Market News

Indian pharma industry: A comparative analysis of Sun Pharma and Divi's Laboratories

.png)

6 min read | Updated on December 03, 2024, 17:01 IST

SUMMARY

The Indian pharmaceutical sector, poised for exponential growth, highlights key differences between Sun Pharma and Divi's Laboratories. Sun Pharma excels in revenues and profit growth, driven by generics and branded medications, while Divi’s leads in operating margins and capex investments.

Stock list

Indian pharma industry: A comparative analysis of Sun Pharma and Divi's Laboratories

The Indian Pharmaceutical sector is set to multiply in the coming years and become known as the "Pharmacy of the World" and "Healers of the World." This recognition comes from India’s important role in making affordable drugs and COVID-19 vaccines available to the world at large. The current valuation for the industry is a whopping $55 billion, and by 2030, it will balloon to $130 billion.

Indian pharmaceuticals play an important role in global healthcare, which can reach $450 billion by 2047. Indian pharmaceutical exports, which amount to $27.85 billion currently, have made India the top supplier of medicines to over 200 countries.

Company Background

Sun Pharmaceutical Industries is engaged in manufacturing, developing, and marketing a wide range of branded and generic formulations and Active Pharmaceutical Ingredients (APIs). It is the largest pharmaceutical company in India. The total market capitalisation of the company is ₹4,28,581 crore.

Divi's Laboratories is a holding company that manufactures active pharmaceutical ingredients, intermediates, and nutraceuticals. It also provides generic APIs, nutraceutical ingredients, and custom synthesis for big pharma. The company's total market capitalisation is ₹1,64,060 crore.

Q2 FY25 Highlights

Sun Pharmaceutical Industries reported a 28% YoY rise in its consolidated net profit for Q2FY25 to ₹3,040.16 crore. The consolidated revenue from operations stood at ₹13,264.22 crore during the quarter from ₹12,003.11 crore in Q2FY24, a YoY jump of nearly 10.5%.

Divi’s Lab achieved a consolidated revenue of ₹2,444 crore for Q2 FY25, up by 22.50% from ₹1,995 crore in Q2 FY2024. Profit after tax for Q2 FY25 was ₹510 crore, up by 46.55% from ₹348 crore in Q2 FY2024.

Stock Metrics

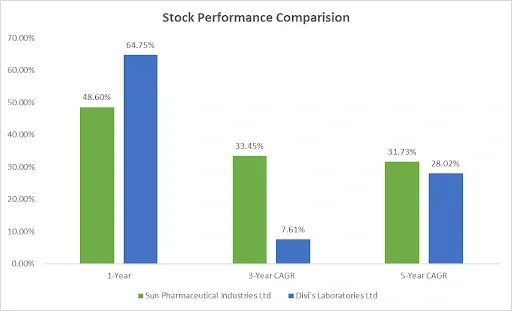

In the short term, Divi’s lab has performed phenomenally better than Sun Pharma, while in the medium and long term, Sun Pharma's stock price has managed to sustain and deliver stable gains.

Sectoral Metrics

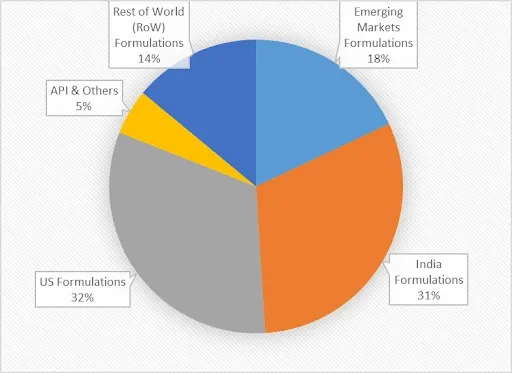

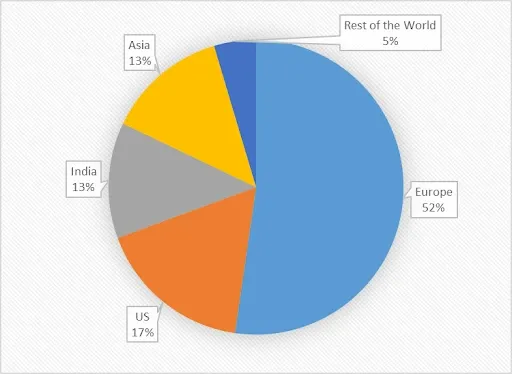

The revenue split shows that Sun Pharma is more dependent on the US and Indian markets, while Divi’s lab is more dependent on the European and US markets.

In the pharmaceutical sector, ANDAs and NDAs are closely linked to pharmaceutical companies and are used to track them. As of FY24, Sun Pharma had 582 ANDAs and NDAs approved, and 118 were still pending. ANDAs and NDAs do not apply to the Divis lab as it is not involved in directly manufacturing drugs and pharmaceuticals.

For pharma companies, R&D spending is a key metric to compare. In the last 5 years, Sun Pharma saw high spending on R&D compared to Divi’s Laboratories. In FY24, it spent 9.2% of its annual sales. In the case of Divis Lab, the R&D spending for FY24 was 0.91% of annual sales.

