Market News

Reliance Industries shares trade flat ahead of 48th AGM; details to consider

.png)

4 min read | Updated on August 29, 2025, 09:57 IST

SUMMARY

Reliance Industries share price: Earlier in August 2025, S&P Global Ratings said there was a potential for upside to Reliance Industries, provided it operates at lower leverage and strengthens non-energy revenue streams.

Stock list

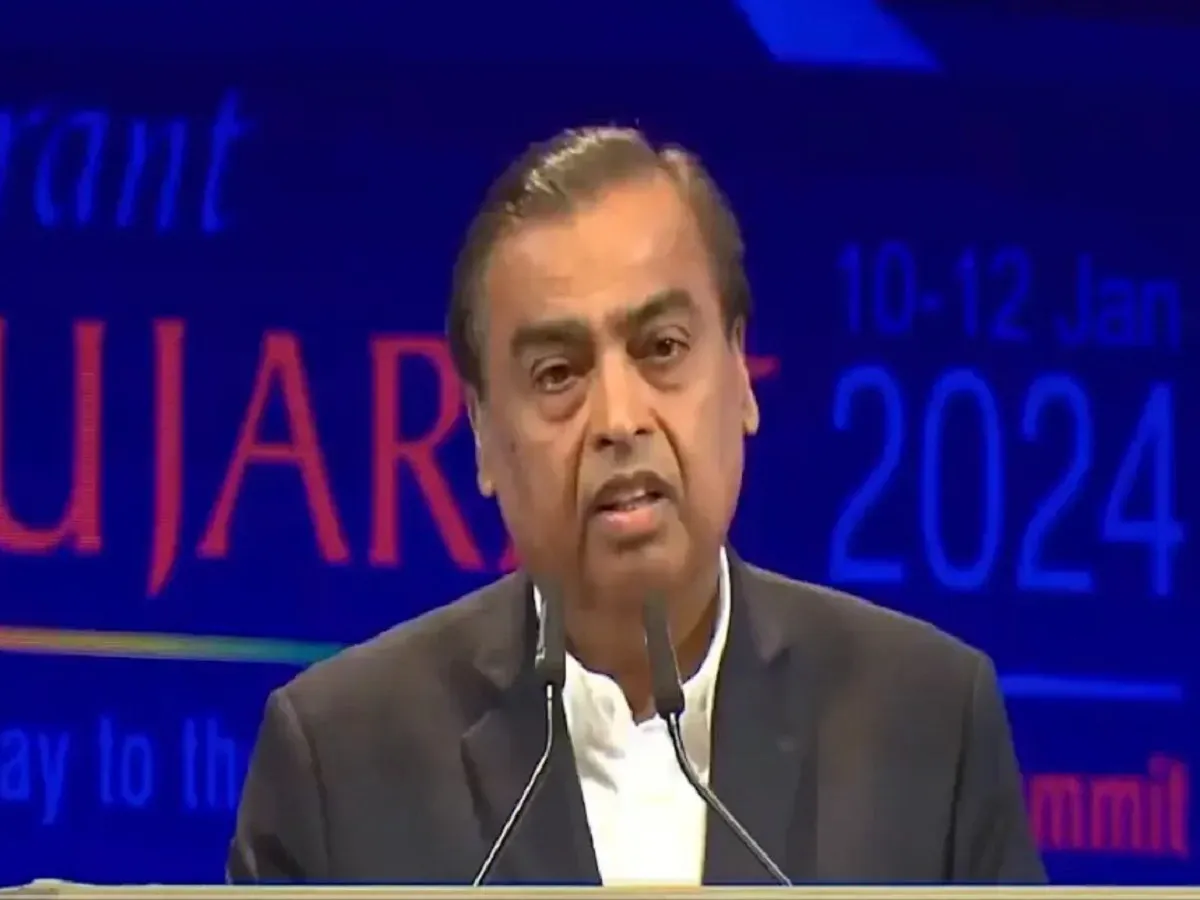

RIL is likely to announce its telecom arm Jio's share sale via initial public offering (IPO). | Image: Shutterstock

The stock was trading 0.12% lower at ₹1,384.20 on the NSE.

