Market News

Trade setup for April 4: Will NIFTY50 and SENSEX defend 23,000 and 76,000 on Friday? Here's all you need to know

.png)

4 min read | Updated on April 07, 2025, 08:34 IST

SUMMARY

NIFTY50 and SENSEX form a shooting star pattern on the weekly charts, indicating a shift in stance from bullish to bearish. On daily charts, the NIFTY50 continued to defend their 50 EMA levels. Negative cues from the global markets may lead to gap down opening on Friday.

GIFT NIFTY indicates gap down opening for Indian markets on Friday | Image source: Shutterstock.

Asian markets at 7 am

Nikkei: 33,859 (-2.5%)

Hang Seng: (-1.5%)

Kospi: 2,473 (-0.5%)

US markets

Dow Jones: 40,545 (-3.9%)

S&P500: 5,396 (4.8%)

NASDAQ: 16,550 (-5.9%)

The benchmark indices of Wall Street plunged the most after Thursday, March 2020, after the Trump administration announced sweeping tariffs on its global trading partners. President Trump announced a baseline 10% reciprocal tariff on all nations exporting to the US and higher rates on 60 select nations. The tariffs were as high as 49% for some trading partners like Cambodia and Vietnam, while key countries like China were levied 34%, India at 26%, Japan at 24%, and EU at 20%.

Experts believe the tariff could have a damaging impact on the US economy, raising inflation and causing a slowdown. Further, International Monetory Fund also warned tariffs pose significant risk to the global economy amid sluggish growth.

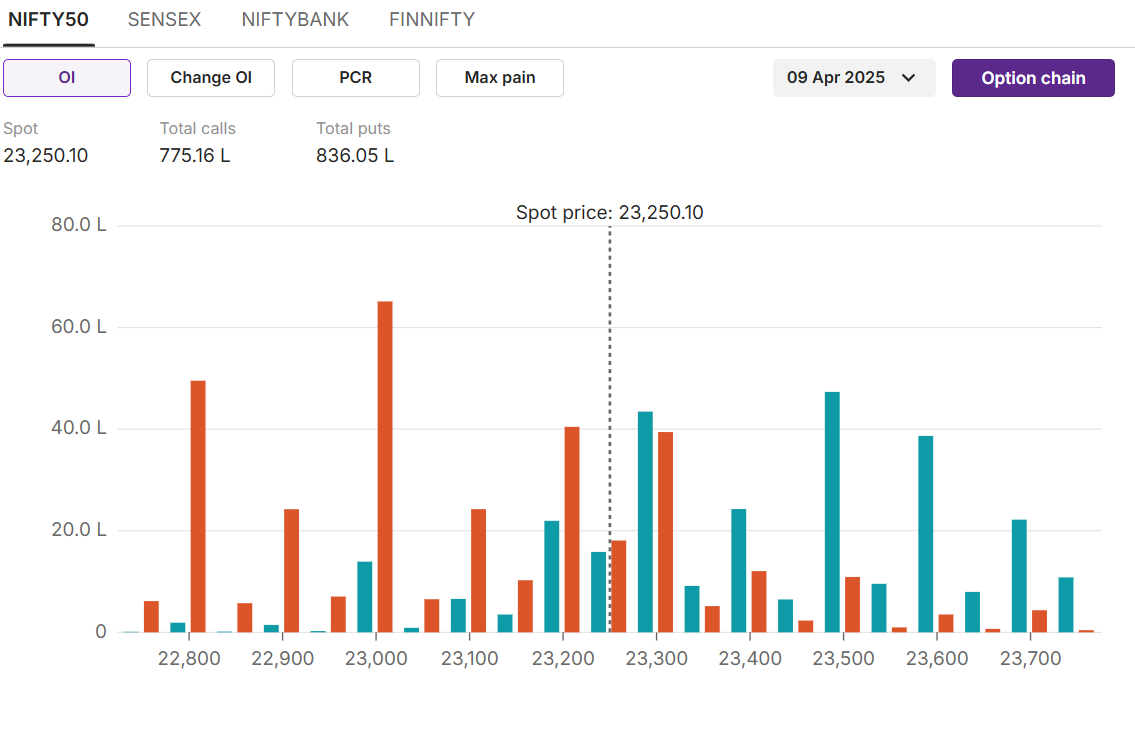

NIFTY50

Max call OI:23,500

Max put OI:23,000 (Ten strikes to ATM, 09 April Expiry)

NIFTY50 continued to defend the short and medium-term averages on daily charts despite high volatility. On an eventful Thursday, when markets reacted to 26% reciprocal tariffs levied on India, the NIFTY50 index opened nearly 200 points lower but later recouped partial losses to close 0.82% lower on Thursday. NIFTY50’s open and low were approximately at same levels of 23,145- 150, indicating strength at lower levels.

On weekly charts, the index has formed a shooting star pattern, indicating increased bearishness in the markets. The longer wick of the candlestick pattern indicates, the upside lost stream with more sellers at higher levels. Friday’s close below the previous week’s low would confirm the trend reversal in the markets.

