Market News

Indigo flight fiasco: Here's what charts indicate after freefall

.png)

3 min read | Updated on December 08, 2025, 16:07 IST

SUMMARY

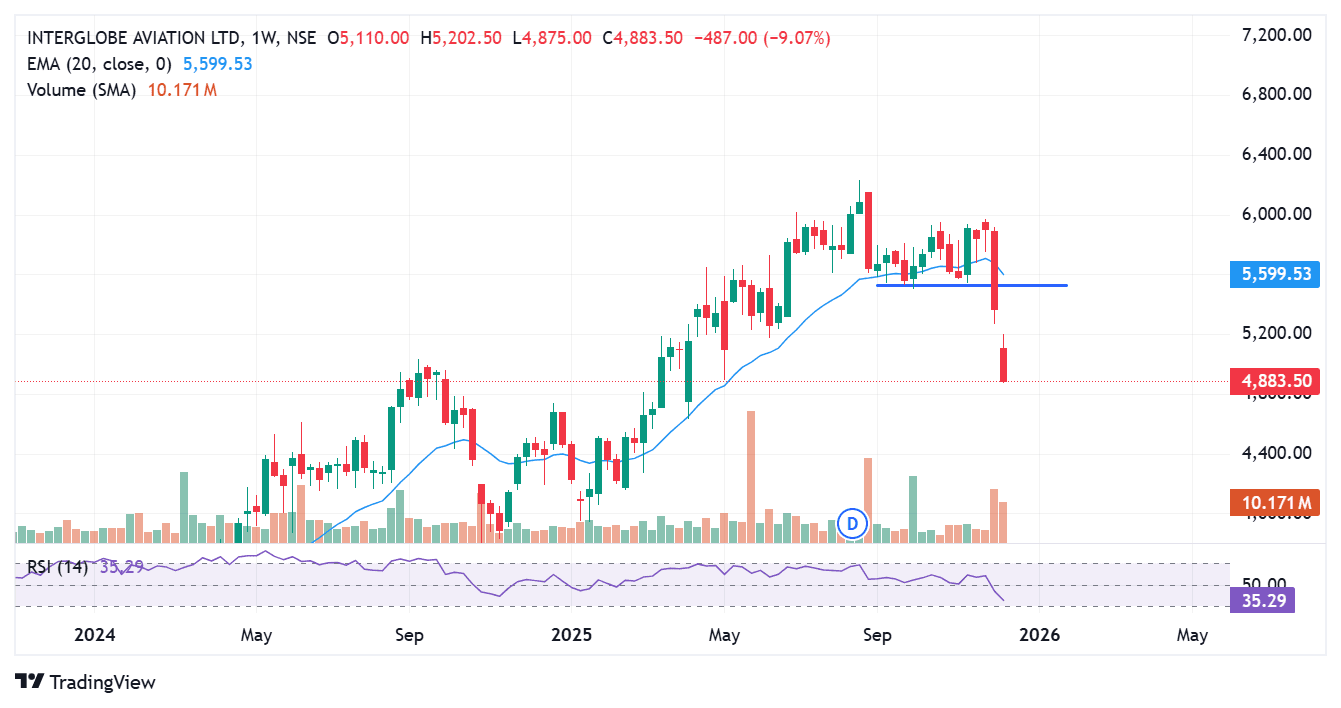

IndiGo shares are in freefall after falling 10% on Monday. The shares have given the majority of the gains in 2025, and are currently trading 16% higher on a YTD basis. The charts indicate a full bears grip on the stock as the selling pressure intensified further.

Stock list

IndiGo shares fell over 20% in 6 trading sessions. Image source: Shutterstock.

IndiGo shares are buzzing in trade on Monday amid the flight cancellation fiasco. The shares have plunged 9% in the previous week and fell another 7.4% on Monday as the situation on the ground remains abnormal with multiple flight cancellations. Flight disruptions at IndiGo entered the seventh day as the crisis-hit carrier cancelled 127 flights from Bengaluru Airport on Monday, PTI reported.

On the weekly charts, the ₹5,600 level was a crucial support for Indigo on multiple occasions was broken on Friday, with a closing at the ₹5,370 level.

Additionally, the stock also traded below the long-term moving average level of 200 SMA at ₹5,458 apiece on the NSE on the daily charts. A weekly closing below the 200 SMA level indicates increased bearish momentum in the stock.

