Market News

Trade setup April 1: Tariffs and 200 EMA support to decide the outlook for NIFTY50 and SENSEX

.png)

5 min read | Updated on April 01, 2025, 07:45 IST

SUMMARY

NIFTY50 and SENSEX face selling pressure at their previous swing highs as tariff tantrums jitter investors' sentiments. Market participants are eyeing key triggers like reciprocal tariff announcements, RBI policy outcomes, and monthly auto sales data for March for the outlook on April 1.

GIFT Nifty futures indicate a positive start for Indian markets on Monday| Image source: Shutterstock.

Asian markets @ 7 am

GIFT NIFTY: 23,458 (+0.39%)

Nikkei 225: 35,809 (+0.52%)

Hang Seng: 23,240 (+0.66%)

U.S. market update

Dow Jones: 42,001 (+1.0%)

S&P 500: 5,611(+0.55%)

Nasdaq Composite: 17,299 (-0.1%)

The US markets closed in green on Monday amid a whipsaw movement in the benchmark indices. The US markets opened up 1% lower on Monday on the Dow Jones, S&P500 and NASDAQ and closed in green on the S&P500 and Dow Jones, while NASDAQ closed with little losses. The volatility heightened as investors navigated through economic growth concerns amid escalated trade tensions.

Despite the green closing, attention remains on the tariff announcements on April 2. Some experts believe the extent of reciprocal tariffs could be less than feared. However, despite the magnitude of the tariff, the announcements will remain the key trigger for markets for the coming week.

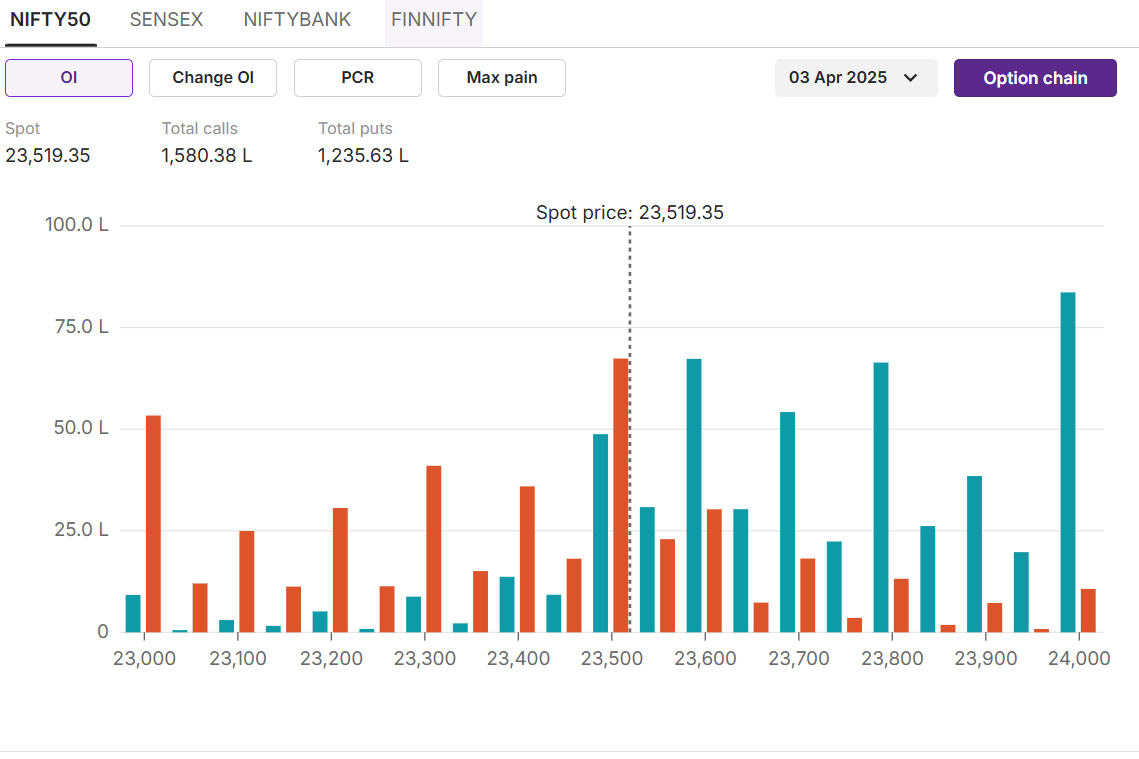

NIFTY50

Max call OI:24,000

Max put OI:23,500

( Ten strikes to ATM, 3rd April Expiry)

