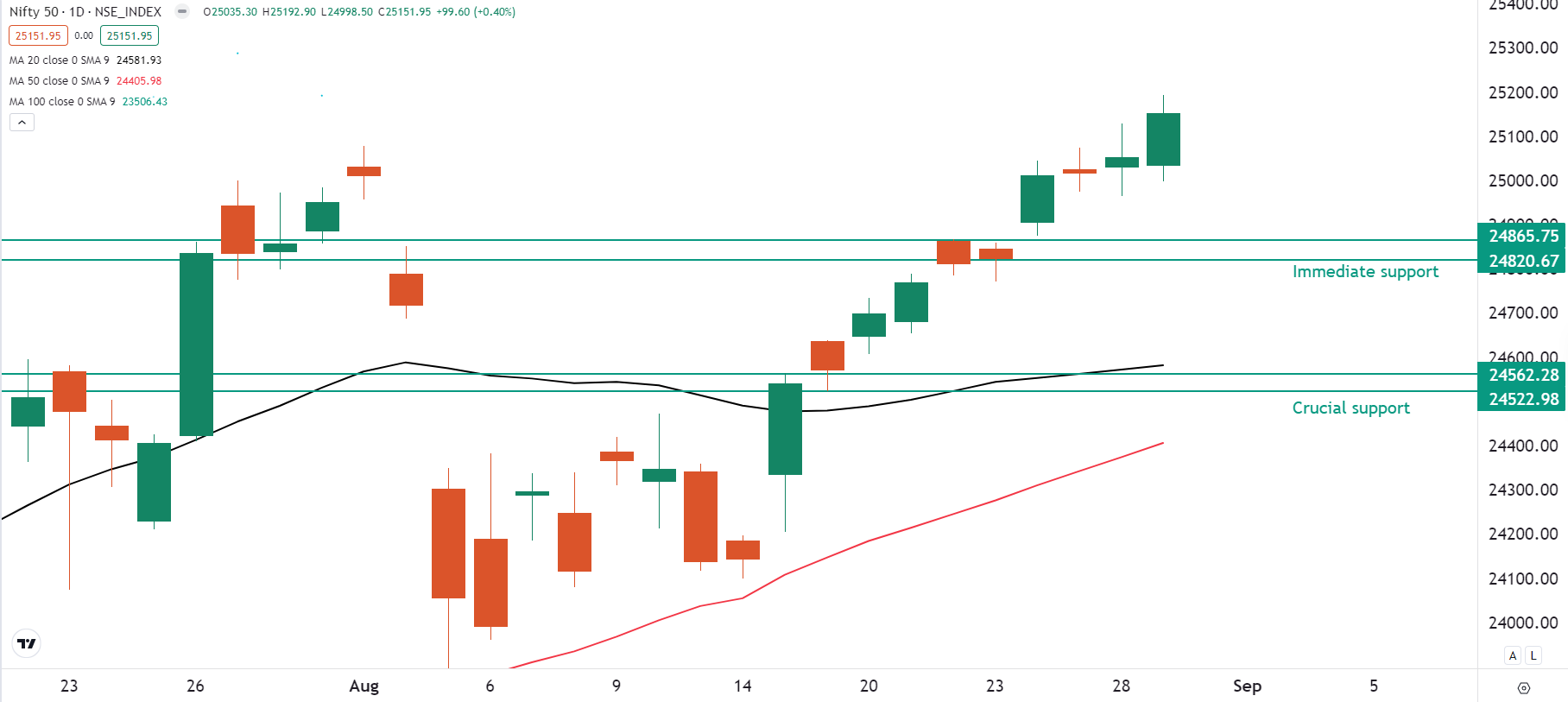

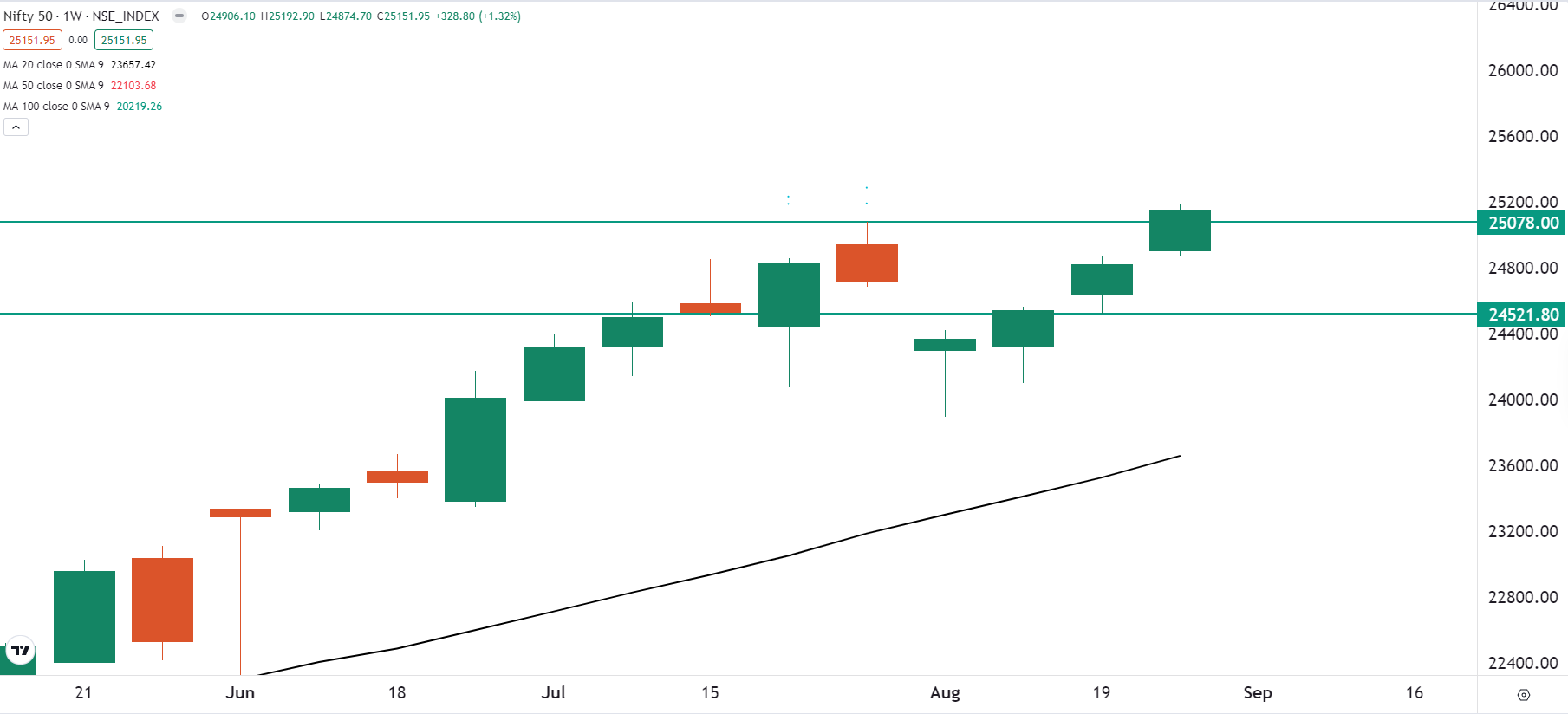

The NIFTY50 closed in the green for the eleventh consecutive day, forming a bullish candle on the daily chart. The index hit a new all-time high on the day of the expiry of monthly futures and options contracts, closing the day above its previous all-time high (25,078).

In a highly volatile session, driven by the Annual General Meeting of Reliance Industries, the NIFTY50 experienced sharp swings in both directions. Despite the volatility, the index closed firmly in the green, bolstered by positive momentum in technology and the buyback announcement from Reliance Industries.

For the upcoming sessions, the outlook for the index remains positive, with immediate support in the 24,800 zone. As long as the index stays above this zone on a closing basis, the broader trend is likely to remain bullish.

Given the subdued open interest volume for the 5 September expiry, traders should closely monitor both weekly and monthly closing of the NIFTY50. If the index sustains its gains and closes the August series above the 25,000 mark, it could further extend its bullish momentum. However, a close below 25,000 may indicate short-term weakness.

