Market News

Trade Setup for August 23: NIFTY50 sustains above 24,800, encounters resistance around second bearish gap

.png)

4 min read | Updated on August 23, 2024, 07:38 IST

SUMMARY

The NIFTY50 has encountered resistance at the lower end of the second bearish gap formed on the 2nd of August. Traders may monitor today's price action around this area, as a close above 24,700 will indicate a continuation of the bullish trend.

Stock list

The NIFTY50 closed in the green for the fifth consecutive day, closing above the 24,800 level but forming a negative candle on the daily chart.

Asian markets update at 7 am

The GIFT NIFTY is trading flat, indicating a subdued start for the NIFTY50 today around 24,800 mark. Meanwhile, the other Asian markets are trading mixed. Japan’s Nikkei 225 is flat, while Hong Kong’s Hang Seng index is down 0.6%.

U.S. market update

- Dow Jones: 40,712 (▼0.4%)

- S&P 500: 5,570 (▼0.8%)

- Nasdaq Composite: 17,619 (▼1.6%)

US indices ended Thursday's session in the red ahead of today's speech by Fed Chair Jerome Powell at the Jackson Hole Symposium. Thursday's retreat was led by technology stocks.

Traders will be paying close attention to the Fed Chair's speech, hoping for further insight into monetary policy. According to the Fed's July minutes, most participants indicated a likely rate cut at the September meeting if data continues to come in as expected.

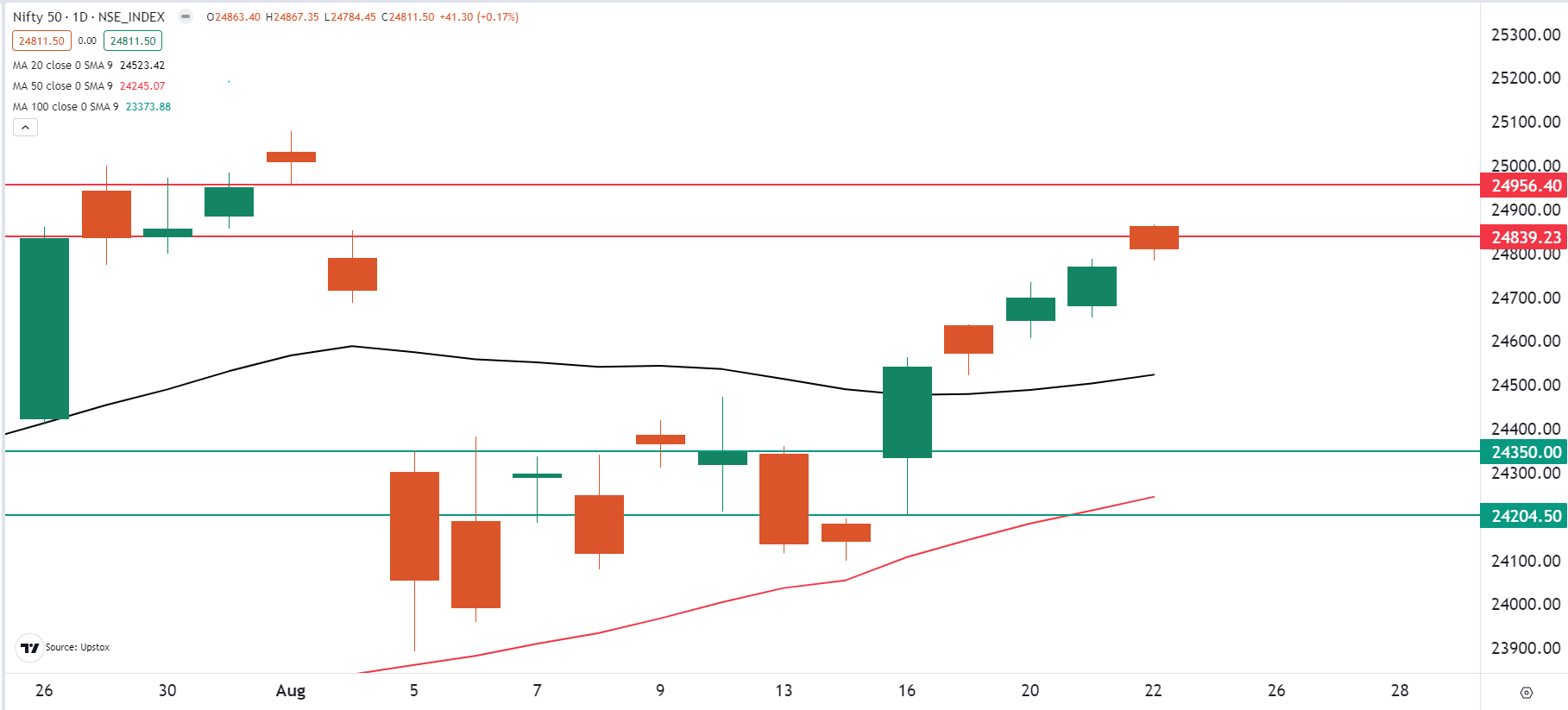

NIFTY50

- August Futures: 24,840 (▲0.1%)