NIFTY50 continued its bullish momentum for the second week in a row after bouncing back from lower levels. NIFTY50 managed to close in green after facing resistance at the previous swing high levels of 23,800, levels last touched in February 2024. The selling pressure at higher levels was primarily driven by anxiety about tariff impact of impending reciprocal tariff announcements by the US President. In addition, experts believe that profit booking at higher levels also added some pressure on the benchmark index.

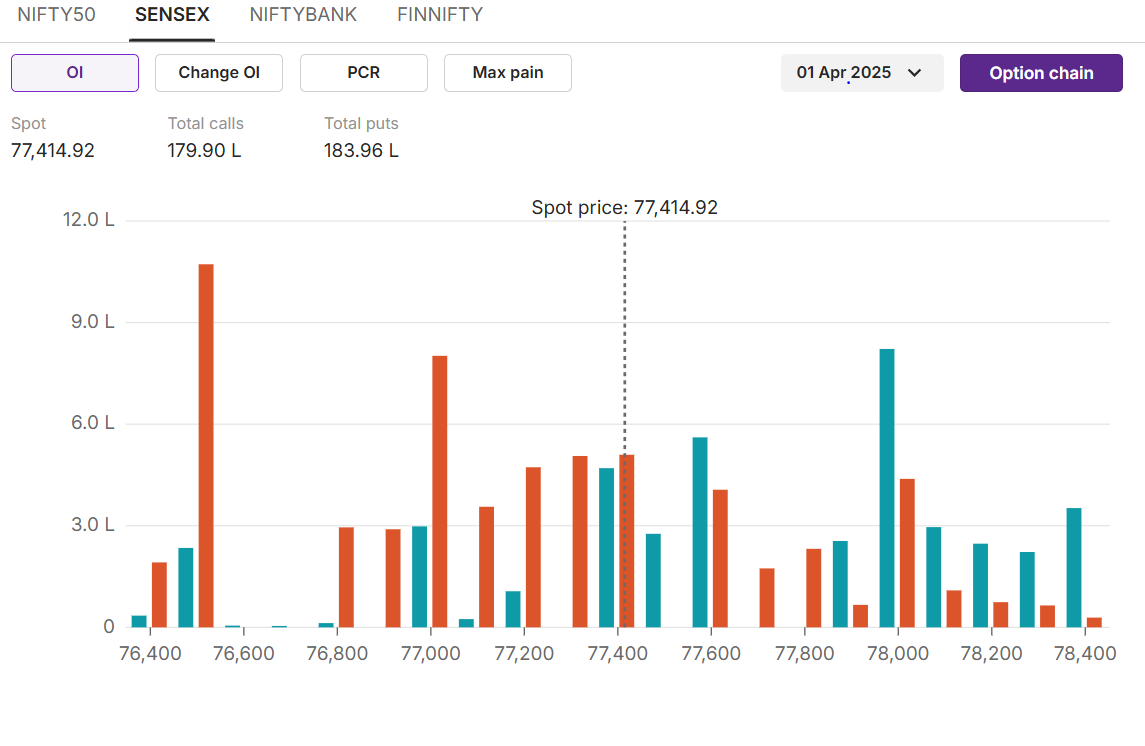

SENSEX

Max Call OI:78,000

Max Put OI:76,500

(Ten strikes to the ATM, 1st April Expiry)

SENSEX managed to close the previous week in green with 0.72% gains amid facing selling pressure at higher levels. The index faced resistance at the previous swing high level of 78,740. The index continued its gains at the start of the week but later fell due to selling pressure by the FIIs on Friday, 28th March 2024. Tariff concerns, cautious outlook on earnings season, and some profit booking at higher levels weighed down on the sentiments

Foreign Institutional Investors (FIIs) snapped their buying streak on the sevent day as they sold Indian equities worth ₹4,352 crore. On the flip side, Domestic Institutional Investors (DIIs) bought equities worth ₹7,646 crore on Thursday.

Stock scanner

Under F&O ban: Nil

Out of F&O ban: Nil

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story