Market News

NIFTY50 aims for 23,800, BANK NIFTY nears record high

.png)

3 min read | Updated on March 11, 2024, 08:29 IST

SUMMARY

The NIFTY 50 closed flat on Thursday after a strong rally, forming a doji candlestick on the daily chart. This indecisiveness comes despite a bullish weekly chart indicating potential support. The BANK NIFTY faced profit-booking near its all-time high, but remains close to resistance. Experts believe that a break above 48,200 could extend the rally, while support lies between 46,800 and 46,900.

Stock list

Trade setup for 11 March.

Asian markets update

The GIFT NIFTY is trading 0.2% lower from Friday's close, indicating a flat to negative start for the Indian equities. Asian peers are trading mixed. Japan's Nikkei 225 is down over 2% while Hong Kong's Hang Seng Index is up over 1%.

U.S. market update

U.S. markets closed lower on Friday as investors digested the February jobs report which was slightly higher than expectation. The Dow Jones Industrial average fell 0.1% to 38,722, while the S&P 500 declined 0.6% to 5,123. The tech-heavy Nasdaq Composite dropped 1.1% to 16,085.

NIFTY50

- March Futures: 22,552 (▼0.2%)

- Open Interest: 2,52,033 (▼5.5%)

The NIFTY 50 ended Thursday's session flat, forming a doji candlestick on the daily chart. This indecision follows Wednesday's strong bullish engulfing pattern, where the index closed well above the previous day's close on Thursday.

According to the experts, the index has formed a bullish candle on the weekly chart, signalling support based buying at lower levels.

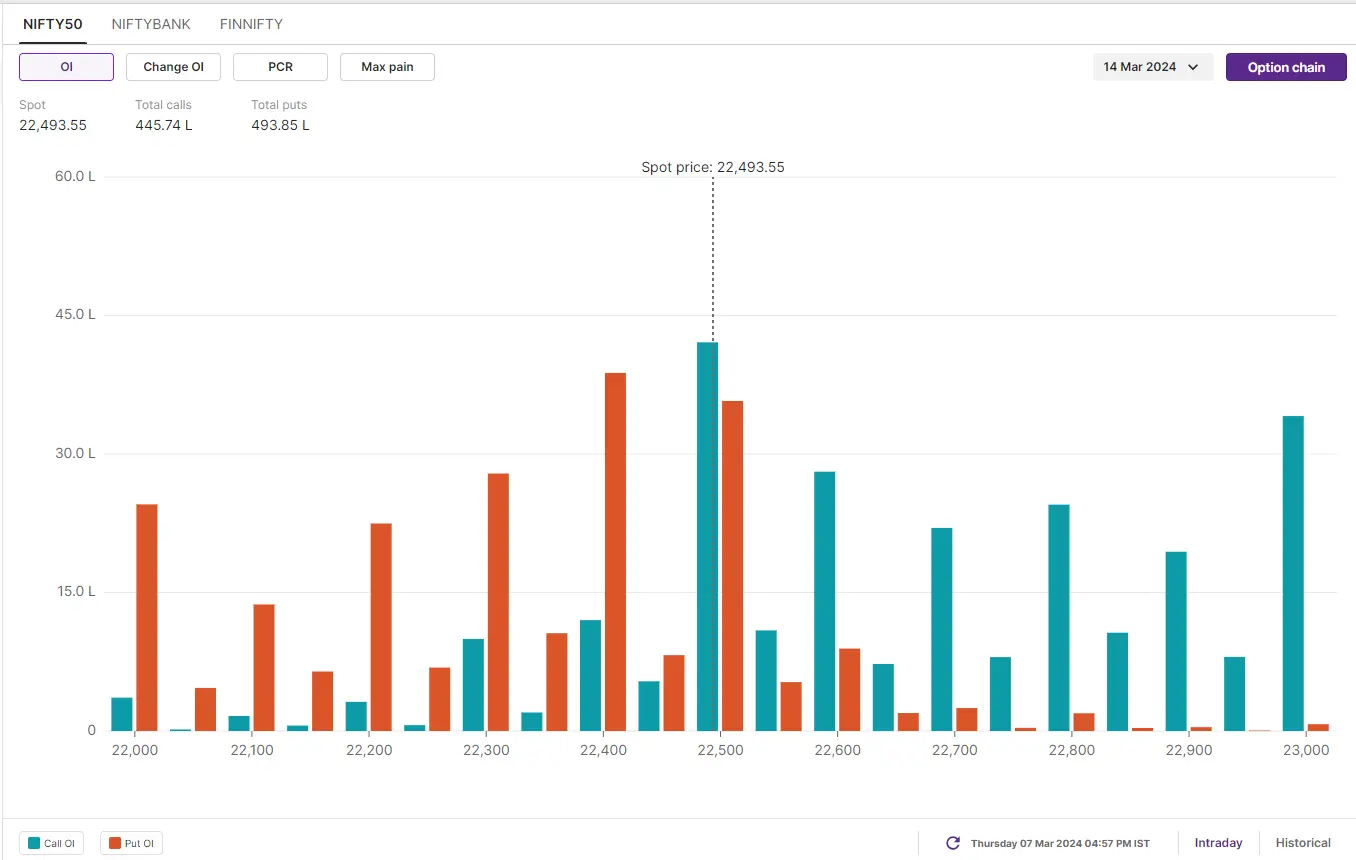

The initial OI build-up for the 14 March expiry shows a significant call base at the 22,500 and 23,000 strikes. Conversely, the put base is established at the 22,400 and 22,500 strikes. As per the initial build-up, the NIFTY50 is expected to trade between 21,800 and 23,000 this week.

BANK NIFTY

- March Futures: 47,958 (▼0.4%)

- Open Interest: 1,31,218 (▼11.9%)

After inching closer to all-time high, the BANK NIFTY witnessed profit-booking ahead of the long weekend on Thursday. The index started Thursday's session above the 48,000 mark, but failed to sustain the gains at higher levels.

Experts believe that the banking index has rallied over 3% in the past four weeks and has moved near its immediate resistance zone of 48,000 and 48,200. A close above 48,200 on the daily chart will further extend the momentum in favour of bulls. The immediate support for the BANK NIFTY is between 46,800 and 46,900 zone.

For BANKNIFTY's 13 March expiry, options data shows significant open interest at the 48,000 & 49,000 call strikes and the 48,000 & 47,500 put strikes. Based on the open interest, traders are eyeing BANKNIFTY's trading range between 46,000 and 49,100 this week.

FII-DII activity

Stock scanner

-

Long build-up: Tata Chemicals, Tata Power, Bajaj-Auto and Tata Steel

-

Short build-up: Mahindra And Mahindra, NMDC, Apollo Tyres and Mphasis

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

About The Author

Next Story