Market News

SENSEX surges over 650 points, NIFTY50 firm above 24,850; Here are key factors boosting the rally

.jpeg)

4 min read | Updated on September 04, 2025, 10:11 IST

SUMMARY

Mahindra & Mahindra was top gainer in the NIFTY50 index. Bajaj Finance, Eicher Motors, HDFC Life, Grasim Industries, Nestle India and ITC were also among the gainers.

The overall market breadth was positive as 2,294 shares were advancing while 1,043 were declining on the BSE. Image: Shutterstock

The SENSEX rose as much as 889 points, and the NIFTY50 index touched an intraday high of 24,980.75, led by GST beneficiary sectors such as auto and FMCG shares.

As of 9:25 am, the SENSEX was up 548 points at 81,116, and the NIFTY50 index climbed 154 points to 24,868.

Here are key factors boosting the rally in markets:

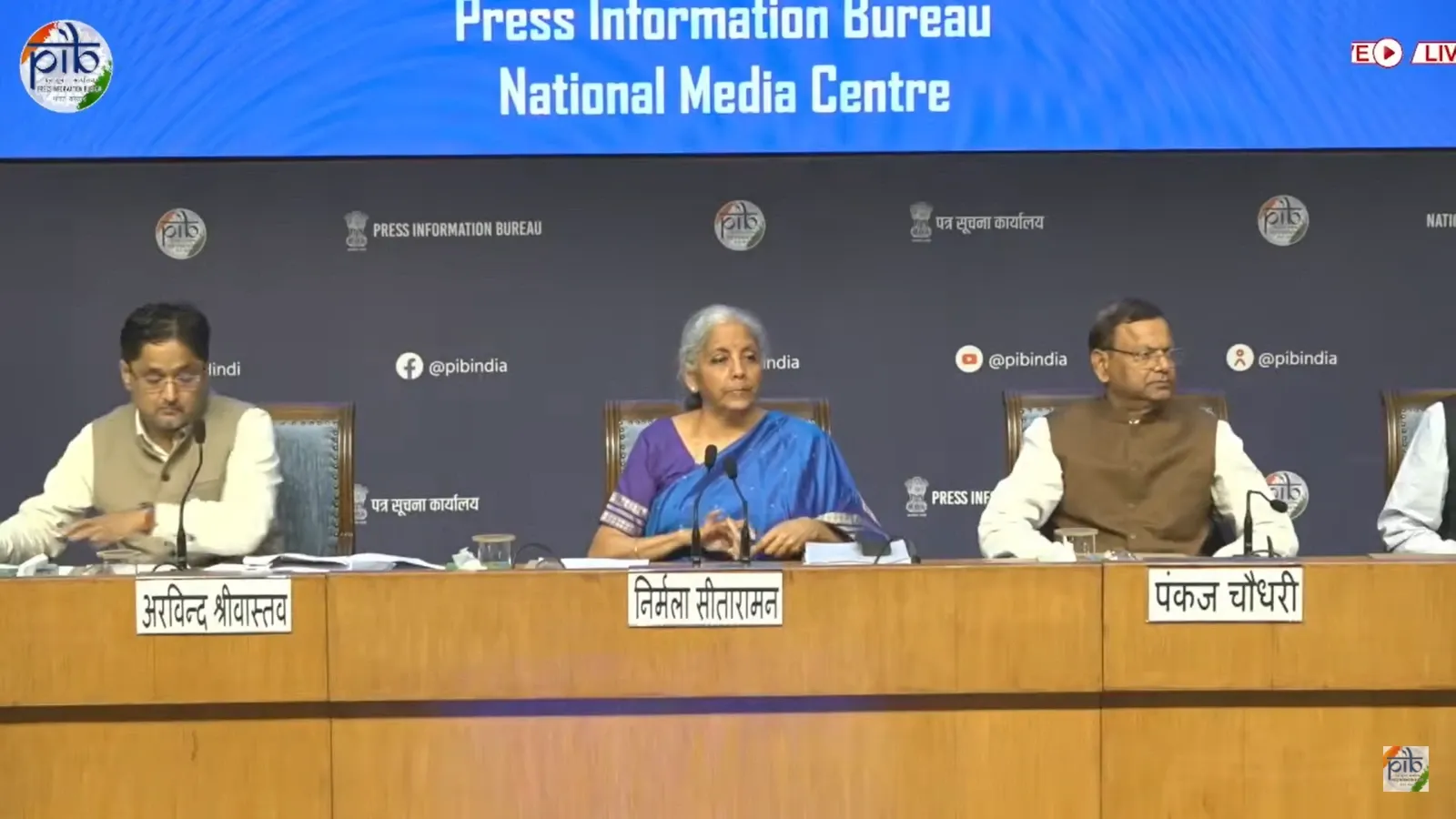

Investor sentiment turned bullish on Thursday after the GST Council unanimously approved overhauling the GST regime. The GST Council approved limiting slabs to 5% and 18%, effective from September 22, the first day of Navaratri.

Almost all personal-use items and aspirational goods for the middle class, like AC and washing machines, will see rate cuts as the government looks to boost domestic spending and cushion the economic blow of the US tariffs.

The premium paid for individual life insurance and health insurance (including family floater) policies has also been exempted from GST.

Earlier, such policies were subject to 18% GST.

Briefing reporters after a marathon day-long GST Council meeting, Sitharaman said all decisions were taken unanimously, with no disagreement with any state.

The panel approved simplifying the GST from the current four slabs – 5, 12, 18 and 28% – to a two-rate structure – 5 and 18%. A special 40% slab is also proposed for a select few items such as high-end cars, tobacco and cigarettes.

The new rates for all products, except pan masala, gutkha, cigarettes, chewing tobacco products like zarda, unmanufactured tobacco and bidi, will be effective September 22, she said.

