Market News

Lemon Tree Hotels shares rise 5% on robust Q3 results; EBITDA surges 30% to ₹185 crore; check 7 key takeaways

4 min read | Updated on February 05, 2025, 11:32 IST

SUMMARY

Lemon Tree Hotels reported a net profit or profit after tax (PAT) attributable to equity holders of the parent at ₹62.49 crore, up 76.2% against ₹35.45 crore registered in the corresponding quarter of the previous fiscal year.

Stock list

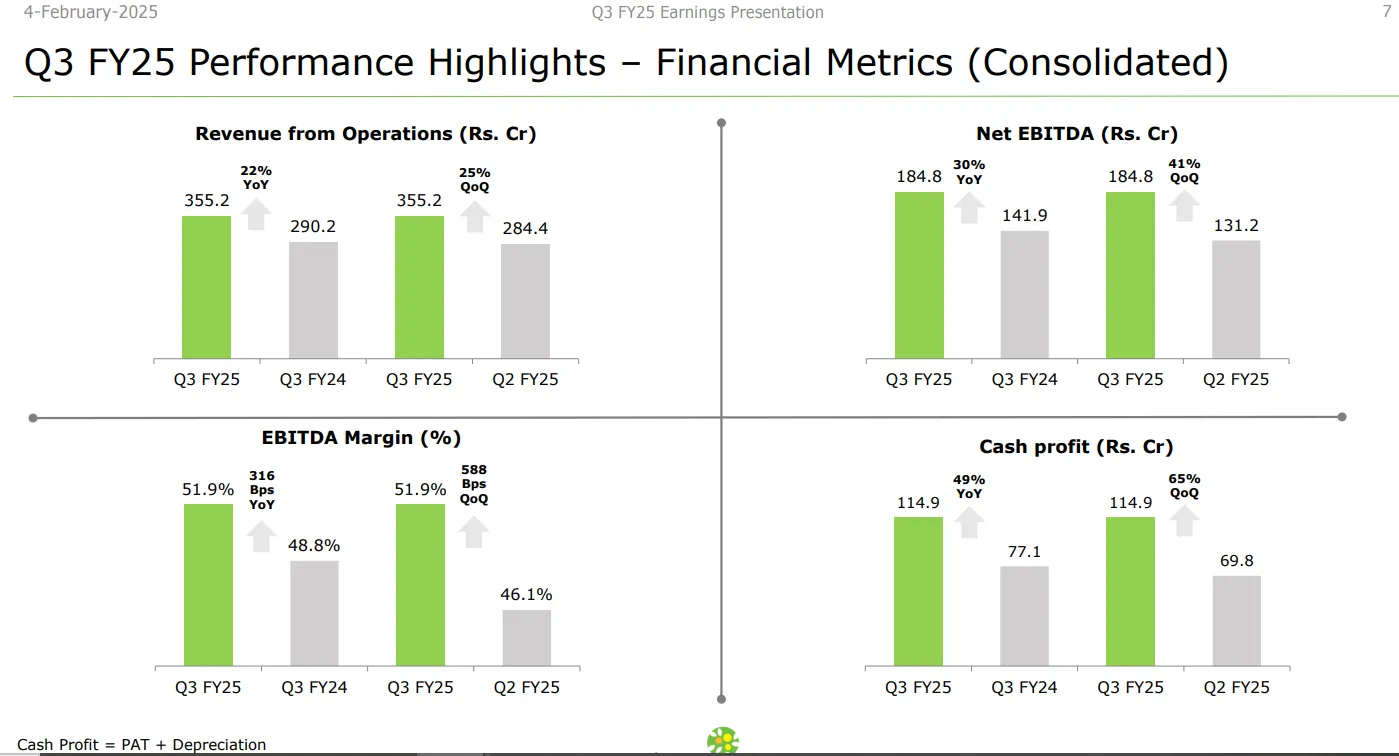

The occupancy for the quarter stood at 74.2%, an increase of 826 bps YoY. Image: Company's investor presentation

Last seen, the stock was trading 3.61% higher at ₹152.79 on the NSE.

The company reported a net profit or profit after tax (PAT) attributable to equity holders of the parent at ₹62.49 crore, up 76.2% against ₹35.45 crore registered in the corresponding quarter of the previous fiscal year.

