Market News

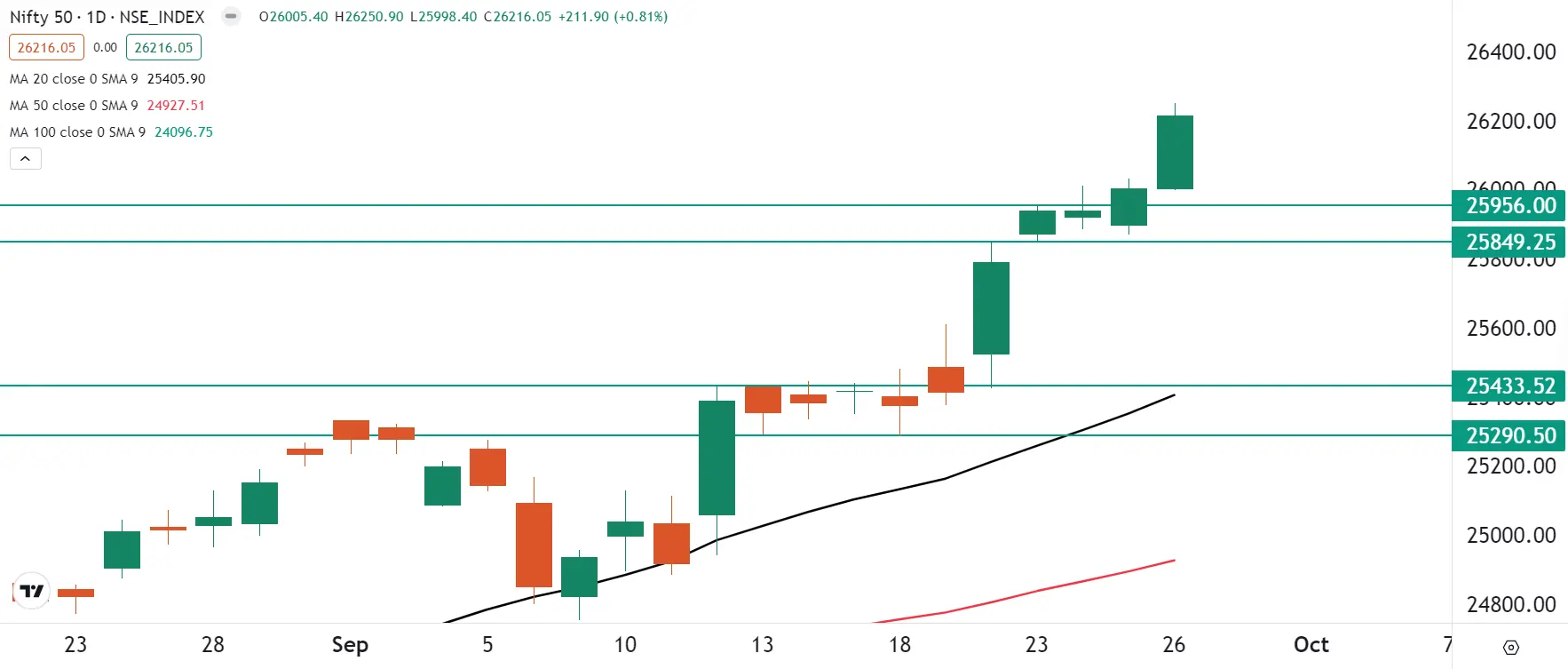

Trade Setup for Sept 27: NIFTY50 bullish momentum hinges on weekly close above 26,000

.png)