Investor wealth soars

With Thursday's surge in markets, investors' wealth soared by ₹1.79 lakh crore, data from BSE showed.

Sectoral landscape

Auto stocks were witnessing strong buying momentum after the GST council decided to cut rates on most of the vehicles from 28% to 18%.

The measure of auto stocks on the National Stock Exchange, the NIFTY Auto index, rose as much as 954 points, or 3.7%, to hit an intraday high of 26,729.65.

Mahindra & Mahindra was the top gainer in the NIFTY Auto index; the stock rose 6.51% to ₹3,499. Eicher Motors, Balkrishna Industries, Tata Motors, TVS Motor Company, Samvardhana Motherson and Hero MotoCorp also between 1-3%.

FMCG shares were also witnessing buying interest after the Council cut rates on daily essential items like shampoo, soaps, biscuits, butter, ghee, etc., to 5% from the earlier rate of 12%.

The NIFTY FMCG index jumped as much as 1,515 points, or 2.66%, to hit an intraday high of 58,485.05.

Shares of Britannia Industries, the country's largest biscuit maker, were the top gainer in the FMCG space; the stock rose 5.5% to ₹6,234.

Colgate-Palmolive, Emami, Dabur, Nestle India, ITC and Hindustan Unilever also rose between 1.7% and 4%.

NIFTY Bank, Financial Services, Realty and Consumer Durables indices also rose between 1-2%.

On the other hand, select IT, metal, pharma and oil & gas shares were witnessing selling pressure.

Broader markets underperform

Mid- and small-cap shares were underperforming their larger peers as the NIFTY Midcap 100 index rose 0.4% while the NIFTY Smallcap 100 index advanced 0.24%.

NIFTY50 gainers and losers

Mahindra & Mahindra was the top gainer in the NIFTY50 index. Bajaj Finance, Eicher Motors, HDFC Life, Grasim Industries, Nestle India and ITC were also among the gainers.

On the flipside, Tata Consumer Products, IndusInd Bank, Infosys, Tata Steel, Reliance Industries, Wipro and JSW Steel were among the losers.

The overall market breadth was positive, as 2,294 shares were advancing while 1,043 were declining on the BSE.

Related News

About The Author

Next Story