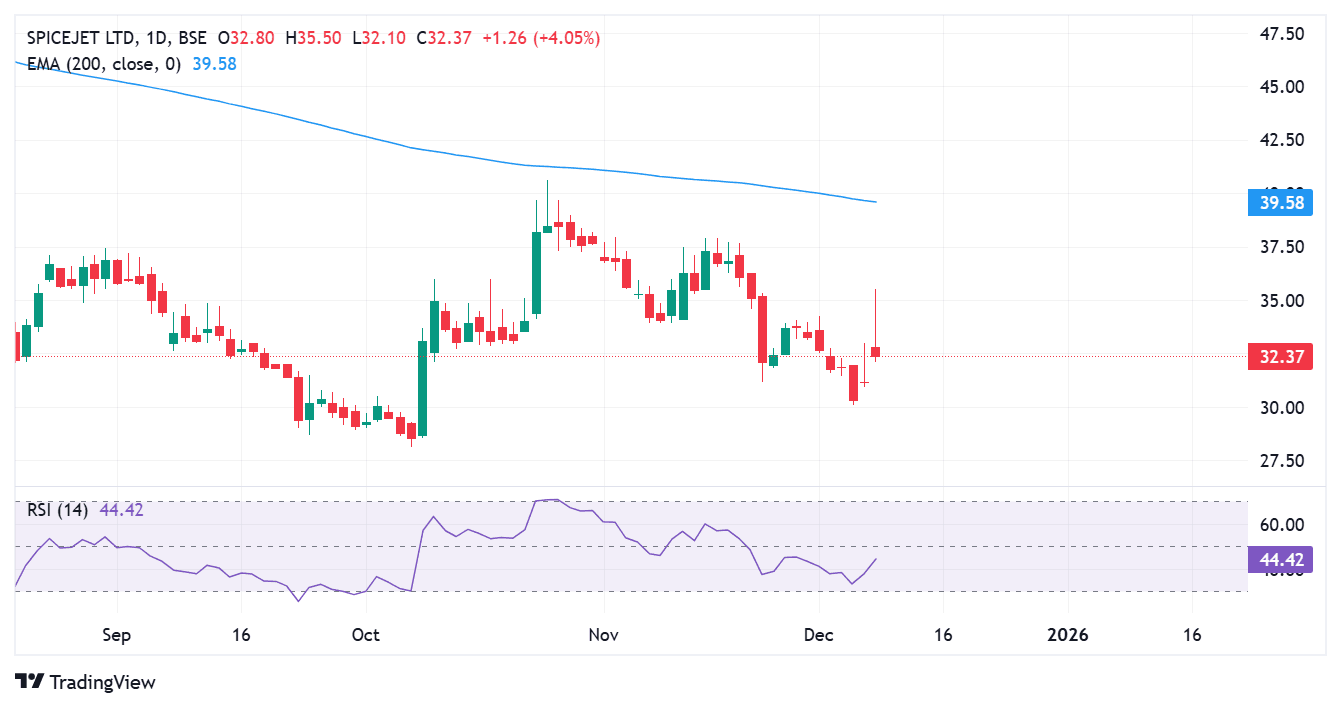

On the other hand, another domestic airliner, SpiceJet, was in focus as its shares rallied over 13% in Monday’s trading session, as other airliners gained to benefit from the current scenario.

In the last two trading sessions, SpiceJet shares have surged as much as 17% amid higher-than-usual trading volumes.

Amid the fiasco, global brokerages like Jefferies and UBS have highlighted key risks to the downside of the stocks. Jefferies said, IndiGo has been hit hardest by new FDTL rules, which cut pilot duty hours & raised crew needs, testing its lean, high-utilisation model Rule change coincided with capacity expansion, tech issues, & congestion, triggering cascading disruptions Airline is now recalibrating schedules & expects normalcy by mid-December.

Industry remains consolidated, though IndiGo faces rising costs from disruptions, INR weakness & higher crew expenses. UBS expects the fallout of the crisis could add cost pressure to the company, along with INR depreciation, leading to weak operational margins in the coming quarters.

Q2FY26 results

IndiGo reported a weak set of numbers in the September quarter. The Q2FY26 revenue jumped nearly 10% YoY to ₹18,555 crore as against ₹16,969 crore. On the operational front, the company’s EBITDA fell by over 64% YoY to ₹579 crore, as against ₹1,631 crore, while the EBITDA margin shrank to 3.1%. Lastly, at the bottom-line level, the company posted a net loss of ₹2,481 crore as against ₹986 crore in the previous year’s same quarter.

The Q2FY26 shareholding pattern also highlighted a trend of consistently declining promoter shareholding. The promoter and Co-founder, Rakesh Gangwal, announced a phased exit of his stake in the company and currently holds less than 4.53% stake in the company, down from 11.7% in the September 2023 quarter. While the other co-founder, Rakesh Bhatia, continues to hold a 35% stake in the company through Interglobe Enterprises Ltd. while FIIs and DIIs piled on to the stake through block deals and held 28.4% and 25% stake in the company.

About The Author

Next Story