- Open Interest: 4,22,240 (▼1.5%)

The NIFTY50 closed in the green for the fifth consecutive day, closing above the 24,800 level but forming a negative candle on the daily chart. The index traded in a tight range of 80 points on the weekly options expiry and closed up 0.1%.

In today's session, traders can watch the price action around the second bearish gap. This gap was formed on the 2nd of August. Yesterday the NIFTY50 found resistance at the lower end of the gap, suggesting a pause at current levels. If the index takes this area on a closing basis, or closes above the 24,700 area on a weekly basis, then the structure could remain bullish.

However, a close below 24,700 indicates short-term weakness with immediate resistance around the area of the second bearish gap, while support remains at 24,500.

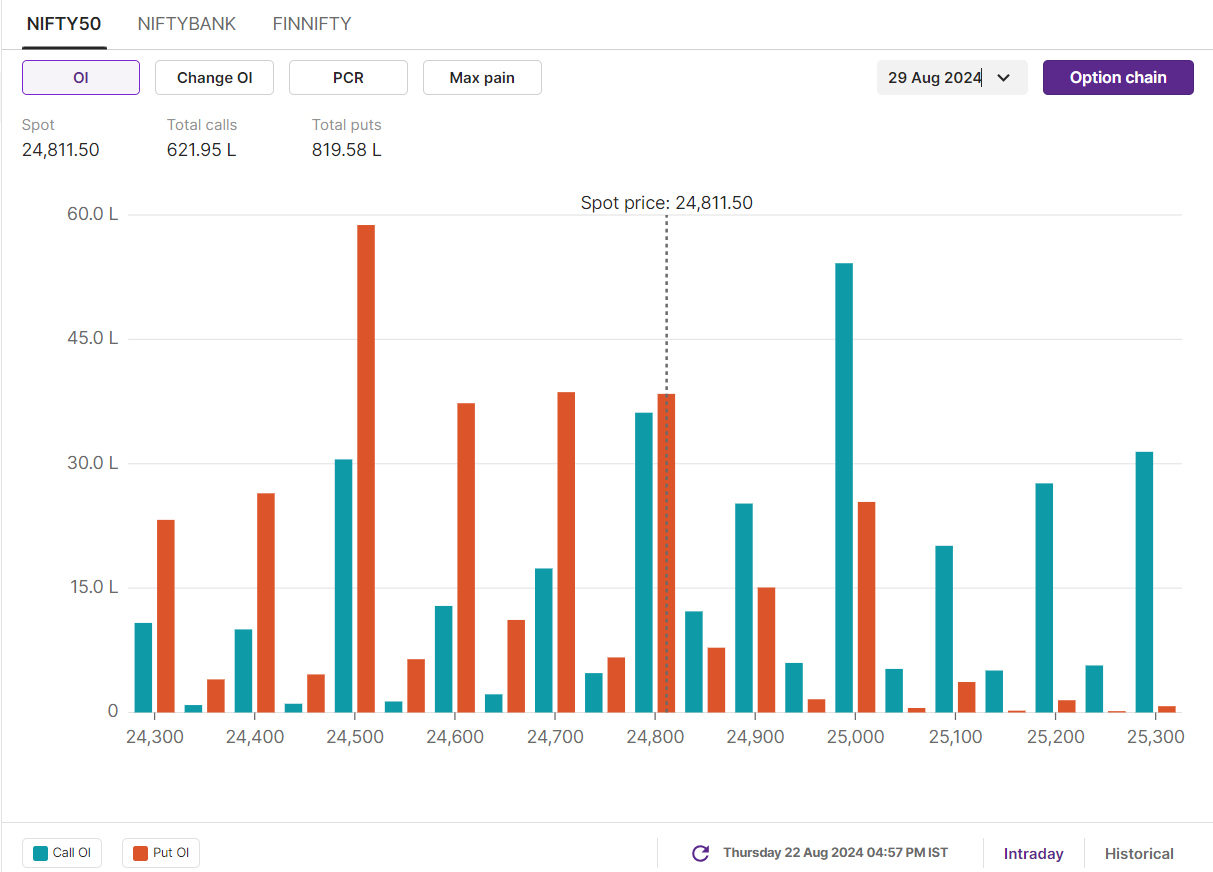

Open interest positioning for the monthly expiry of the NIFTY50 remains range-bound. The index has a significant call base at the 25,000 and 25,000 strikes. These strikes will act as immediate resistance for the index. Meanwhile, the put base has been established at the 24,000 and 24,500 strikes, indicating immediate support.

