Market News

One year after record highs: Why NIFTY50's rally ran out of steam and what’s next

SUMMARY

India’s benchmark indices gave negative returns for the last 12 months. This was mainly due to record selling by foreign institutional investors amid higher tariffs on Indian exports to the US. Any breakthrough on the trade deal between India and US could lift equities to record highs.

The SENSEX and NIFTY50 are down 6.45% and 6.17% respectively, from their record highs of 85,978.25 and 26,277.35, touched on September 27, 2024. Image: Shutterstock

Indian benchmark indices, long seen as one of the most resilient growth stories among emerging markets, have been lacklustre since September 2024. The SENSEX and NIFTY50 are down 6.45% and 6.17% respectively, from their record highs of 85,978.25 and 26,277.35, touched on September 27, 2024. This marks a notable pause after a nearly four-year bull run that saw the NIFTY50 surge more than 3.5 times from its March 2020 lows.

The reversal in Indian equities has been triggered by a mix of global and domestic headwinds. Foreign institutional investors (FIIs) have been net sellers since October 2024, pulling out a record ₹2,42,400 crore—the steepest bout of FII selling on record, as per data from National Securities Depository Limited (NSDL).

Further, elevated valuations, stricter regulations on derivatives trading and disappointing corporate earnings have added to the drag on Indian markets.

On the global front, the US decision to impose steep tariffs on Indian exports has dimmed outlooks for several sectors. Meanwhile, continuing geopolitical tensions—from the Russia-Ukraine war to the Israel-Hamas conflict—have made investors risk averse towards emerging markets. Together, these factors have eroded the momentum that once powered Indian stocks higher.

Domestic flows cushion FII outflows

Despite the heavy foreign outflows, Indian equities have avoided a deeper correction thanks to the rising strength of domestic investors. The number of demat accounts has ballooned from 3.6 crore in March 2020 to 18 crore by July 2024, reflecting the surge of retail participation. Systematic Investment Plans (SIPs) have been especially important, now contributing nearly $3 billion a month, according to a Jefferies report. In the first five months of FY26 alone, India recorded $21 billion of equity inflows, offsetting much of the FII selling.

This resilience is echoed by analysts like Jefferies’ Mahesh Nandurkar, who argues that steady mutual fund inflows will likely keep the market trading sideways through 2025, rather than plunging it into a crisis. Such support has created a structural cushion for equities, insulating them from sharper global shocks.

A phase of healthy consolidation

Even as domestic flows hold firm, foreign ownership of Indian stocks has slipped to 16%, down from 22% in 2019—a multi-year low. According to Jefferies’ GREED & fear report, India has underperformed the MSCI Emerging Markets index by 30 percentage points over the past year, its worst relative showing since 1996. While this signals a pause in foreign enthusiasm, strategist Christopher Wood frames it as a “healthy consolidation” rather than the beginning of a downturn.

The supply of fresh equity, estimated at $50–70 billion over the next year as corporates and private equity firms tap markets at still-favourable valuations, could also keep benchmarks range-bound.