BANK NIFTY

- September Futures: 51,490 (▲0.1%)

- Open Interest: 1,59,742 (▲7.2%)

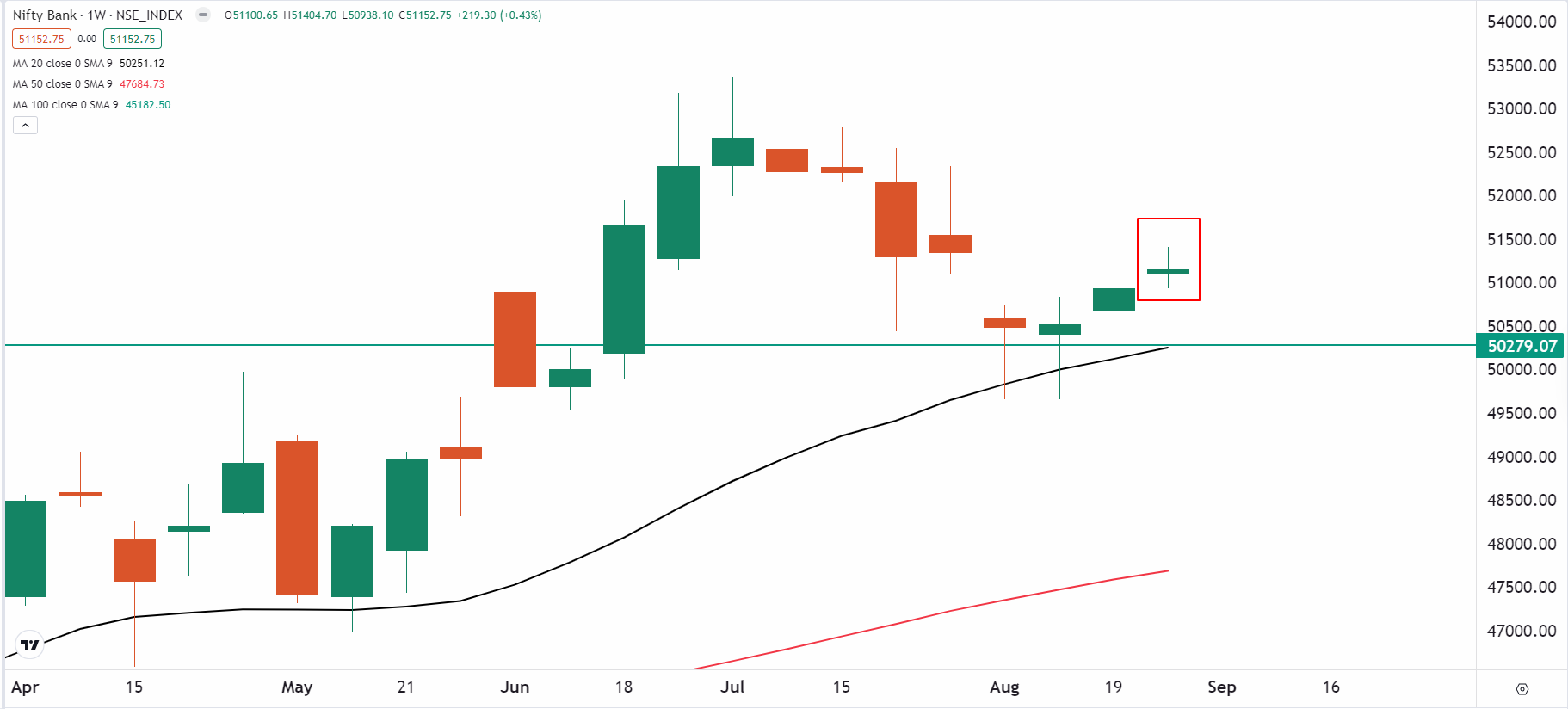

The BANK NIFTY remained range-bound for the sixth day consecutive day, failing to generate follow-through momentum. The index traded within the range of the 27 August candle, forming a second consecutive inside candle on the daily chart.

For BANK NIFTY, we maintain our trade setup and analysis from past five sessions. As highlighted in our previous blogs, the index is currently trading between its 50-day and 20-day moving averages (DMAs). It is also holding above the breakout from the descending trendline drawn from its previous all-time high. Additionally, the formation of two consecutive inside candles on the daily chart suggests a potential buildup for the pending momentum.

For the upcoming sessions, traders can monitor the break of 50 and 20 DMAs along with the high and low of the 27 August candle, highlighted in the image below. A break above or below these levels will provide traders further directional clues.

Meanwhile, BANK NIFTY open interest data for the 4 September expiry shows the highest call base at 51,500 and the highest put base at the 50,000 strike. The current build suggests range-bound activity for the index, as indicated by the early signs of a doji candlestick pattern on the weekly chart. However, traders are advised to monitor the weekly close as any change in the technical structure will provide further directional clues.

FII-DII activity

Stock scanner

Short build-up: Interglobe Aviation (Indigo), Max Healthcare, IPCA Laboratories and Aarti Industries

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story