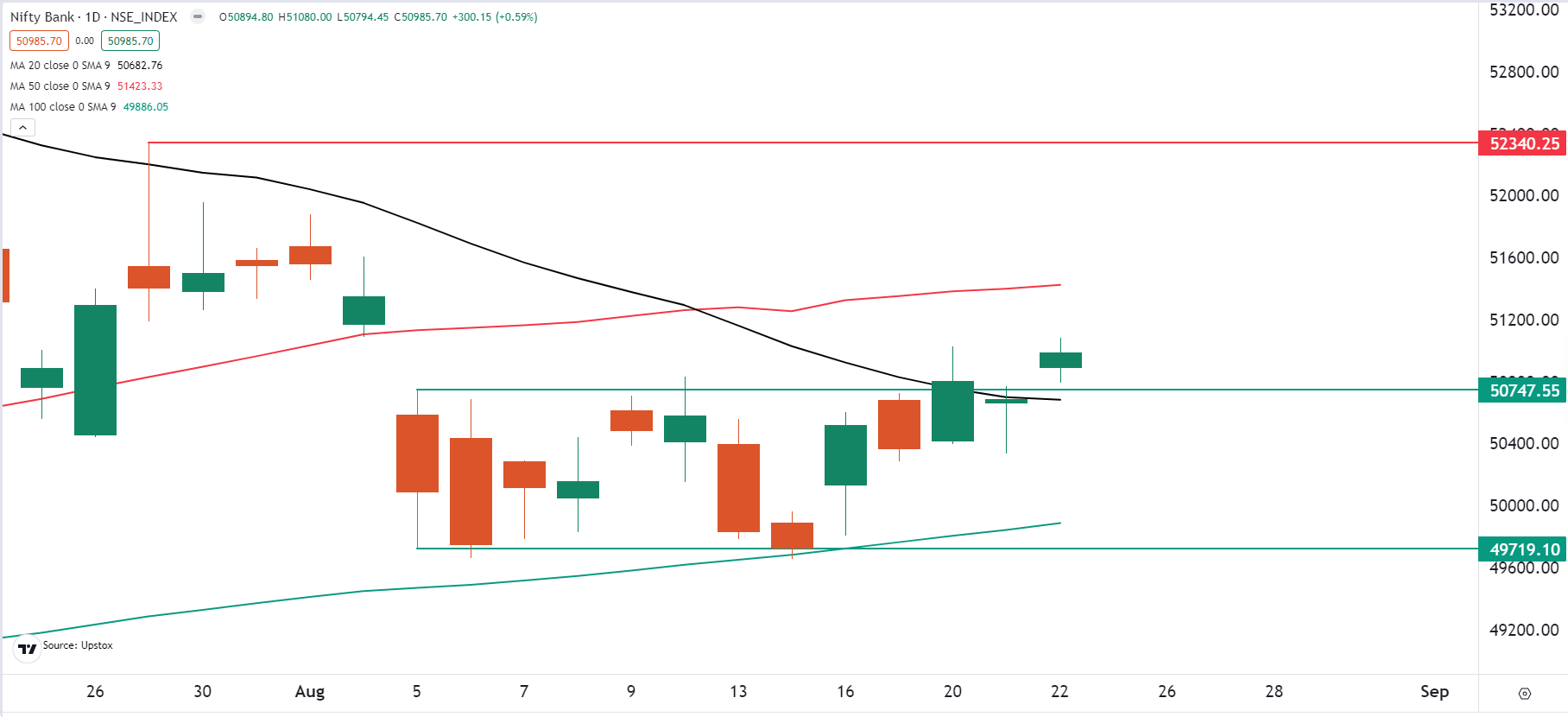

BANK NIFTY

- August Futures: 50,806 (▲0.4%)

- Open Interest: 1,76,166 (▼2.8%)

The BANK NIFTY index ended Thursday's session in green, closing the bearish gap formed on 2 August after thirteen sessions. The index posted its highest close in the last thirteen sessions and closed above the immediate resistance level of 50,800.