On the daily charts, the index shows consolidation at 23,000- 23,300 levels with a bearish bias. However, the index continues to defend 20 and 50 EMA levels indicating some strength at lower levels. The swing low of 23,136 of the last three trading sessions will remain as a crucial support for Friday, a closing below this level may add fresh selling pressure.

On the daily charts, the index shows consolidation at 23,000- 23,300 levels with a bearish bias. However, the index continues to defend 20 and 50 EMA levels indicating some strength at lower levels. The swing low of 23,136 of the last three trading sessions will remain as a crucial support for Friday, a closing below this level may add fresh selling pressure.

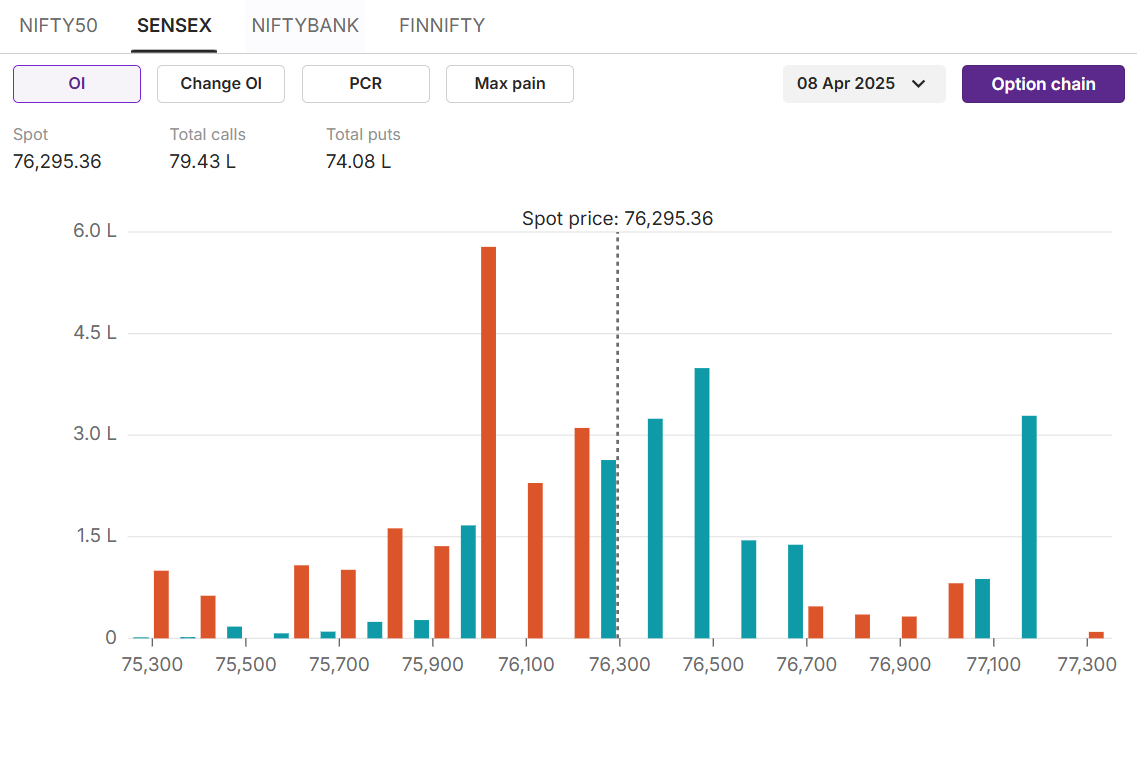

SENSEX

Max call OI: 76,500

Max put OI: 76,000

( Ten strikes to ATM, 08 Apr Expiry) The SENSEX is on the verge of closing the week in the red. Similar to the NIFTY50, SENSEX has failed to close above the previous week’s high and has witnessed selling pressure at higher levels. The selling was intensified by the FIIs as they remained net sellers on Thursday by selling ₹2,800 crore worth of Indian equities.

On daily charts, the index failed to complete the positive crossover of 20 EMA crossing 50 EMA from below. However, the swing low of the past three sessions at 76,000 was defended on Thursday. A Friday’s close below these levels could ignite fresh selling pressure in the markets.

On daily charts, the index failed to complete the positive crossover of 20 EMA crossing 50 EMA from below. However, the swing low of the past three sessions at 76,000 was defended on Thursday. A Friday’s close below these levels could ignite fresh selling pressure in the markets.

On the options front, 76,000 puts hold the highest open interest, indicating strong support for the current expiry. On the other hand, 76,500 strike calls hold the highest open interest, indicating resistance at these levels.

On the options front, 76,000 puts hold the highest open interest, indicating strong support for the current expiry. On the other hand, 76,500 strike calls hold the highest open interest, indicating resistance at these levels.

Stock scanner

Stock scannerLong build-up: PowerGrid Corp, Sun Pharmaceuticals

Short build-up: HCL Technologies, TCS

Top traded futures contracts: Bajaj Finance, HDFC Bank, Infosys, TCS

Top traded options contracts: SBIN 820 CE, Reliance 1300 CE, HDFC Bank 1900 CE

Under F&O ban: Nil

Out of F&O ban: Nil

About The Author

Next Story