Market News

Stock Market Weekly Recap: SENSEX, NIFTY snap 3-week losing run; rise up to 1.7% in Budget week

.png)

6 min read | Updated on February 01, 2025, 21:21 IST

SUMMARY

With the major event of the Union Budget over, investors' focus will now shift to quarterly earnings for further cues into stocks. While some movements could be seen on the sectoral front after the budget proposals, RBI policy will be a major trigger next week.

Stock list

SENSEX closed flat at 77,505.96 and NIFTY marginally down at 23,482.15 on Saturday, February 1. | Image: PTI

- Investors lost more than ₹9 lakh crore in a single day on January 27.

- NIFTY Realty, NIFTY Auto, and NIFTY FMCG were top gainers among sectoral indices.

- Whirlpool shares tank nearly 30% in two sessions as parent firm to trim stake.

It’s that time of the week again. We are back with another quick recap of stock markets in the week leading up to Union Budget 2025.

Benchmark indices SENSEX and NIFTY rose by up to 1.7% in the eventful week, as stock markets operated for an extra day, on February 1, Saturday, due to the presentation of the Union Budget.

Despite the tax relief announced by Finance Minister Nirmala Sitharaman, markets remained volatile on Budget Day. However, the key indices snapped their three-week losing run on a weekly basis.

Before this, markets opened on Saturdays for regular trading on February 1, 2020, and February 28, 2015, on account of the Budget presentation.

In addition to the expectations from Union Budget 2025, the week witnessed major events such as the FOMC meeting, RBI’s liquidity measures, and a global rout in tech stocks on concerns over low-cost Chinese competitor DeepSeek.

Stock markets tumbled on Monday, with key indices dropping to more than seven-month lows due to heavy selling in IT and oil shares. SENSEX tanked 824 points or over 1% to 75,366.17. NIFTY sank 263.05 points or 1.14% to close below the 23,000 level for the first time since June 6, 2024.

While Donald Trump’s aggressive trade policy hit sentiment, recent developments around Deepseek’s cost-effective AI bot, which raised concerns over high AI hardware spending, dragged tech stocks worldwide. Investors lost more than ₹9 lakh crore in a single day.

US markets also tumbled following deep losses in tech shares amid fears that a Chinese low-cost competitor was undermining their AI business. The S&P 500 fell 1.5%, as Nvidia tanked 16.9%. Other Big Tech stocks also declined significantly.

Stocks continued to rise on Wednesday helped by buying in IT, capital goods and industrial shares and firm global trends. The highlight of the day was a sharp rally in border markets as smallcap and midcap indices soared by over 3% and 2% respectively. SENSEX advanced 631 points to close above 76,000 and NIFTY gained 205 points to regain the 23,100 level.

Buying in L&T following impressive Q3 results helped markets extend gains to the fourth day as the Economic Survey painted a rosy picture and fueled hopes of a pro-growth budget. SENSEX jumped 741 points and NIFTY by 259 points on gains in energy, FMCG, and realty shares ahead of budget. NIFTY closed above 23,500 on Friday.

Finance Minister Nirmala Sitharaman announced major tax relief for the middle class by raising the tax-exempt income limit to ₹12 lakh under the new tax regime and also tweaked the tax slabs. However, a modest 10% YoY increase in capex for FY26 fell short of expectations and indices closed on a flat note on Saturday after a volatile trade. SENSEX closed flat at 77,505.96 and NIFTY marginally down at 23,482.15, snapping its four-day winning streak.

Top NIFTY gainers & losers

| Gainers | Losers |

|---|---|

| Trent Ltd (12.9%) | HCL Tech (-5.5%) |

| Mahindra & Mahindra (9.8%) | Wipro (-4.8%) |

| Bajaj Auto (9%) | Tech Mahindra (-4.5%) |

Top sectoral gainers & losers

| Gainers | Losers |

|---|---|

| NIFTY Realty (12%) | NIFTY IT (-3%) |

| NIFTY Auto (5%) | NIFTY Media (-2%) |

| NIFTY FMCG (4%) | NIFTY Metal (-2%) |

US markets

| Index | Change |

|---|---|

| S&P 500 | -0.91% |

| Dow Jones | 0.26% |

| Nasdaq Composite | -1.64% |

Commodities (MCX)

| Commodity | Price | Change |

|---|---|---|

| Gold | ₹82,100/10g | Up 0.26% |

| Silver | ₹93,250/kg | Down 0.8% |

Currency gainers/losers (USD, GBP)

