Market News

Stock Market Weekly Recap: NIFTY, SENSEX extend winning streak for 3rd consecutive week; NIFTY Bank rises 2.7%

.png)

5 min read | Updated on December 07, 2024, 09:33 IST

SUMMARY

After the key event of the RBI MPC meeting outcome, investors will focus on the release of US payroll and US CPI inflation data. The US data is likely to impact the outcome of the US Fed's December policy meeting. Indian stocks will be mostly guided by global trends.

Stock list

- NIFTY, SENSEX rise 2% each on a weekly basis.

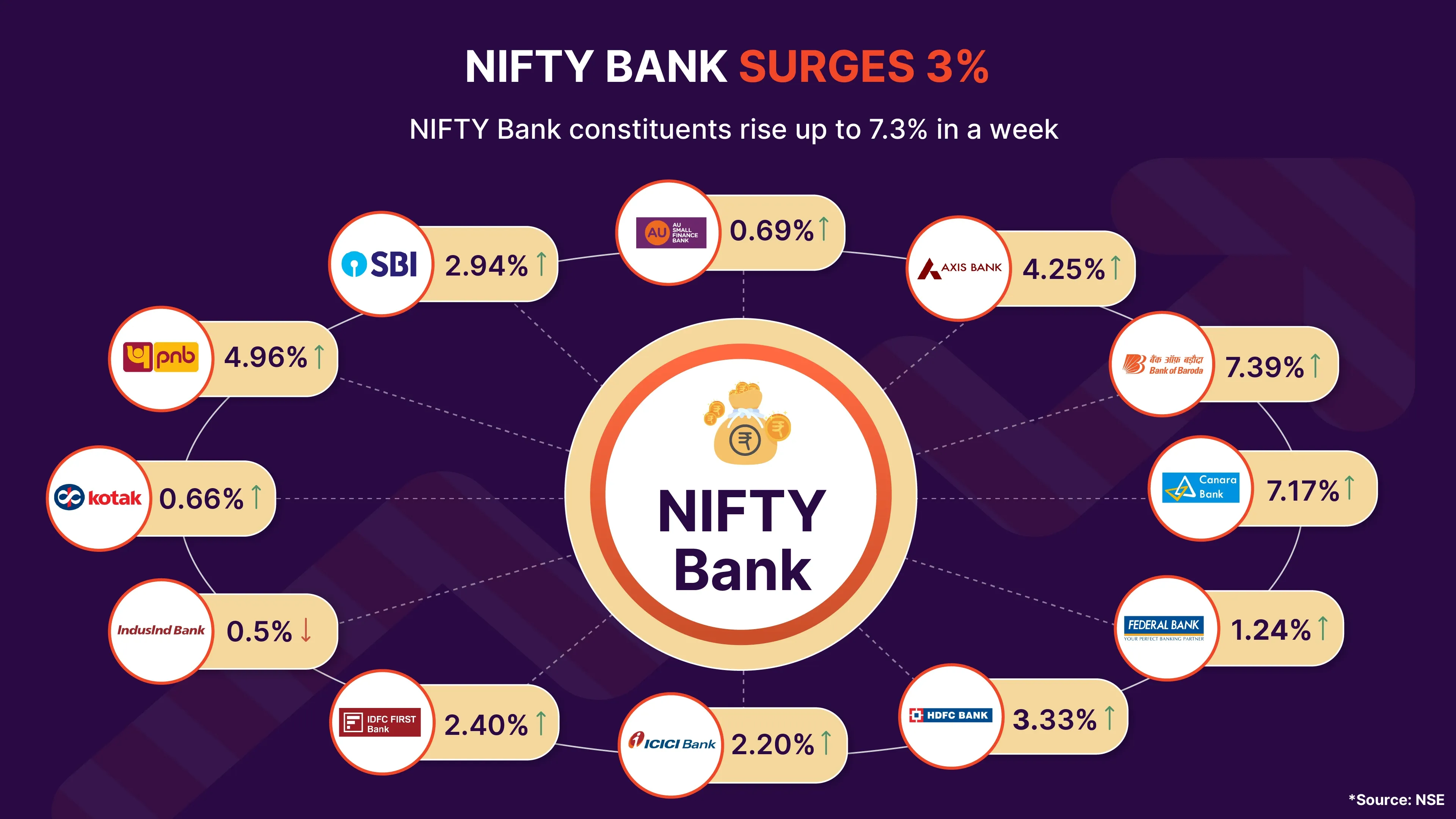

- NIFTY Bank gained around 2.7% this week on hopes of a CRR cut by the RBI.

