Market News

Trade setup for 25 July: Will NIFTY50 end July series above 24,000? Watch these levels for today’s expiry

.png)

4 min read | Updated on July 25, 2024, 08:05 IST

SUMMARY

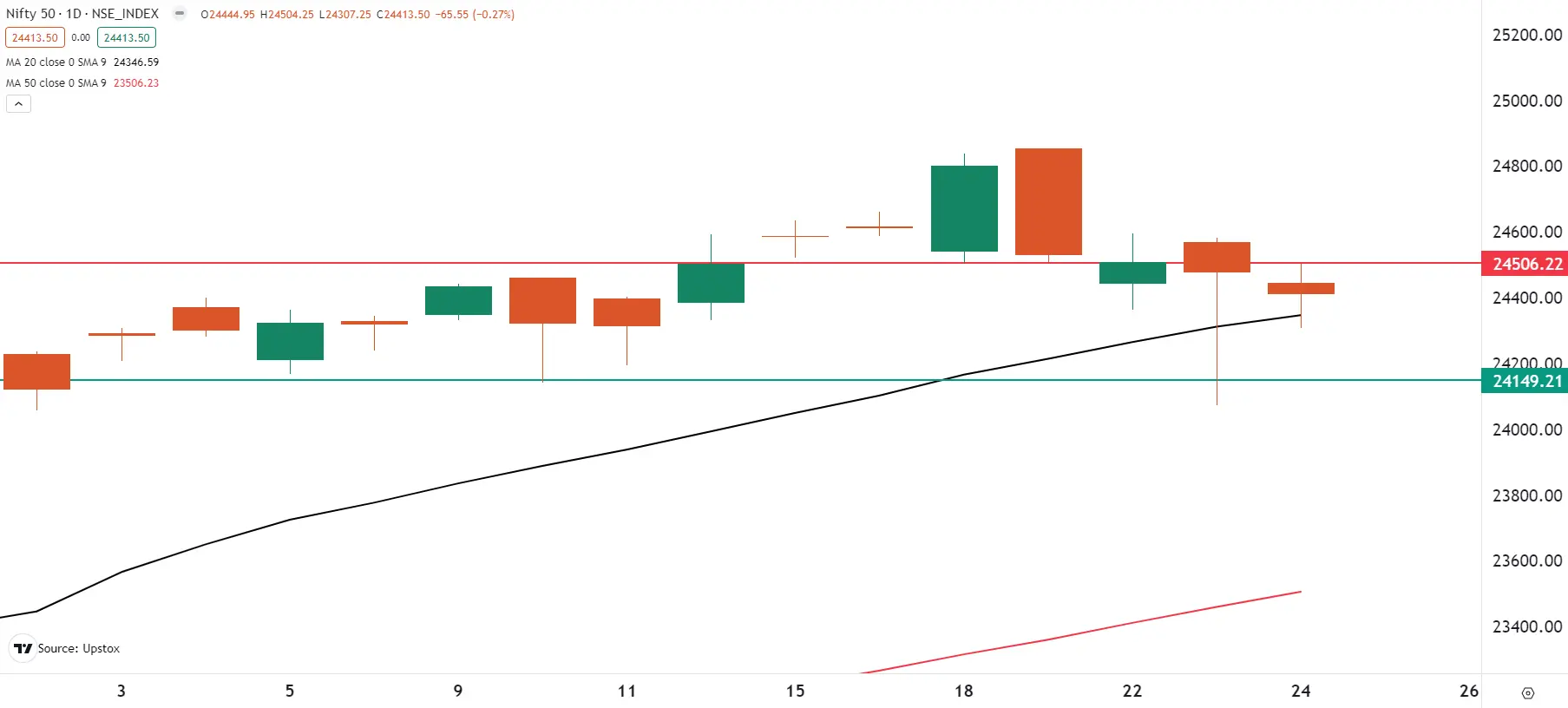

The NIFTY50 index has formed an inside candle on the daily chart, indicating a pause and consolidation. For today’s expiry, traders have placed significant OI on 24,400 strike, indicating the options market is expecting NIFTY50’s expiry between 24,700 and 24,200.

Stock list

On the daily chart, the NIFTY50 index protected its 20-day moving average for the second day in a row.

Asian markets update at 7 am

The GIFT NIFTY dropped nearly 1%, pointing to a negative start for the NIFTY50 on the monthly expiry of its options contracts. Meanwhile, other Asian indices are also trading in red. Japan’s Nikkei 225 is down 0.3%, while Hong Kong’s Hang Seng index slipped 1.2%.

U.S. market update

- Dow Jones: 39,853 (▼1.2%)

- S&P 500: 5,427 (▼2.3%)

- Nasdaq Composite: 17,342 (▼3.6%)

U.S. market ended Wednesday's session sharply lower amid a sell-off in technology stocks. Shares of Alphabet (Google) and Tesla fell between 5% and 12% after reporting their second quarter results.

Although Google's revenue and profit both beat Street estimates, YouTube advertising revenue came in below estimates. Meanwhile, Tesla reported weaker-than-expected results, with revenues declining 7 YoY%.

NIFTY50

- July Futures: 24,388 (▼0.1%)

- Open Interest: 3,73,049 (▼19.8%)

After a sharp recovery from the budget day’s low, the NIFTY50 traded in a narrow range and remained weak throughout the day. The index formed an inside candle on the daily chart and failed to provide the follow-through and confirmation of bullish reversal hammer pattern on 23 July.

On the daily chart, the NIFTY50 index protected its 20-day moving average for the second day in a row. Positionally, the index is broadly trading between 24,800 and 24,000 zone. Until the breaks out of this zone, it may remain range-bound.

As per the 15-minute time frame, the NIFTY50 index has immediate support around 24,200 zone, while the immediate resistance around 24,500. A breakout on either side of this range will provide traders directional clues.

The open interest (OI) build-up for today’s expiry highlights maximum put OI at 24,000 strike, pointing it as crucial support for the index. The call base on the other hand is spread between 24,800 and 25,000 strikes, indicating resistance for the index around these levels.

BANK NIFTY

- July Futures: 51,401 (▼0.6%)

- Open Interest: 88,997 (▼17.2%)

The BANK NIFTY continued to be volatile on the day of expiry and closed in the red for the second day in a row. The index fell below key support levels, confirming the bearish engulfing pattern formed on the 23 July.

As shown in the chart below, the BANK NIFTY index is currently between its 20-day and 50-day moving averages. The index is likely to remain range-bound and volatile until it breaks decisively out of this range on a closing basis. Furthermore, the index has managed to hold its previous all-time high of 51,133 on a closing basis. A close below this level will signal further weakness in the index.

The initial open interest build-up of the BANK NIFTY’s monthly expiry has maximum put open interest at the 51,000 strike. This indicates that the index has support around this area. On the other hand, the call base is present at 52,000 and 53,000, making these levels resistance.

FII-DII activity

Stock scanner

Under F&O ban: Vodafone-Idea and India Cements

Out of F&O ban: Gujarat Narmada Valley Fertilisers & Chemicals and Steel Authority of India

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story