Market News

NIFTY50 surpasses 25,300, surging to highest level in nearly four weeks; here is what is driving the rally

SUMMARY

The renewed buying in domestic equities resumed just ahead of the start of the September quarter corporate earnings season, which began with the country's largest information technology company, Tata Consultancy Services, reporting its September quarter earnings on Thursday.

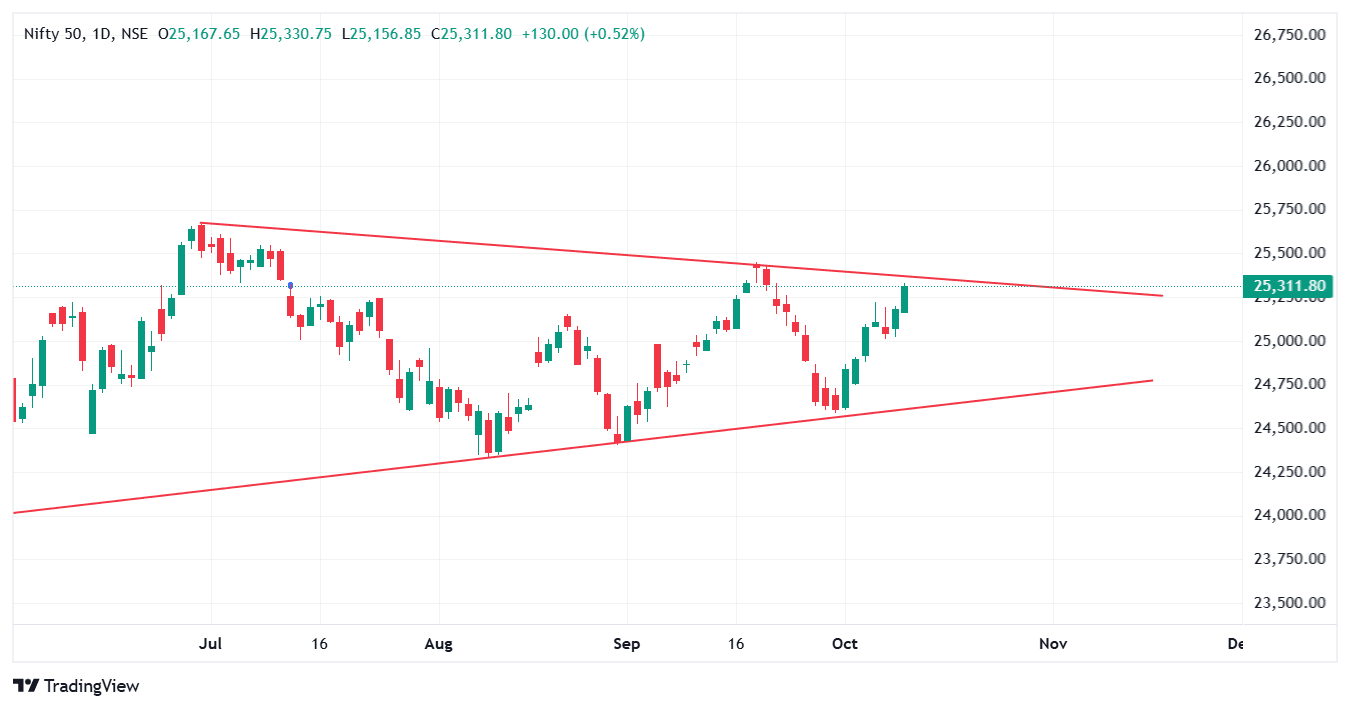

On the technical charts, the NIFTY50 is forming a symmetrical triangle pattern. Image: Shutterstock

The National Stock Exchange benchmark NIFTY50 index briefly moved above its important psychological level of 25,300 for the first time since September 22, data from the NSE showed. The NIFTY50 index touched an intraday high of 25,330 on Friday, logging in a second straight day of gains. For the week, NIFTY50 ended 1.57% higher.

Likewise, the BSE benchmark SENSEX ended 1.59% higher for the week and it also touched its highest level in over three weeks.

The renewed buying in domestic equities resumed just ahead of the start of the September quarter corporate earnings season, which began with the country's largest information technology company, Tata Consultancy Services, reporting its September quarter earnings on Thursday. Next week, the country's most valuable company, Reliance Industries, will report its second-quarter earnings.

Expectations of recovery in corporate earnings after the last four quarters of subdued earnings are also leading to buying in equities, analysts note.

Meanwhile, optimism about earnings recovery is driven by the fact that the Indian economy grew by 7.8% in the April-June quarter of the current financial year 2025-26, aided by a robust performance of the services sector.

The growth in real gross domestic product (GDP) in Q1 of FY26 is higher than the 6.5% expansion recorded in the same period a year ago, the National Statistics Office (NSO) said in a statement.

Analysts added that the fresh up move in the market is also backed by renewed buying by the foreign institutional investors (FIIs).

Since the start of the week, FIIs have turned net buyers. Since Monday, October 6, FIIs have bought shares worth ₹2,517 crore in the cash market, according to data compiled by Stockedge.

On a monthly basis, FIIs have slowed the pace of selling. They have so far this month sold ₹4,497 crore, data compiled by National Securities Depository Limited (NSDL) showed.

FIIs have been relentlessly selling shares in Indian markets, and they have so far this year offloaded shares worth ₹1,59,017 crore.

Meanwhile, hopes of normalisation of trade relations between India and the United States are also keeping buying interest alive for equities after Prime Minister Narendra Modi on Thursday said the Comprehensive Economic and Trade Agreement (CETA) between India and the United Kingdom will lower import costs, generate new jobs and boost bilateral trade.

Addressing a joint press meet after holding talks with the British Prime Minister, Modi said, “I am happy to welcome Prime Minister Keir Starmer on his first visit to India. Under his leadership, India and the UK’s relationship has grown stronger.”

During PM Modi’s visit to the UK in July, the two countries agreed upon the Comprehensive Economic and Trade Agreement (CETA).

Technical outlook

On the technical charts, the NIFTY50 is forming a symmetrical triangle pattern. Experts believe a breakout from this triangle formation could lead to a massive move on either side.

At current levels, NIFTY holds crucial resistance at the swing high trend line level of 25,300 and support at the swing low trend line of 24,500.

About The Authors

Next Story

.jpeg)