BANK NIFTY is at a critical juncture. A close above 50,830, last week's high, could extend its rebound towards the 52,000 mark. However, if the index fails to break this level, weakness may set in, with immediate support around the 50,000 zone.

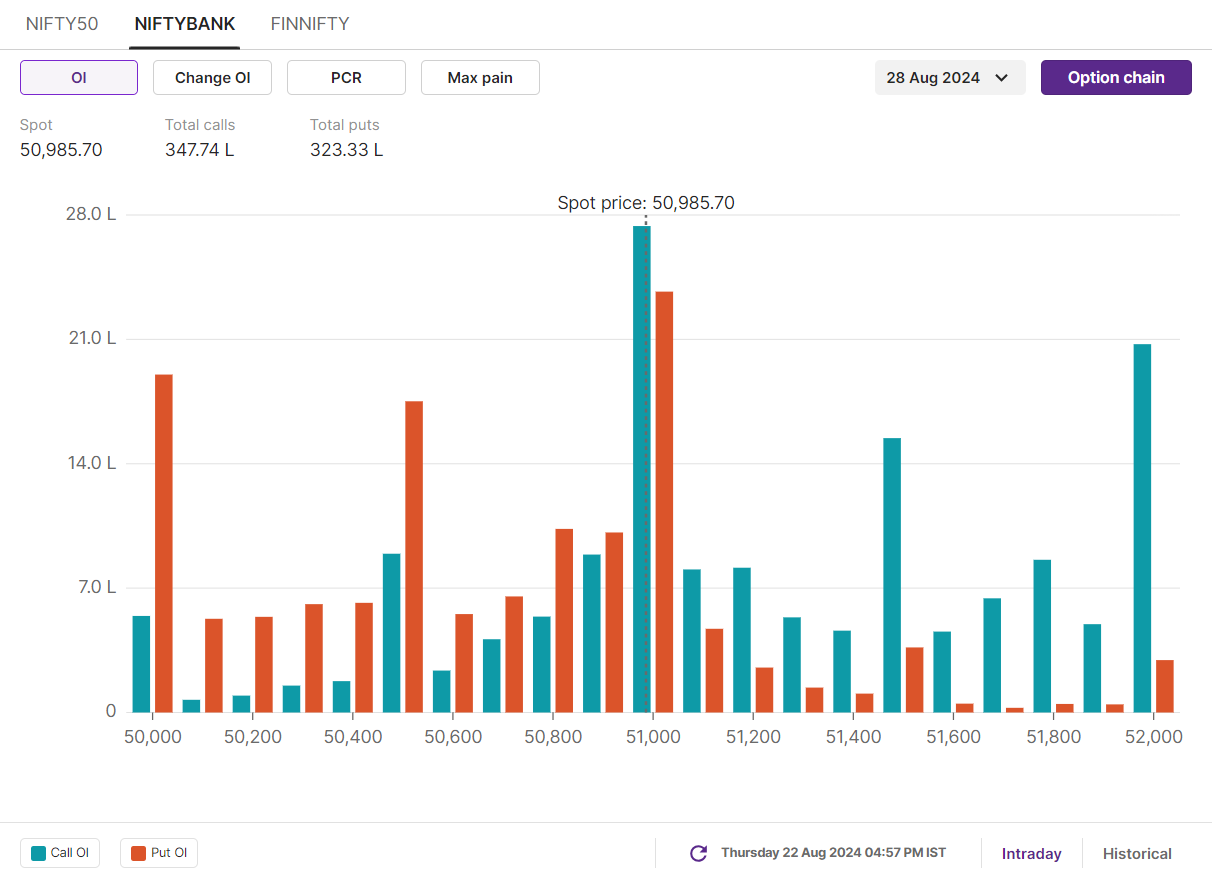

Initial open interest for the August 28th BANK NIFTY expiry shows a strong call and put base at the 51,000 strike, suggesting range-bound movement around this level. Traders should closely watch the changes in open interest around the close to better gauge potential shifts in momentum.

FII-DII activity

Stock scanner

Short build-up: Cholamandalam Investment

Out of F&O ban: Balrampur Chini

Added under F&O ban: Chambal Fertilisers, IEX and RBL Bank

Under F&O ban: Aarti Industries, Aditya Birla Fashion and Retail, Birlasoft, Chambal Fertilisers, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Granules India, Hindustan Copper, IEX, India Cements, LIC Housing Finance, National Aluminium, Piramal Enterprises, RBL Bank and Sun TV

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story