Market News

Stock Market Weekly Recap: SENSEX, NIFTY50 scale all-time highs in 3rd straight week of gains

.png)

4 min read | Updated on September 29, 2024, 10:33 IST

SUMMARY

The benchmark indices failed to hold a five-day winning streak on Friday as NIFTY50 and SENSEX closed 37 points and 264 points lower, respectively. However, they continued a three-week rally to close nearly 1.5% and 1.2% higher on the NIFTY50 and SENSEX. It took just two sessions for SENSEX to take a 1,000-point leap to scale the 85,000 peak. NIFTY50 took a 38-session stride to jump from 25,000 to 26,000.

Stock list

It took just two sessions for SENSEX to take a 1,000-point leap to scale the 85,000 peak. NIFTY took a 38-session stride to jump from 25,000 to 26,000.

- NIFTY breached the 26,000 mark for the first time this week; surged to its lifetime high of 26,277.35 on Friday.

- NIFTY took a 38-session stride to jump from 25,000 to 26,000.

- SENSEX took a 1,000-point leap in just two sessions to scale the 85,000 peak.

- Fuel retailer BPCL rallied around 10% this week to hit lifetime highs.

We are back with a quick recap of the stock markets this week, marked by a bull run for benchmark indices.

The key indices hit new lifetime highs this week with NIFTY scaling the record 26,000 level before taking a breather at fag-end. Marking their straight third week of gains, SENSEX advanced around 1.2%, or 1,027 points, and NIFTY gained 388 points, or 1.48%, driven mainly by global factors.

NIFTY breached the 26,000 mark for the first time this week and hit its lifetime high of 26,277.35 on Friday. SENSEX, on the other hand, settled above the record 85,000 mark on Wednesday.

It took just two sessions for SENSEX to take a 1,000-point leap to scale the 85,000 peak. NIFTY took a 38-session stride to jump from 25,000 to 26,000.

Domestic equity markets mostly mirrored the rally in global markets. While investors welcomed signals of more rate cuts of up to 100 basis points by the US Federal Reserve this year, a stimulus by the Chinese government eased some growth-related concerns. Positive US data also supported the case for more rate cuts which boosted US stocks and Asian equities.

FIIs also sought to book some profits this week as Indian equities traded at record highs but on a monthly basis, foreign investors stayed invested.

Stock markets opened the week on a firm note and key indices closed the day at record high levels. SENSEX piled on gains to move towards 85,000 target while NIFTY closed above 25,900. Stock markets saw some volatility on Tuesday amid selling by FIIs. The key indices closed almost flat after moving between gains and losses.

SENSEX and NIFTY advanced by a quarter per cent on Wednesday to achieve new milestones. SENSEX breached 85,000 and NIFTY crossed 26,000.

China's economic stimulus announcement boosted Asian equities whose ripple effects were also felt in home markets. SENSEX jumped 666 points while NIFTY closed above 26,200 mark on Thursday.

Stock indices took a breather on Friday as investors preferred to book profits mainly in banking and FMCG stocks. SENSEX closed the week at 85,571.85 and NIFTY at 26,178.95.

Metals, Oil & Gas among major sectoral gainers

Most of the sectoral indices saw healthy gains this week. However, BSE Metals, BSE Oil & Gas and BSE Auto were the major outperformers. Crude oil prices remained under pressure while China’ stimulus measures revived metal shares.