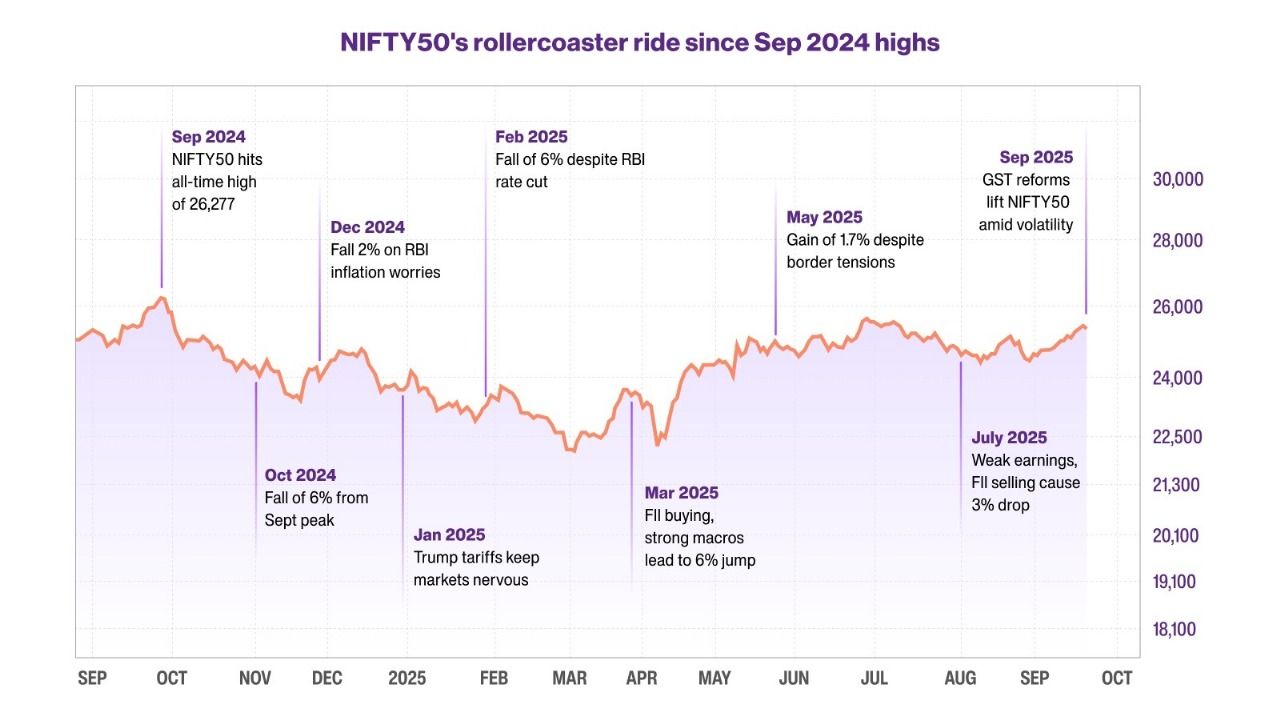

Here is what the markets saw in the past year:

Source: Tradingview

NIFTY50 made a new record high of 26,277 in September after witnessing volatility which originated in the run up to the result of the general elections.

After hitting record high levels, the benchmark and broader indices witnessed heavy selling pressure on account of profit booking at higher levels. The profit booking was largely attributed to overvaluation, record FII selling of over ₹1.14 lakh crore in secondary markets and the absence of a major positive trigger for the markets.

Weakness continued in November as NIFTY50 consolidated further at lower levels awaiting RBI’s monetary stance. Meanwhile, tight regulations on derivatives also added to the selling pressure.

NIFTY50 fell 2% in December as the RBI kept the rates unchanged, FII selling intensified across the board, keeping the overall markets on the edge.

January’s market performance was dominated by key events like Trump’s inauguration as president for the second term and the first set of tariffs unleashed on Canada, Mexico and China. At the end of the month, markets shifted focus towards the NDA government’s first budget in its third term.

The budget brought the much-needed cheer to Indian taxpayers as the government proposed nil tax on income up to ₹12 lakh. However, the major tax boost failed to excite the investor sentiment as the selling continued in the Indian markets led by global uncertainty over tariffs and recession risks.

After selling shares worth nearly ₹60,000 crore in February, foreign investors turned net buyers for the first time in six months. In addition, strong macroeconomic data at 6.2% GDP growth and hopes of US Federal Reserve rate cuts supported the investor sentiment, leading to a 5.7% rally in March.

NIFTY50 rallied 3.4% in April, as the focus shifted to corporate earnings, strong FII buying, RBI rate cut and hopes of a trade deal boosted sentiment.

The first two weeks of May witnessed intense border tensions between India and Pakistan. Markets shrugged off worries as strong FII buying lent support to Indian markets. The focus shifted to monsoon and softening inflation.

June continued with a 3% rally in NIFTY50 driven by eased border and geopolitical tensions. A drop in crude oil prices, by the end of the month the focus shifted to Q1 earnings

The Q1FY26 earnings posted an all round underperformance which failed to boost the investor sentiment. Furthermore, the FII selling resumed with full might as foreign investors sold nearly ₹47,000 crore in the secondary markets in July, which led to nearly 3% drop in the NIFTY50

The weak broader earnings, intensified FII selling, led to persistent weakness in the markets in August with a 1.3% fall in the NIFTY50. However, Prime Minister Modi’s remarks on GST reforms on Independence Day boosted investor sentiments. In addition, the 7.5% GDP growth despite external shocks boosted the investor confidence.

Starting September, the new GST rates were announced and implemented from September 22. The new GST reforms uplifted the markets from lower levels. However, volatility persisted due to new tariffs of 50% imposed on India, headwinds to the Indian IT sector due to new H1 B visa rules kept the index movement under check.

To summarise, external shocks dominated the market movements in the last year. While internal headwinds were taken care of, the external headwinds continue to add pressure on Indian markets. According to the experts, any breakthrough on the trade deal front between India and the US, could lift the markets towards previous record highs. The Q2 and Q3 earnings will be in focus for ascertaining the real impact of the new GST reforms on the economy.

About The Authors

Next Story

.jpeg)