Market News

Stock Market Weekly Recap: Weak Q2 results, FII outflows drag NIFTY, SENSEX for 4th week

.png)

4 min read | Updated on October 26, 2024, 09:23 IST

SUMMARY

SENSEX and NIFTY closed lower for the fourth straight week due to unabated selling by foreign institutional investors (FIIs) and weaker-than-expected Q2 results by bluechips.

Stock list

- This is the fourth straight week of losses for benchmark indices since the week ended on September 27.

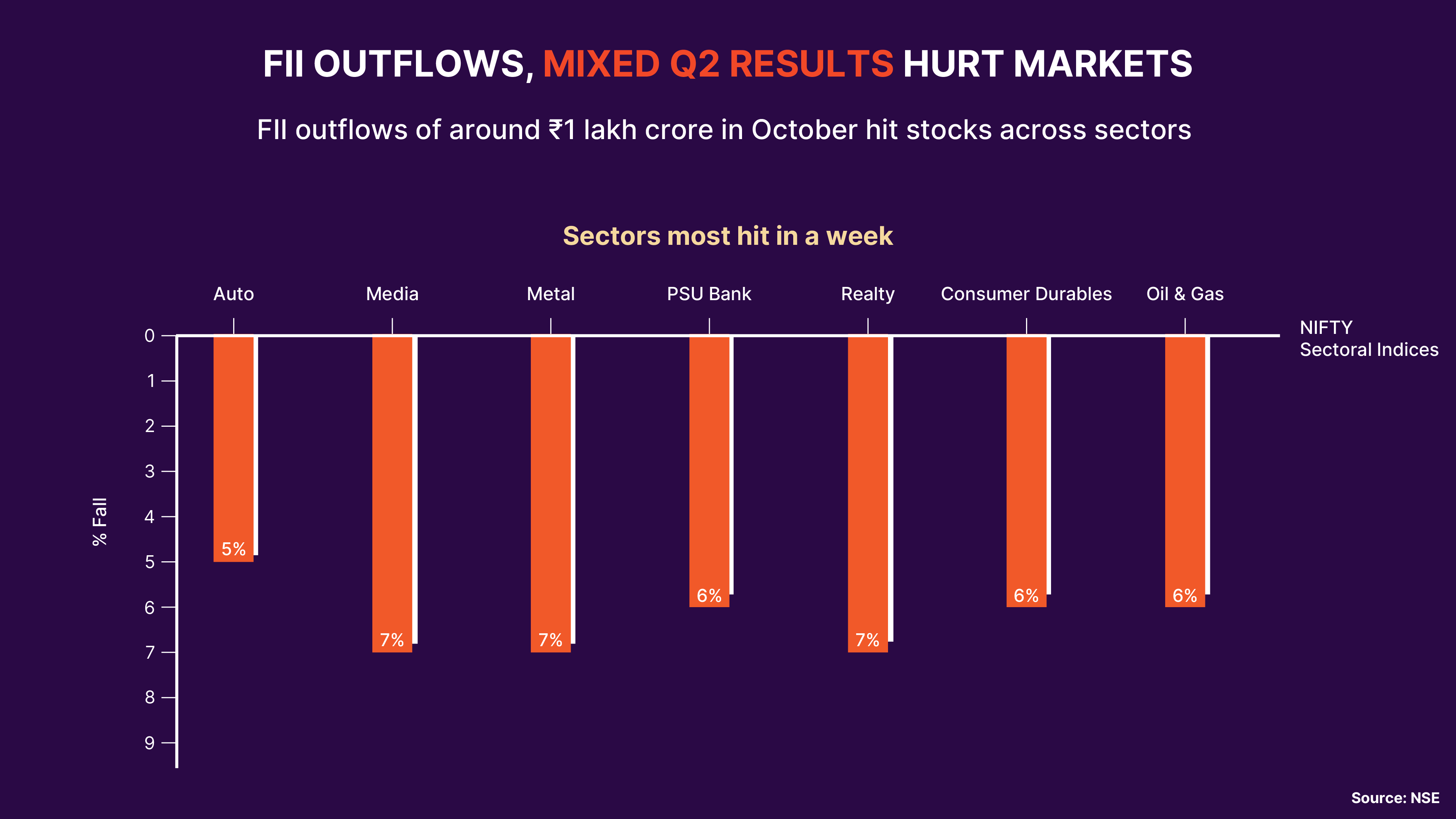

- FIIs sold equities worth ₹98,000 crore in the cash segment on a net basis in October so far.

