Market News

Reliance Industries first Indian firm to cross ₹21 lakh crore in market cap; five key things to know

.png)

3 min read | Updated on July 01, 2024, 20:34 IST

SUMMARY

RIL peaked to an intraday high of ₹3,129.85 apiece on the National Stock Exchange (NSE), up 2.2% as against the previous day's close.

The Mukesh Ambani-led RIL has doubled its market cap in the last five years

Oil-to-telecom conglomerate Reliance Industries Ltd (RIL) on Friday, June 28, became the first Indian listed entity to cross the ₹21 lakh crore in terms of market capitalisation.

The milestone was achieved by the company within the first hour of the trading session, as its shares soared to a new all-time high.

The stock peaked to an intraday high of ₹3,129.85 apiece on the National Stock Exchange (NSE), up 2.2% as against the previous day's close. However, by 12:18 pm, it pared some of the gains and was trading 1.64% higher at ₹3,111.15.

The market capitalisation, at the current market price of shares, stood at ₹21.1 lakh crore.

As RIL achieves the historic milestone, here are five key things to know about the Mukesh Ambani-led megacap conglomerate.

1. M-cap doubled in last 5 years

The market capitalisation of Reliance Industries has doubled in the last five years since it hit the ₹10 lakh crore mark in November 2019.

Notably, the company had breached the ₹1 lakh crore milestone in 2005, and surpassed the ₹4 lakh crore market capitalisation in October 2007. It took another decade to reach the ₹5 lakh crore milestone.

2. RIL growth and expansion

Founded by Dhirubhai Ambani in 1957, Reliance started its journey with yarn trading businesses in Mumbai. In 1973, Reliance Textile Industries was established, marking a significant milestone in the company's journey. Reliance Textile's IPO in 1977 shattered many records and was oversubscribed 7 times. Reliance forayed into the petrochemicals segment in 1980 and there has not been any looking back since then.

Over the years, RIL diversified into other sectors such as petrochemicals and refining, renewable energy, retail, media, financial services and telecommunication. The company announced a demerger of its financial services business in 2023.

Reliance disrupted the telecommunication space in India with the launch of Jio in 2016. The new entity expanded its market presence quickly, establishing itself as the 2nd largest single-country operator in the world.

3. RIL shareholding

RIL promoters include the Ambani family led by Mukesh Ambani, who hold a majority of 50.3% stake in the company, as of March 2024. Of the remaining shares, over 22.1% stake is held by foreign institutional investors (FIIs), and 17.2% by domestic institutional investors.

4. RIL revenue in FY2024

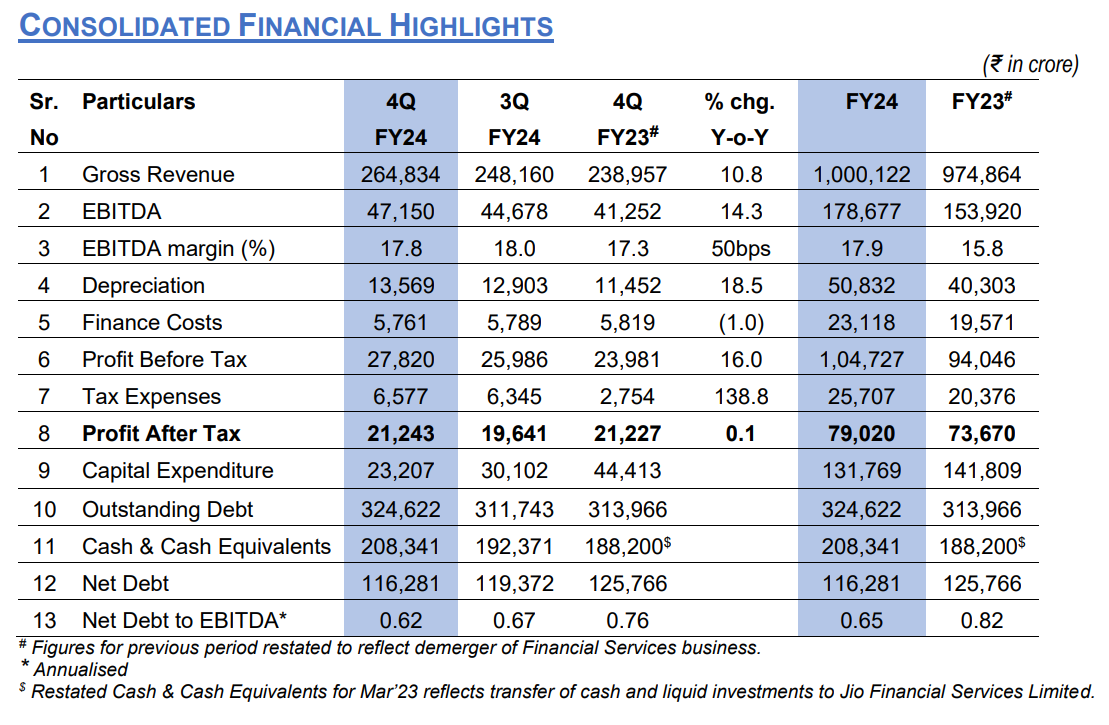

In fiscal year 2023-2024, Reliance Industries reported a consolidated revenue of ₹1,000,122 crore, up 2.6% year-on-year as compared to ₹974,864 crore in FY 2022-23.

5. Reliance Industries net profit in FY 2024

The company's net profit shot up to ₹79,020 crore in FY 2024, marking a 7.3% year-on-year growth. Its EBITDA (earnings before interest, taxes, depreciation, and amortisation) stood at ₹178,677 crore in FY24, up 16.3% from the previous financial year.

About The Author

Next Story