Market News

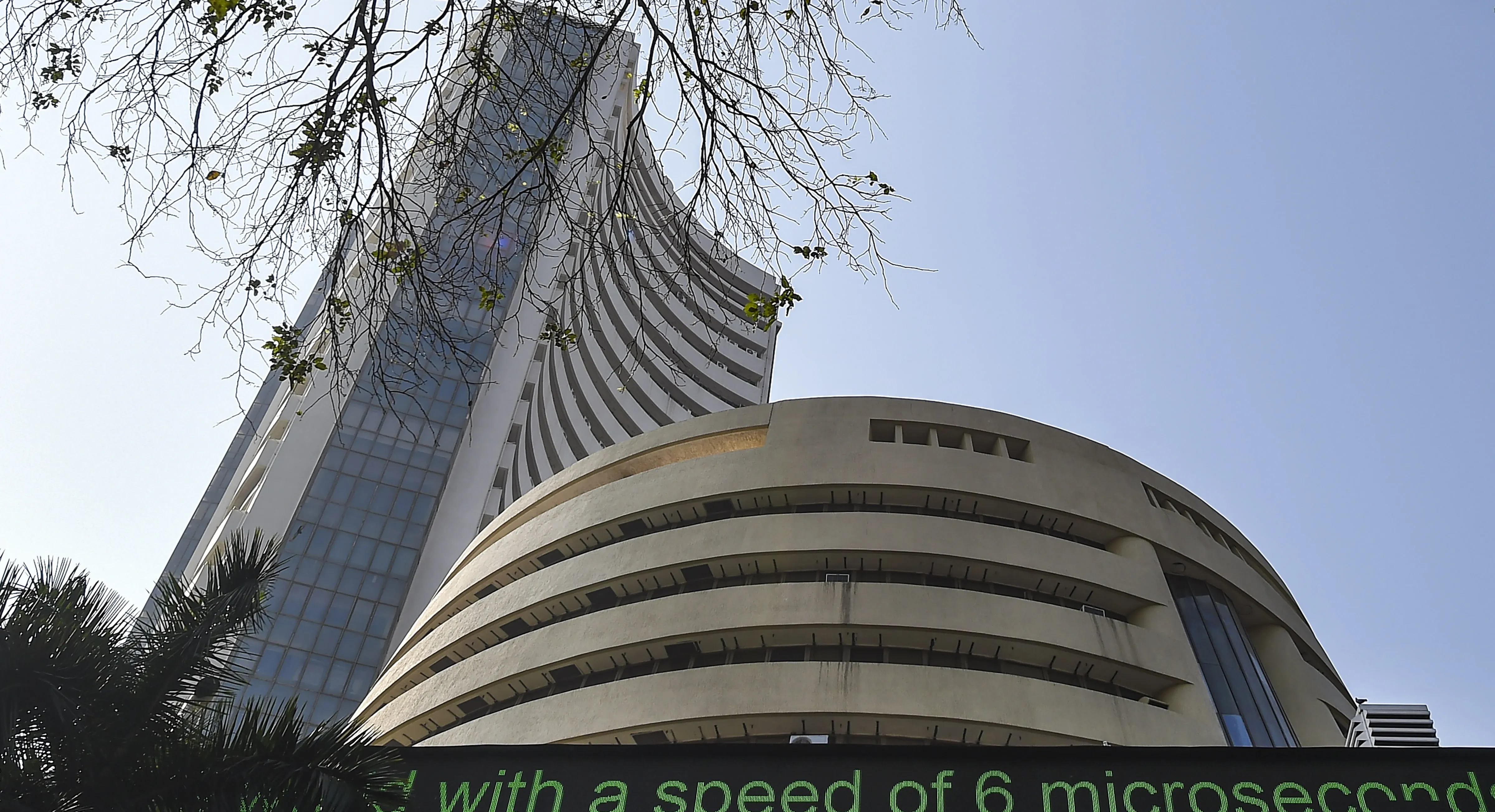

NIFTY50, SENSEX today: Wall Street cues, FII activity, key things to know before markets open on January 22

.png)

5 min read | Updated on January 22, 2026, 08:24 IST

SUMMARY

Foreign institutional investors sold shares worth ₹1,788 crore on Wednesday while domestic institutional investors bought shares worth ₹4,520 crore.