The oil-to-telecom conglomerate, in its filing to stock exchanges on Thursday, July 31, 2025, said that the 48th annual general meeting, or AGM (Post-IPO), of the members of the company will be held on Friday, August 29, 2025, at 2:00 P.M. through Video Conferencing ("VC") / Other Audio Visual Means ("OAVM"), in accordance with the applicable circulars issued by the Ministry of Corporate Affairs and the Securities and Exchange Board of India (SEBI).

Earlier in August 2025, S&P Global Ratings said there was a potential for upside to Reliance Industries, provided it operates at lower leverage and strengthens non-energy revenue streams.

S&P earlier raised the issuer credit ratings of Reliance as well as companies such as Oil and Natural Gas Corp (ONGC), NTPC and Tata Power to 'BBB' from 'BBB-' following an upgrade in India's sovereign rating to 'BBB/A-2' from 'BBB-/A-3' on economic resilience and sustained fiscal consolidation.

"There is a potential for upside in RIL's rating. It is at 'BBB+'... This (rating going up by a notch) would require a standalone credit profile to improve. For this, what we have said we need is a continuation of the company to operate at a lower leverage, and we will likely need a strengthening on the business side, particularly contribution from non-energy revenues because these are less volatile," said Neel Gopalakrishnan, credit analyst, S&P Global Ratings.

A combination of these factors could "push the rating up, and it is something to watch for the next year or so," Gopalakrishnan said.

S&P stated that its stable outlook on the company's rating "reflects our expectation that Reliance Industries' strengthening cash flows and disciplined spending will help the company to preserve its financial profile over the next 12-24 months."

The rating agency could, however, lower the rating if Reliance's capital expenditure, including acquisitions in digital or retail businesses, is higher than expected or the cash flow projection for the company reduces due to lower earnings stemming from underperformance in any key business.

Reliance's debt-to-EBITDA ratio sustainably exceeding 2.5x would indicate such deterioration.

"We could upgrade the rating if the company demonstrates a record of conservative financial policy, such that its debt-to-EBITDA stays well below 2x. A higher rating could also require a greater share of revenue from non-energy segments," it had said.

Key expectations

The oil-to-telecom conglomerate is likely to announce its telecom arm Jio's share sale via initial public offering (IPO) as the company looks to unlock value for its shareholders, Amit Kumar Gupta, founder of Fintrekk Capital, a SEBI-registered research analyst, told Upstox News.

"Reliance Jio became free cash flow (FCF) positive and also enabled Reliance Industries to be FCF positive on a consolidated basis in FY2025. However, due to the higher retail/O2C/new energy capex, overall capex was flat annually at ₹1.3 lakh crore. With capex not likely to rise much and amid improving profitability of key businesses (ex-E&P), expect FCF to rise further," said a report, quoting Kotak Institutional Equities.

Reliance Industries Q1 FY26 result

Billionaire Mukesh Ambani-backed Reliance Industries, the country's most valuable company, on Friday, July 18, reported a net profit of ₹26,994 crore in the first quarter of the current financial year, marking an increase of 78% from ₹15,138 crore in the same period last year.

The sharp jump in profit came on the back of a strong surge in other income in the first quarter. Reliance Industries' other income in the June quarter jumped 280% to ₹15,119 crore as against ₹3,983 in the year-ago period.

Other income included a gain of ₹8,924 crore, being proceeds of profit from the sale of listed investments, Reliance Industries said in an exchange filing. The Ambani-backed company sold its stake in Asian Paints in multiple tranches last month.

Reliance Industries' revenue from operations rose 5% to ₹2,48,660 crore from ₹2,36,217 crore.

Operationally, Reliance Industries reported stable performance as its earnings before interest, taxes, depreciation, and amortisation (EBITDA), also known as operating profit, rose nearly 11% to ₹ 42,905 crore, and its operating profit margin expanded by 80 basis points to 17.25% as against 16.41% seen in the corresponding period last year.

Related News

About The Author

Next Story