Market News

Reliance AGM 2025: Mukesh Ambani likely to unveil Jio IPO plans on Aug 29; a quick recap of key announcements at 47th AGM

.png)

3 min read | Updated on August 25, 2025, 14:07 IST

SUMMARY

Reliance Industries is likely to announce its telecom arm Jio's share sale via initial public offering (IPO) as the company looks to unlock value for its shareholders, said Amit Kumar Gupta, founder of Fintrekk Capital, a SEBI-registered research analyst, told Upstox News.

Stock list

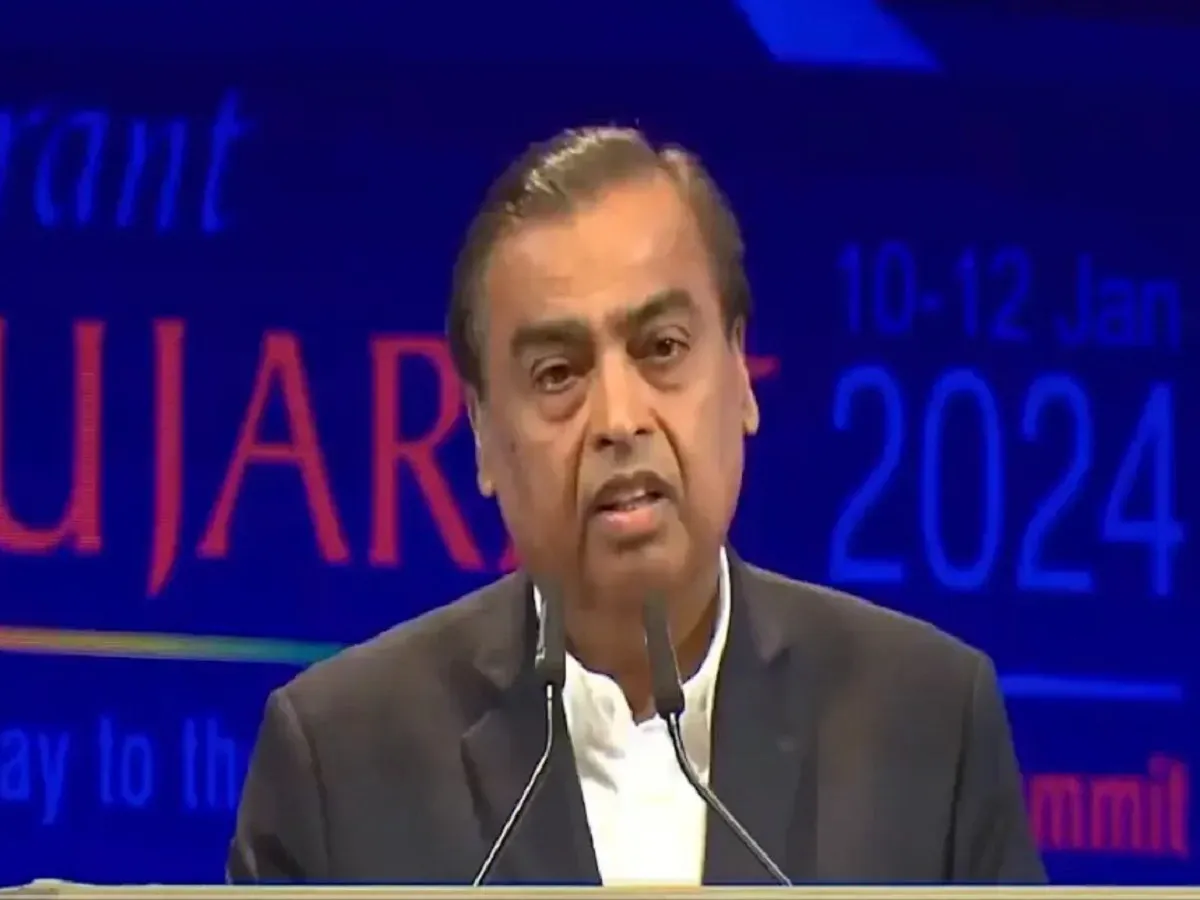

Mukesh Ambani will address shareholders on 48th Annual General Meeting on Friday, August 29. Image: Shutterstock

Mukesh Ambani-backed Reliance Industries, the country's most valuable company, will address shareholders on Friday, August 29, on account of the 48th Annual General Meeting. Ambani last year at the 47th AGM announced and highlighted Reliance's commitment to integrating innovative AI technologies across its businesses and the development of a national AI infrastructure.

Reliance Industries is likely to announce its telecom arm Jio's share sale via initial public offering (IPO) as the company looks to unlock value for its shareholders, Amit Kumar Gupta, founder of Fintrekk Capital, a SEBI-registered research analyst, told Upstox News.

"Reliance Jio became free cash flow (FCF) positive and also enabled Reliance Industries to be FCF positive on a consolidated basis in FY2025. However, due to the higher retail/O2C/new energy capex, overall capex was flat annually at ₹1.3 lakh crore. With capex not likely to rise much and amid improving profitability of key businesses (ex-E&P), expect FCF to rise further," said a report, quoting Kotak Institutional Equities.

Last year, Ambani said that Jio completed the pan-India rollout of Jio True 5G, the world's largest and fastest 5G deployment. Over 85% of the 5G radio cells operating in India belong to Jio. With the widest coverage and the highest quality, Jio True 5G now reaches every corner of India.

"Jio has transformed India from 5G-dark to 5G-bright, creating one of the world's most advanced 5G networks. Through unmatched spectrum holdings, 5G standalone architecture, and advanced technologies like carrier aggregation and network slicing, Jio is the only operator in India, and among the first globally, to fully harness 5G's power. Jio True 5G has also achieved the world's fastest 5G adoption. In just two years, over 130 million customers have embraced Jio True 5G," Ambani told shareholders last year.

On retail business, Ambani had last year said that Reliance Retail had an unbeatable omni-channel model providing customers seamless experience across physical and online channels and convenience.

"We have a common inventory across channels that provides hyperlocal delivery leveraging our widest store network. We have built multiple channels to serve customers through about 19,000 own stores with nearly 80 million sq. ft. across 7,000+ cities, 4 million kirana partners and a wide bouquet of digital platforms which provides us access to consumers across the country. We have built an extensive and efficient supply chain with over 32 million sq. ft. of warehouse network to support our pan-India operations," Ambani said.

Reliance Industries Q1 earnings

Reliance Industries last month reported a net profit of ₹26,994 crore in the first quarter of the current financial year (Q1 FY26), marking an increase of 78% from ₹15,138 crore in the same period last year.

The sharp jump in profit came on the back of a strong surge in other income in the first quarter. Reliance Industries' other income in the June quarter jumped 280% to ₹15,119 crore as against ₹3,983 in the year-ago period.

Other income included a gain of ₹8,924 crore, being proceeds of profit from the sale of listed investments, Reliance Industries said in an exchange filing. The Ambani-backed company sold its stake in Asian Paints in multiple tranches last month.

Reliance Industries' revenue from operations rose 5% to ₹2,48,660 crore from ₹2,36,217 crore.

Operationally, Reliance Industries reported stable performance as its earnings before interest, taxes, depreciation, and amortisation (EBITDA), also known as operating profit, rose nearly 11% to ₹ 42,905 crore, and its operating profit margin expanded by 80 basis points to 17.25% as against 16.41% seen in the corresponding period last year.

Reliance Industries shares traded 0.05% higher at ₹1,410.

About The Author

Next Story