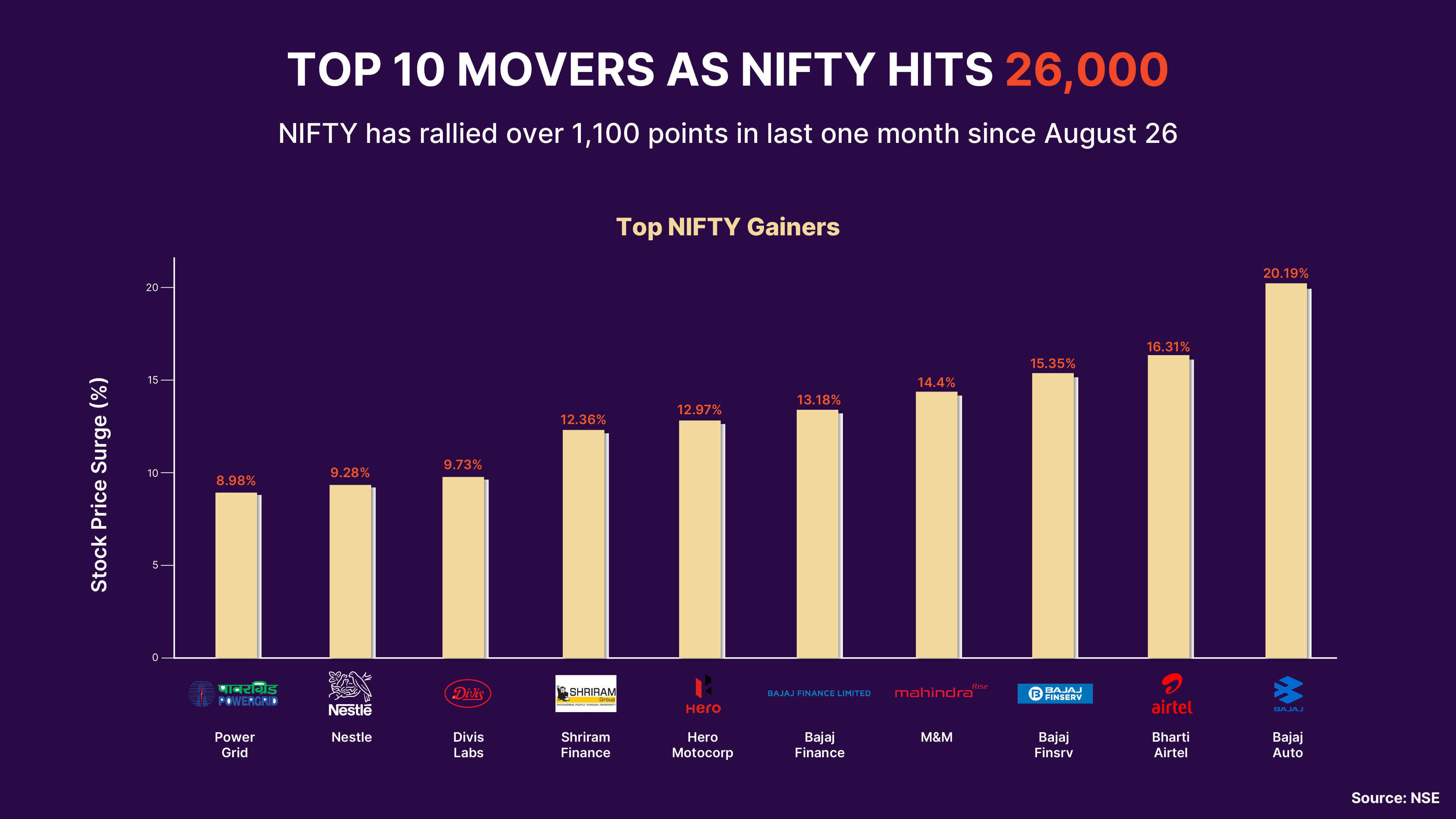

Bajaj Auto, Bharti Aitel propel NIFTY50 to scale 26K Peak

NIFTY hit the 25,000 mark for the first time on August 1. However, it lost momentum soon after and traded below the key level until August 26. Since August 26, NIFTY closed above 25,000, except for three sessions, and raced towards the record 26,000 mount powered by Bajaj Auto, Airtel, Bajaj Finserv and Mahindra and Mahindra. Shriram Finance and Hero MotoCorp also piled on gains in nearly one-month rally.

In the last one month, since August 26, the benchmark index gained over 1,100 points.

BPCL rises 10% to scale new lifetime high

Fuel retailer BPCL rallied around 10% this week to hit lifetime highs. The stock had witnessed some selling in previous weeks on reports that the government may go for fuel price cuts.

IEX shares decline 14% from 52-week high

Shares of power exchange IEX dropped around 11% this week after reports suggested that the government may implement market coupling by fiscal-end or early next fiscal. IEX shares had hit a fresh 52-week high recently but dropped around 15% from the year-high levels after the reports of the government's proposed move.

What lies ahead?

Stock markets took a breather on Friday after a record-breaking run. Indian stocks are expected to trade in a range in the holiday-shortened week as markets will be closed on October 2 for Gandhi Jayanti. Global trends are likely to influence the Indian equities ahead of the start of the earnings season.

Related News

About The Author

Next Story