Market News

Rail Vikas Nigam to Cochin Shipyard: Top-performing PSU stocks of 2024

.png)

5 min read | Updated on December 23, 2024, 14:44 IST

SUMMARY

2024 has been a blockbuster year for Indian PSU stocks. Rail Vikas Nigam, Cochin Shipyard, and Mazagon Dock have delivered triple-digit returns to investors so far this year. Meanwhile, the NSE PSE Index, which is a basket of 20 PSU stocks, has outperformed the benchmark NIFTY50 index.

Stock list

Top performing PSU stocks: Which of these best performers will sustain momentum in 2025 and how?

This year, 2024, has been a blockbuster year for India PSU, with several PSU stocks registering double-digit gains in share price driven by earning growth, order inflows, and low valuation. The NSE PSE Index, which is a basket of 20 PSU stocks, outperformed benchmark NIFTY with a 27.1% return in 2024 on a year-to-date (YTD) basis.

Apart from the NSE PSE index, PSU stocks like Rail Vikas Nigam gained (138%), Cochin Shipyard (118%), and Mazagon Dock (105%) gained in triple digits so far this year. Other top performers include Housing & Urban Development Corporation (88.8%), NBCC India (72.2%), and National Aluminium Company (64.1%) for the year.

Earlier in September 2024, the PSU stock witnessed correction due to earnings slowdown and concern of change in government policies, but PSUs bounced back later in late November as concern faded with the government back with capex schemes.

With 2025 closing, all eyes now shift to three major events lined up in early 2025: the Union Budget (February), the RBI’s MPC meeting under the new Governor (February), and Donald Trump’s assuming the charge (January). The government policy focused on capex-led growth is expected to remain intact, along with this clear revenue visibility for PSUs, which would sustain momentum for PSU stocks in 2025.

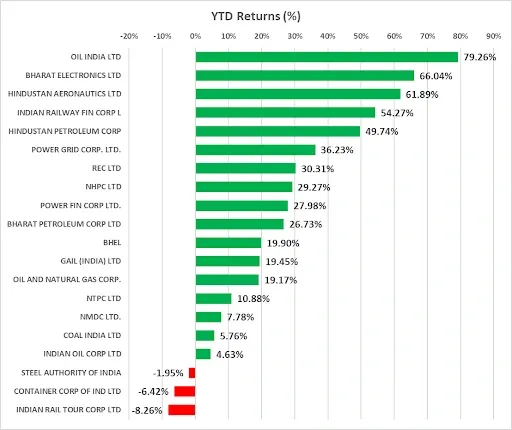

NIFTY PSE Index constituent's performance in 2024, so far

(Source - NSE)

(Source - NSE)Defence stocks

Looking at the order book and government policy support through Indigenous procurement, there is clear revenue visibility in defence companies. Hindustan Aeronautics Limited (HAL) in 2024 has gained 51% so far and is likely to be in momentum next year, along with Bharat Electronics (BEL), Mazagon Dock Shipbuilders, Garden Reach Shipbuilders, and Cochin Shipyard in 2025. The defence budget trend will focus on capex towards modernising infrastructure, and the growth momentum will be sustained.

Recently, the Cabinet Committee of Security (CCS) approved orders worth ₹21,100 crore, of which ₹13,500 included a contract to procure 12 Su-30MKI aircraft from HAL within the next 15 months that will benefit HAL.

BEL, which also had an order book of ₹74,595 crore as of September 2024, would also benefit from the approval to make radar and electronic warfare systems.

HAL has not disclosed its Q2FY25 order book, but is expected to be more than ₹1 lakh crore. In the case of Mazagon Dock and Cochin Shipyard, the business growth is likely to be sustained by a robust order book and strategic expansion. Mazagon Dock’s order book, as of September 2024, stands at ₹39,872 crores. Cochin Shipyard did not disclose its order book for Q2FY25 but reported the Q1FY25 order book at ₹22,000 crore for unexecuted orders.

Oil & Gas stocks

Hindustan Petroleum Corporation Ltd (HPCL), which holds a strong position in the market with consistent improvement in market share, including motor and aviation fuels, is also expected to perform well in 2025. The business's core profitability is expected to double due to expansion projects and increased throughput in the next year, driving the performance.

Bharat Petroleum Corporation Ltd (BPCL) has reported lower-than-expected earnings in Q2FY25, but its sourcing of Russian crude has decreased to 34%, and the company's Propylene Derivatives Petrochemicals Project (PDPP) utilisation is currently at 80%, which are positive for the company. Also, the regulatory framework for auto fuel marketing margins has supported oil marketing companies (OMCs) which would benefit the company in the coming year.

Railway stocks

Indian Railways Finance Corporation (IRFC) and Rail Vikas Nigam Ltd (RVNL) are also likely to continue the momentum in 2025 amid a recovery in capital expenditure by the central government and key announcements in the Union Budget 2025. The recent November month’s cabinet approval for three mega railways projects worth ₹7,927 crore has optimised the sector. IRFC, the sole financier for railway projects, would benefit capex in the sector. While RVNL will continue to benefit from the electrification of railway lines.

Power stocks

In the power sector, the Power Grid Corporation of India and REC Ltd will sustain the momentum. Power Grid plans to grow investment in the sector with an ambitious capex target of ₹3 trillion until FY32 and raised capex and capitalization target for FY27 which will lead to a large market share in the upcoming Tariff Based Competitive Bidding (TBCB) projects. Additionally, REC Ltd is also placed well within the sector, with strong financials, improving asset quality, and a strategic focus on renewable energy, which is likely to drive growth for the company.

Conclusion

Market volatility is likely to persist in 2025, prompted by tariff wars, the continued depression of the rupee, rising energy prices, the central bank’s policy stance, and a change in the US government's power. Amidst this, investors need to be prepared with an investment framework.

According to experts, the momentum in PSU stocks will remain stock-specific, unlike in 2024. PSUs are spread across sectors like railways, defence, banking and NBFCs, power, and many more, but investors should look for PSUs with strong fundamentals.

About The Author

Next Story