- NIFTY Realty, Metal and Media were lead losers among sectoral indices this week, dropping 7% each.

It’s that time of the week again. Let’s take a look at what kept the sentiment on the D-Street subdued this week as Indian benchmarks extended losses.

SENSEX and NIFTY closed lower for the fourth straight week due to unabated selling by foreign institutional investors (FIIs) and weaker-than-expected Q2 results by bluechips.

On a weekly basis, SENSEX declined by 1,822 points, or 2.27%, as the barometer closed with losses in all five sessions of the week. NIFTY also declined by 2.75%, or 673 points, after facing losses in all five sessions.

This is the fourth straight week of losses for benchmark indices since the week ended on September 27.

So far in October, FIIs have taken out around ₹98,000 crore from Indian equities on a net basis. Strengthening US bond yields and attractive valuations of Chinese and Hong Kong markets are key triggers for FII outflows. Premium valuations of Indian equities have also dampened the weak financial performance in the second quarter of FY 2024-25.

Stock markets opened on a weak note on Monday. The key indices edged lower in a volatile trade on mixed earnings by corporates.

NIFTY settled below the 24,800 level, dragged by losses in Kotak Mahindra Bank.

NIFTY and SENSEX dropped to their two-month low levels on Tuesday due to intense selling across sectors. Realty, metal and auto sectors were the worst affected, while midcap and smallcap segments lost between 2.75% and 3.65%. NIFTY tanked more than 300 points to settle at 24,472, while SENSEX lost 930 points to close at 80,220.

Stock markets witnessed losses in the next two sessions as financial results from bluechips failed to cheer investors.

NIFTY and SENSEX dropped nearly 1% on Friday as FIIs continued to exit Indian stocks. SENSEX dropped 662.87 points, or 0.83%, to settle the week at 79,402.29. NIFTY lost 218.6 points, or 0.9%, to end at 24,180.8.

Realty, Metal & Media shares worst hit

Intense selling by FIIs was the major reason for the market crash this week. According to market data, FIIs sold equities worth ₹98,000 crore in the cash segment on a net basis in October so far. Till Thursday this week, FIIs sold shares worth ₹16,987 crore on a net basis in the cash segment.

Cheaper valuations of China—and Hong Kong-listed shares and Beijing's stimulus measures to stabilise the economy triggered selling in Indian markets.

Realty, media, and metal shares were the worst hit amid FII selling. Among NIFTY sectoral indices, Realty, Metal, and Media were the lead losers. These three indices dropped 7% each this week.

Oil & Gas and Consumer Durables also came under selling pressure, falling by 6% each. NIFTY Auto dropped 5% this week while FMCG retreated 3% as companies highlighted a weak urban demand in the financial results.

Broader markets also wilted, with NIFTY midcap and small-cap retreating by 5-6%.

Adani Enterprises, IndusInd Bank, Tata Consumer Products major NIFTY losers

FMCG shares HUL, Nestle face heat after Q2 results, weak management commentary

FMCG major Hindustan Unilever dropped more than 5% on Thursday after weaker-than-expected Q2 results and a weak commentary.

However, FMCG shares saw gains on Friday on value-buying by investors.

What lies ahead?

Stock markets are expected to trade volatile in the holiday-shortened week between October 28 and November 1. The upcoming quarterly results may also affect investor sentiment, as some big players across sectors, like Airtel, Maruti Suzuki, Adani Enterprises, and L&T, are scheduled to release earnings reports. Investors will also watch the economic data in the United States for further cues about the US Fed's rate cuts.

About The Author

Next Story