- Titan, Ultratech Cement, Adani Ports, Axis Bank, Bajaj Finance and HCL Tech emerge as major gainers, rising up to 7%.

- BSE shares hit a lifetime high of ₹5,445 apiece on the NSE on Friday after a three-day rally.

It’s that time of the week again. We are back with a quick recap of stock markets.

Benchmark indices, SENSEX and NIFTY, advanced 2% each in their third week of gains. SENSEX jumped 1,906 points, or 2.3%, while NIFTY 50 advanced 546 points, or 2.23%, on a weekly basis.

Indian stocks maintained the gaining momentum despite setbacks on the growth front and troubling global cues.

Hopes of the RBI cutting the cash reserve ratio (CRR) to support the economy aided the rally in banking and rate-sensitive shares.

FIIs turned net buyers in December, which also boosted the market. US markets posting record gains, with Dow Jones scalingthe 45,000 level bolstered buying in Indian markets this week.

Stock markets were off to a solid start this week despite weaker-than-expected Q2 growth numbers.

Benchmarks SENSEX and NIFTY gained over half a percent on a push by realty, pharma and metal shares. NIFTY closed near the day’s high at 24,276.05, up 144 points, on Monday amid hopes of RBI measures to support the economy in the Monetary Policy Committee (MPC) meeting.

NIFTY surpassed its key resistance level of 24,350 on Tuesday helped by banking, metal and energy shares. FIIs turned net buyers which also boosted market sentiment. While SENSEX and NIFTY closed higher by around 0.74%, midcap and smallcap indices rose by nearly 1% each.

Benchmark indices witnessed choppy trade on Wednesday but maintained their winning momentum for the fourth straight day.

Stock markets also digested political turmoil in South Korea. NIFTY ended up 10 points at 24,467.45 while SENSEX advanced 110 points.

Banking shares extended their winning run on Thursday on hopes of a CRR cut. Record gains in the US markets after the US Fed chair comments also boosted domestic stocks.

NIFTY and SENSEX jumped nearly 1% helped by IT, banking and auto shares. Also, NIFTY reclaimed 24,700 - a level targeted after the breakout above 24,350.

Stock markets turned volatile after the RBI policy announcement on Friday. While RBI reduced the CRR by 50 basis points to infuse ₹1.16 lakh crore of liquidity into the system, the cut on GDP growth forecast to 6.6% did not go down well with investors. NIFTY settled 0.12% down at 24,677.8, while SENSEX slipped 0.07% to 81,709.12 after a choppy trade.

Broader markets outperform benchmark indices

Broader markets beat benchmark indices powered by FII buying. NIFTY Midcap indices surged 4% this week, while smallcap indices gained 5% on renewed buying by foreign investors. FIIs turned net buyers in December. They poured in ₹13,763.90 crore this month so far after a huge ₹45,974.12 pullout in November.

NIFTY Bank rallies nearly 3% in a week

Titan, UltraTech Cement, Apollo Hospitals among major gainers this week

HEG, Graphite India shares gain as China bans exports

Shares of carbon and graphite products maker HEG Ltd spurted around 27% this week after China announced a ban on exports of rare earth materials used in smartphones and chip-making. HEG shares spurted up to 41% in the three-day rally before paring some gains on Friday due to profit-taking. Graphite India closed the week higher by around 7%.

BSE shares soar to record high after F&O inclusion

BSE shares hit a lifetime high of ₹5,445 apiece on the NSE on Friday after a three-day rally. The inclusion of the stock in the F&O segment, starting with the December serie,s triggered a spike in trading volume. The stock surged 19% since Wednesday to close the week at ₹5,379.

Mishtann Foods shares tank 20% after SEBI action

Shares of Mishtann Foods Ltd tanked 20% on BSE on Friday after action by the Securities and Exchange Board of India (SEBI) for 'misappropriation’ of funds. The market regulator restrained the company’s promoter and CMD Hiteshkumar Gaurishankar Patel from market participation till further orders.

What lies ahead?

After the key event of the RBI MPC meeting outcome, investors will focus on the release of US payroll and US CPI inflation data. The US data is likely to impact the outcome of the US Fed's December policy meeting. Indian stocks will be mostly guided by global trends. FIIs, which turned net buyers, will also dictate trends in Indian markets.

About The Author

Next Story