5 min read | Updated on September 27, 2024, 08:01 IST

SUMMARY

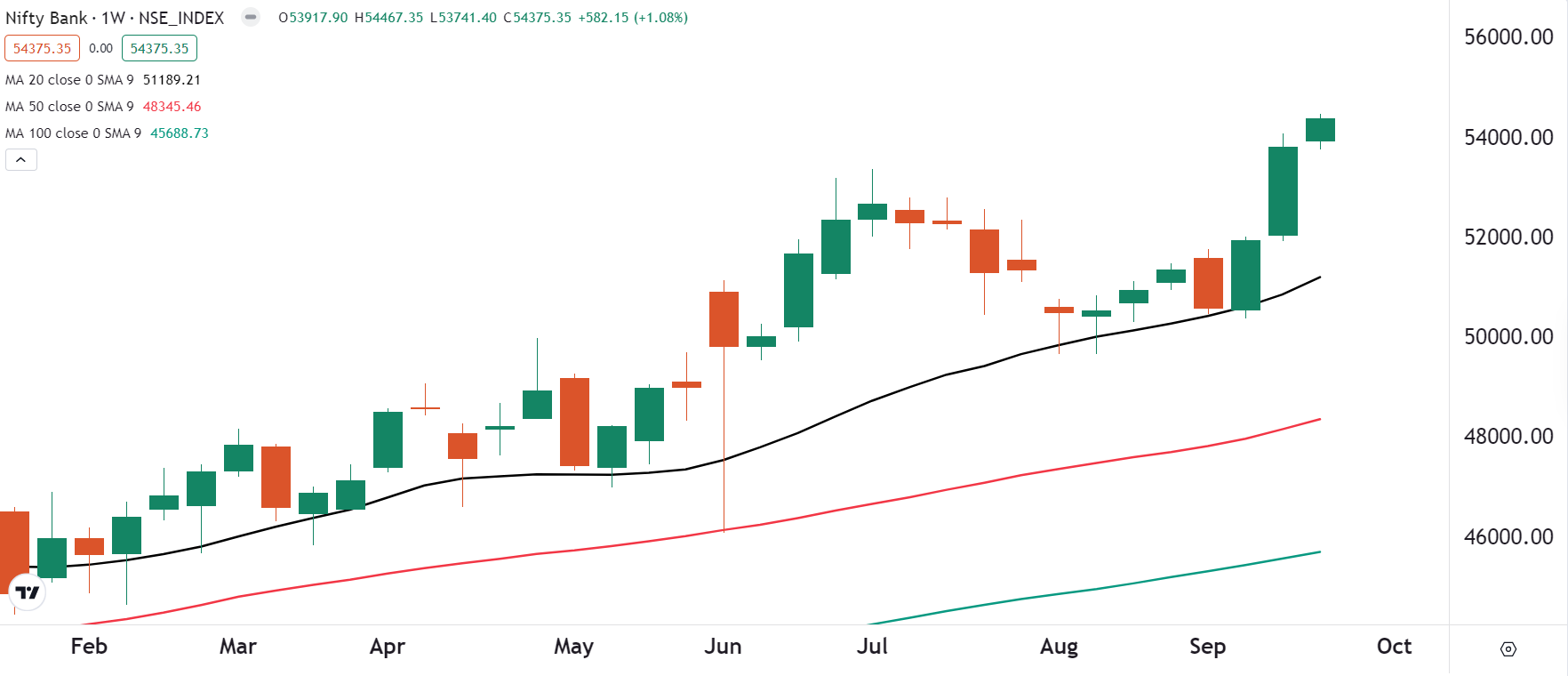

Both the NIFTY50 and BANK NIFTY are forming a bullish candle on the weekly chart, indicating a strong close. However, for confirmation of the bullish continuation, traders are advised to watch to closely monitor the closing price and plan their strategies accordingly.

NIFTY50 & SENSEX eye for positive weekly close on Friday

Asian markets update

The GIFT NIFTY is up 0.5%, indicating a gap-up start for the NIFTY50 today. Meanwhile, the Asian markets are trading in green. Japan’s Nikkei 225 is up 0.7% as the investors assessed the release of latest inflation report which eased to 2.2% from August’s 2.6%.

The Hong Kong’s Hang Seng index jumped over 2% after China's leadersship signalled their intention to revive the economy with new pledges to increase fiscal spending, improve the real-estate crisis and support the stock market.

U.S. market update

Dow Jones: 42,175 (▲0.6%) S&P 500: 5,745 (▲0.4%) Nasdaq Composite: 18,190(▲0.6%)

U.S. indices ended the Thursday’s session in the green following the release of strong economic data. GDP growth for the second quarter came in at 3%, according to the third estimate, above the average annual GDP growth of 2.3% from 2018 to 2023.

In addition, the latest weekly unemployment report showed that initial jobless claims came in at 2,18,000, almost 6,000 below expectations.

NIFTY50

October Futures: (▲0.1%) Open Interest: (▲22.1%)

The NIFTY50 index moved out of its three day consolidation and extended the bullish momentum for the sixth consecutive day. The index the September series of its futures and options contracts on the positive note and ended above the 26,200 mark, led by strong buying in metals and automobile stocks.

BANK NIFTY

October Futures: (▲0.0%) Open Interest: (▲25.6%)

The BANK NIFTY also extended its gains and closed in the green for the second day in a row and formed a bullish candle on the daily chart. After consolidating and taking a pause for three days, the index resumed its upward momentum, ending the day at fresh record high.

FII-DII activity

Stock scanner

Long build-up: Maruti Suzuki, Samvardhana Motherson, Vedanta, Steel Authority of India and Shriram Finance

Short build-up: Crompton Greaves, Havells India and Bharat Forge

Under F&O ban: NIL

Out of F&O ban: Aditya Birla Fashion and Retail, Granules India, Hindustan Copper, Vodafone-Idea and Indian Energy Exchange

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story