| Currency/Index | Change |

|---|---|

| US Dollar Index | 0.96% |

| GBP | -0.58% |

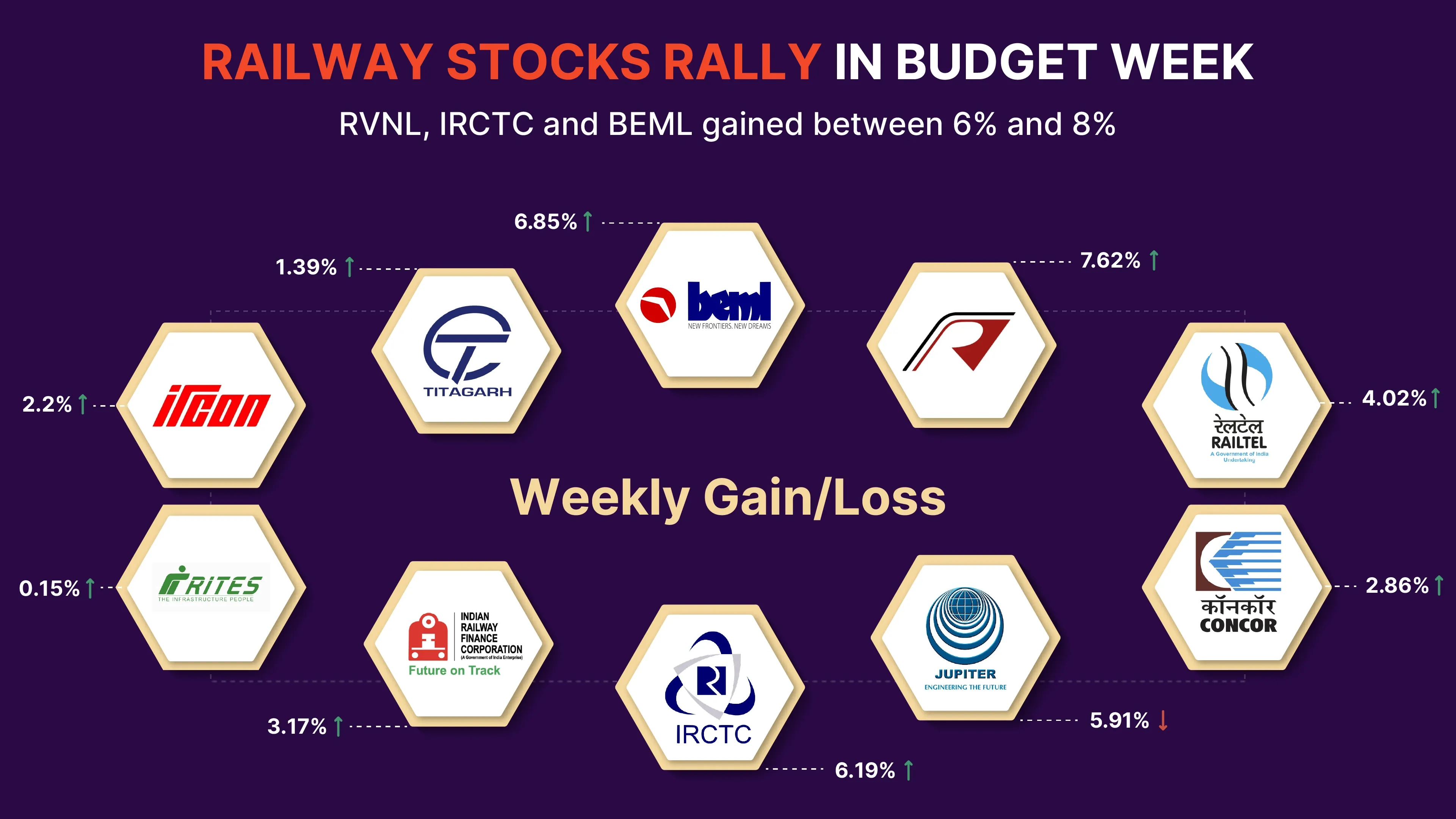

Railway stocks rally amid Budget hopes

Railway stocks gained up to 8% this week amid high expectations of increased allocations for the sector in the Union Budget 2025. However, Finance Minister Nirmala Sitharaman left the allocation for the railway sector unchanged at ₹2.51 lakh crore for FY2026.

In the run-up to the Budget, railway stocks rallied despite a weak market. The anticipation of higher allocation and infrastructure revamp aided the rally. However, on Saturday, railway stocks declined 10%, and most of them settled in the red following the Budget presentation.

Anant Raj shares plunge nearly 20% on DeepSeek AI tremors

Anant Raj, which mainly deals in real estate, plunged around 20% on Tuesday amid concerns over the emergence of low-cost Chinese AI competitor DeepSeek. Anant Raj entered the data centre business through its arm, Anant Raj Cloud, and is expanding its offerings in the AI segment. It also partnered with Google in July 2024 to develop AI-based solutions.

Whirlpool shares tank nearly 30% as parent to trim stake

Whirlpool of India Ltd shares tanked 20% on Thursday to hit the lower circuit, followed by an over 9% plunge on Friday after American home appliances major Whirlpool Corporation announced plans to cut its stake in the Indian arm. Whirlpool Corporation will reduce its shareholding in the Indian unit to around 20% by mid-to-late 2025.

Ola Electric zooms 14.5% as EV 2W maker reclaims top spot

Ola Electric Mobility shares zoomed more than 14.5% on Friday, briefly crossing the IPO price of ₹76 as the EV two-wheeler maker gained 25% market share and emerged as the top player in the segment. The stock closed the day at ₹74.80 apiece on the NSE, up around 12%.

What lies ahead?

With the major event of the Union Budget over, investors' focus will now shift to quarterly earnings for further cues into stocks. While some movements could be seen on the sectoral front after the budget proposals, RBI policy will be a major trigger next week. Investors will also focus on a tariff war with the US imposing a 25% duty on Canada and Mexico, and 10% on China.

About The Author

Next Story