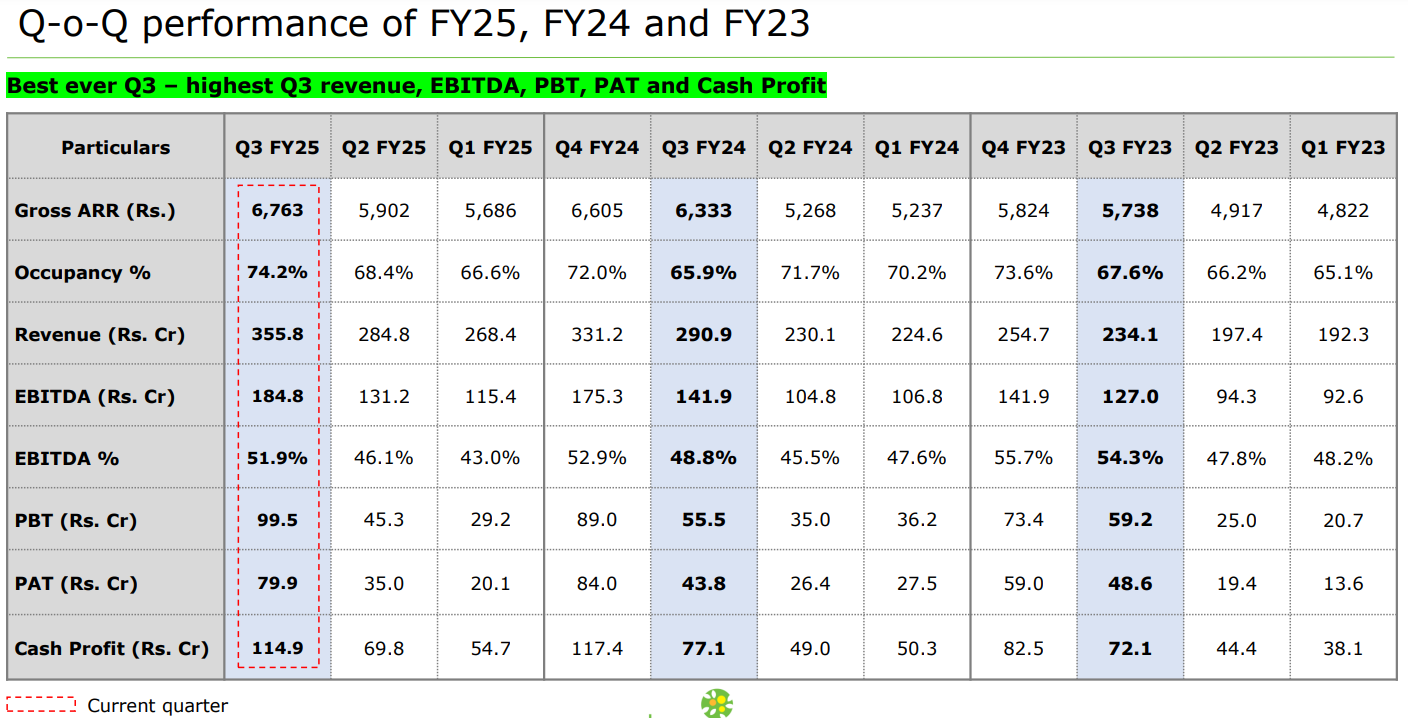

Its total revenue came in at ₹355.8 crore, up 22% YoY, while EBITDA, or earnings before interest, taxes, depreciation, and amortisation, increased by 30% to ₹184.8 crore.

EBITDA margins jumped 316 basis points (bps) to 51.9%.

Cash profit for the company stood at ₹114.9 crore in Q3 FY25, an increase of 49% YoY.

Commenting on the performance for Q3 FY25, Patanjali Keswani, Chairman & Managing Director—Lemon Tree Hotels Limited, said, “Lemon Tree recorded its highest-ever third-quarter revenue this year. At ₹355.8 crore, our revenue grew by 22% compared to Q3 last year, while net EBITDA grew 30% YoY to ₹184.8 crore, translating into a net EBITDA margin of 51.9%, which increased by 316 bps YoY. Q3 FY25 recorded a Gross ARR of ₹6,763, which increased by 7% YoY. The occupancy for the quarter stood at 74.2%, an increase of 826 bps YoY. This translated into a RevPAR of ₹5,018, which increased by 21% YoY."

ARR stands for average room rate. It is calculated by dividing the total amount of revenue during a particular period by the total number of rooms rented out.

RevPAR stands for revenue per available room. RevPAR is a performance measure used in the hospitality industry.

Q3 Business Update

The property will feature 120 elegantly designed rooms and suites, Mirasa—the all-day dining restaurant, Ariva—the bar, expansive banquet spaces, and rejuvenating recreational facilities, including a well-equipped fitness center and spa.

The project qualifies for a capital subsidy and various incentives, including GST reimbursement, under the Meghalaya Industrial and Investment Promotion Policy 2024 and the Uttar Poorva Transformative Industrialisation Scheme 2024, the company added.

"On the asset-light side, we signed 13 new management and franchise contracts, adding 766 new rooms to our pipeline, and operationalised one hotel, adding 38 rooms to our portfolio. As of December 31, 2024, the group's inventory stands at 112 operational hotels with 10,317 rooms and a pipeline of 88 hotels with 6,068 rooms," Lemon Tree Hotels said in its investor presentation.

Outlook

The company said it was confident in its ability to sustain this growth in the coming quarters by focusing on the following growth levers:

-

Accelerated growth in its management and franchised portfolio, with a proportionate increase in fee-based income; and

-

Timely completion of renovation activities in the owned portfolio to further improve Gross ARR and occupancy.

"With demand growth expected to outpace supply in the next few years and increasing discretionary spending on branded hotels in India, our increased investment in renovation will allow us to position Lemon Tree as the preferred brand in the mid-market segment," it added.

Lemon Tree Hotels stock performance

Shares of the company have gained nearly 6% in the past 12 months.

About The Author

Next Story