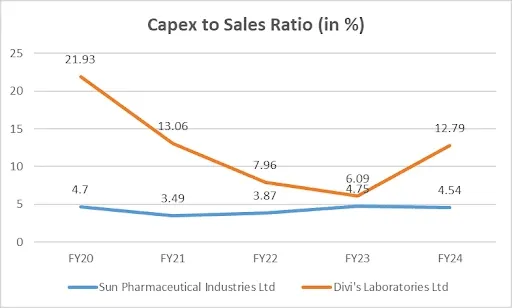

Capital expenditure is money invested in physical assets like plants, equipment, buildings, and land, as it is directly related to business growth and expansion.

Divis Lab is the clear leader in this comparison. While its capex as a percentage of sales has fallen, it still remains ahead of both Sun Pharma. Lately, Divi’s Lab capex has also seen a rebound.

Financial Metrics

Revenue

| Year | FY19 | FY20 | FY21 | FY22 | FY23 | FY24 | 3 Year Growth | 5 Year Growth |

|---|---|---|---|---|---|---|---|---|

| Sun Pharmaceutical Industries Ltd | 29,066 | 32,838 | 33,498 | 38,654 | 43,886 | 48,497 | 13.13% | 10.78% |

| Divi's Laboratories Ltd | 4,946 | 5,394 | 6,969 | 8,960 | 7,767 | 7,845 | 4.03% | 9.66% |

| Source: Screener.com, all values are in ₹ crore |

Sun Pharma's revenues are six times higher than Divi's Lab's. Divi's Labs has much lower revenues than Sun Pharma despite being the second-largest company by market capitalisation. Sun Pharma has had the best revenue growth over the last three and five years, while Divi's Lab’s growth has slowed since FY22.

Net Profit

| Year | FY19 | FY20 | FY21 | FY22 | FY23 | FY24 | 3 Year Growth | 5 Year Growth |

|---|---|---|---|---|---|---|---|---|

| Sun Pharmaceutical Industries Ltd | 3,208 | 4,172 | 2,272 | 3,389 | 8,513 | 9,610 | 61.72% | 24.54% |

| Divi's Laboratories Ltd | 1,353 | 1,377 | 1,984 | 2,960 | 1,824 | 1,600 | -6.92% | 3.41% |

| Source: Screener.com, all values are in ₹ crore |

Sun Pharma's growth rate is noteworthy. Divi’s Lab seems to be struggling with its growth numbers, with its three-year growth rate actually being negative. Until FY22, its profit had been on a growth path, too, with a three-year(FY19 to FY22) growth rate of 29.8% per annum.

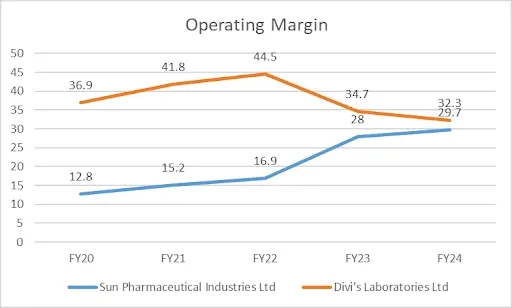

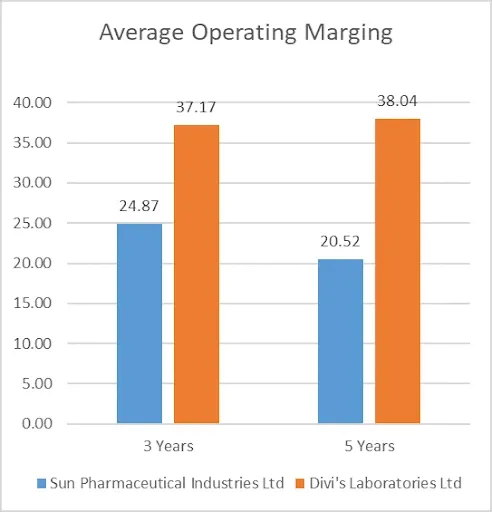

Operating Margin

Values in %

Values in %Divis Lab has the best margin profile; however, its margin has dipped in recent years. Sun Pharma’s margins have shown improvement over the years. Overall, in average terms, Divi’s is far ahead of Sun Pharma. The reason for the difference is Divis's nature of business—Divi’is is an API manufacturer, while Sun Pharma is primarily a medicine manufacturer.

Valuations

| Company | Current P/E | 5 Year Median | Premium to Median |

|---|---|---|---|

| Sun Pharmaceutical Industries Ltd | 38.2x | 30.1x | 8.1x |

| Divi's Laboratories Ltd | 89.4x | 53.5x | 35.9x |

Looking at the valuations, both stocks are currently at a premium to their 5-year median compared to the historical median. However, the premium is quite steep in the case of Divi's Labs and less in the case of Sun Pharma. The industry PE is at 33.7x. In both comparisons, stocks seem overvalued.

Conclusion

Sun Pharma is more dependent on the Indian and U.S. markets, while Divi’s has greater exposure to European and U.S. markets. Sun Pharma dominates revenue and profit growth, focusing on generics and branded drugs. Divi's Laboratories excels in operating margins and capex, reflecting a strong position in the API segment.

About The Author

Next Story