Market News

How to trade in Reliance Industries ahead of its Q1 results?

.png)

4 min read | Updated on February 12, 2026, 13:58 IST

SUMMARY

Shares of Reliance Industries have been consolidating their gains around the all-time high zone for the past 13 trading sessions. Ahead of its earnings announcement and expiry of its monthly futures and options contracts on 25 July, the options market is currently pricing in a move of ±3.3%.

Stock list

Options trading strategy based on earnings price trends

Reliance Industries is expected to report mixed numbers during the first quarter of FY25. The company’s revenue and net profit may increase year-on-year (YoY), but could decline sequentially.

According to experts, Reliance Industries’ consolidated Q1 revenue could increase in the range of 11%-13% year-on-year and range between ₹2.2 to ₹2.3 lakh crore. Sequentially, revenue could remain flat. The company reported revenue of ₹2.36 lakh crore in Q4FY24 and ₹2.07 lakh crore in Q1FY24.

Meanwhile, its net profit is expected to remain flat on a yearly basis and could decline by up to 4% sequentially. The company reported a net profit of ₹21,243 crore in Q4FY24 and ₹18,258 crore in Q1FY24.

Furthermore, Reliance Industries’ consolidated EBITDA is expected to decline by 7%-8% on a sequentially. It is likely to range between ₹39,500 crore to ₹40,000 crore, primarily due to lower refining margins and weaker oil-to-chemical business performance.

Investors and traders will be closely monitoring Reliance Industries' Q1 results to assess the performance of its retail and telecom segments. In addition, management commentary on other businesses will be closely watched.

Ahead of the Q1 results, shares of Reliance Industries closed the day at ₹3,173 and are up 22% since the start of the year.

Technical view

Reliance Industries is consolidating its gains around its all-time high zone for the past 13 trading sessions. After consolidating for almost four months from March to June 2024, Reliance shares have zoomed above their recent all-time high zone and are currently trading above all their major daily moving averages (20 and 50).

According to the current structure, the stock has crucial short-term support around 3,100 and strong support between 2,900 and 3,000. Until Reliance breaches these levels on a closing basis, the trend could remain positive.

Options overview

Open interest (OI) for the 25 July expiry shows highest call options OI at 3,200 strike, which may act as immediate resistance. In addition, significant call and put OI was also placed at 3100 strike on 18 July, indicating a range-bound activity.

Moreover, the stock witnessed significant call unwinding on strikes ranging between 3160 to 3200 ahead of its results announcement on 19 July.

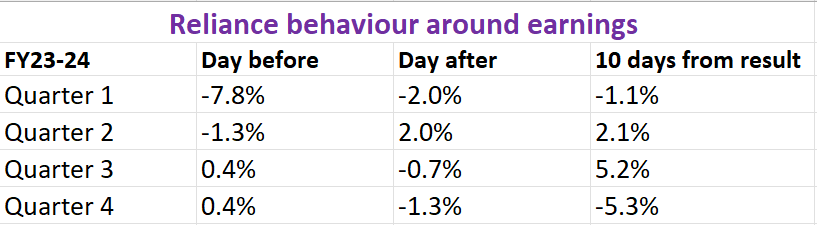

To better understand the price behaviour, let's take a look at how Reliance Industries' share price has performed over the last four quarters around its earnings announcements.

How to plan an options trade in Reliance?

Based on options data suggesting a potential price movement of ±3.3%, traders have the opportunity to engage in either a long or short volatility strategy.

About The Author

Next Story