The FIIs have so far this month sold shares worth ₹30,345 crore. Image: Shutterstock

The Indian equity benchmarks are set to stage a gap up opening on Thursday, January 22, as indicated by GIFT NIFTY futures. NIFTY futures at GIFT City in Ahmedabad surged 178 points to 25,356 amid strong cues from global markets.

The Indian equity benchmarks declined for a third straight session on Wednesday, January 21, amid heightened volatility as rising geopolitical tensions continued to dampen the investors' sentiment. The SENSEX traded in a band of 1,283 points and NIFTY50 index touched over three-month low of 24,920 and a high of 25,301. But markets staged a recovery in afternoon trading owing to short covering as markets entered oversold zone, analysts said.

The SENSEX ended 271 points lower at 81,910 and NIFTY50 index declined 75 points to close at 25,157.

Asian markets

Asian markets were trading higher as geopolitical tensions eased after United States President Donald Trump said that he won’t impose tariffs he had threatened on several European countries.

Japan's Nikkei rose 1.78%, Hong Kong's Hang Seng fell 0.2%, South Korea's KOSPI advanced 1.9% and Australia's S&P/ASX 200 index gained 0.56%.

Wall Street update

US stocks ended higher on Wednesday after President Trump said that he reached the framework for a deal about Greenland and won’t impose tariffs he had threatened on several European countries.

Dow Jones rose 1.21%, S&P 500 index advanced 1.16% and tech heavy Nasdaq climbed 1.18%.

FII/DII activity

Foreign institutional investors sold shares worth ₹1,788 crore on Wednesday while domestic institutional investors bought shares worth ₹4,520 crore, data from the National Stock Exchange showed.

The FIIs have so far this month sold shares worth ₹30,345 crore, according to the data from National Securities Depository Limited (NSDL).

Stocks to watch

The Hyderabad-based drug major posted a profit after tax (PAT) of ₹1,413 crore in the October-December quarter of the last fiscal.

Revenue increased to ₹8,727 crore during the period under review as compared to ₹8,357 crore in the third quarter of last fiscal, the drug maker said in a statement.

The bank's core net interest income rose 6 per cent on-year to ₹6,461 crore in the reporting quarter on the back of a 145 growth in advances and the net interest margin compressing to 2.57% from 2.8%.

Its managing director and chief executive, Rajneesh Karnatak, said BoI is targeting to maintain loan growth at 13-14% in FY26, but conceded that the NIMs will be challenging as the entire impact of RBI's 1.25% rate cut plays out on its loan book.

He said the bank will aim to maintain the NIMs and will exit FY26 with a 2.60% NIM.

On the operating front, the company’s EBITDA for the quarter jumped 77% YoY to ₹368 crore as against ₹207 crore in the previous year’s same quarter. However, the operating margin contracted to 2.6% in the Q3FY26 as compared to 3.8% in the same period last year.

The acquisition cost is over two times August Jewellery's FY25 turnover of about ₹33 crore.

The company had posted a net profit of ₹262.14 crore in the year-ago period, according to a regulatory filing.

Total income rose to ₹4,031.99 crore during the October-December quarter of the 2025-26 fiscal year, from ₹3,559.98 crore a year earlier.

Trade setup

On the technical front, the NIFTY50 managed to close near the 200 EMA levels, giving the hope for bulls of a bounce back from current levels. Experts believe that a weekly closing above the 200 EMA levels would prove to be a medium-term bottom level for the index.

On the options data front, the 25,000 puts witnessed heavy open interest addition and held the highest open interest, indicating strong support for the coming monthly expiry. On the other hand, 25,500 calls hold the highest open interest, indicating a strong resistance for the expiry.

Related News

About The Author

Next Story