Market News

Indian Hotels shares fall after profit misses estimates in March quarter

.png)

3 min read | Updated on May 06, 2025, 09:27 IST

SUMMARY

Indian Hotels' earnings before interest, taxes, depreciation, and amortisation (EBITDA) also known as operating profit rose 30% to ₹918.74 crore in March quarter from ₹706 crore in the same period last year.

Stock list

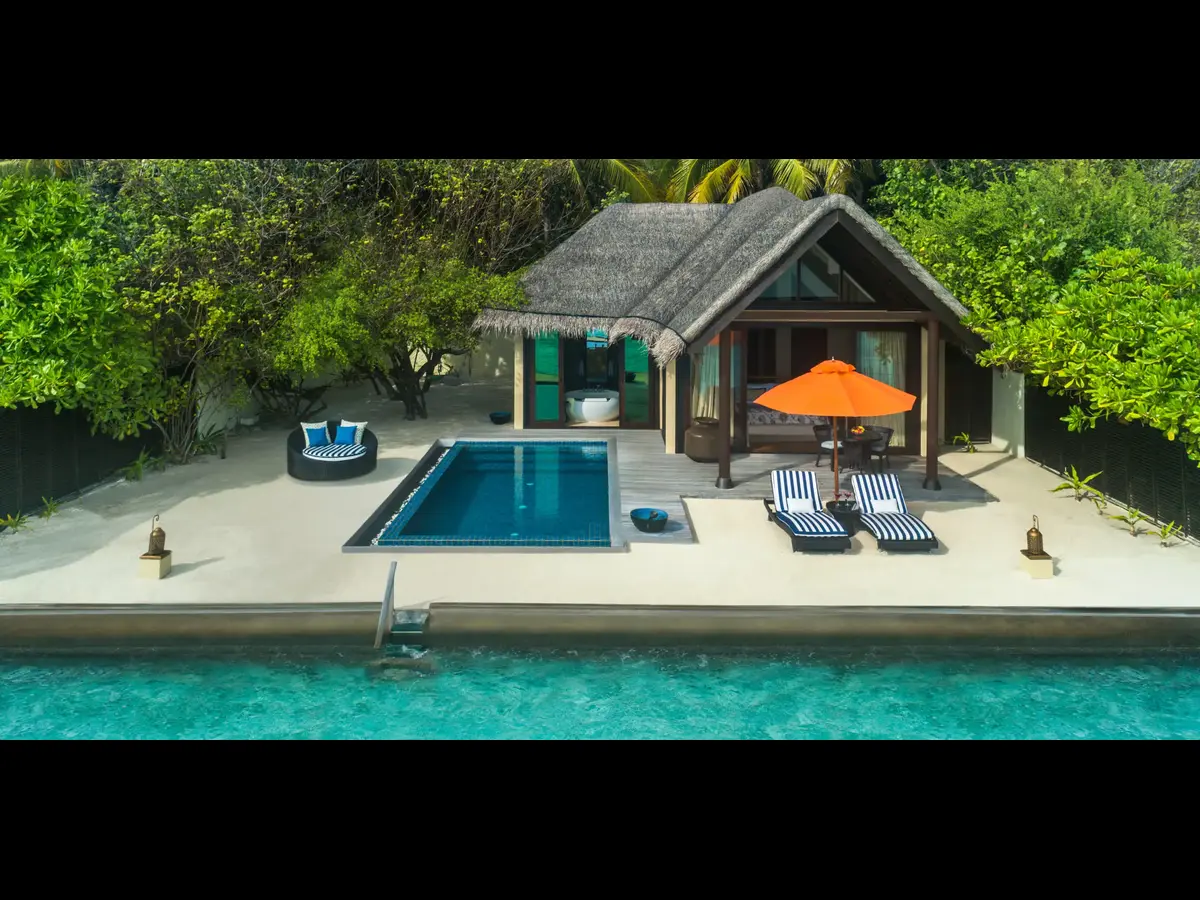

The Indian Hotels on Monday, May 5, reported a net profit of ₹522 crore in January-March quarter. | Image: Taj Hotels

Shares of The Indian Hotels, which operates Taj group of hotels, fell as much as 2.98% to hit an intraday low of ₹777.90 on the BSE after its net profit missed estimates in March quarter. On the National Stock Exchange, Indian Hotels shares declined as much as 3.33% to hit an intraday low of ₹775.

The company reported a net profit of ₹522 crore in January-March quarter, marking an upside of 25% from ₹418 crore in the same period last year. Its revenue from operations rose 27% to ₹2,487 crore as against ₹1,951 crore in the year-ago period. Analysts on an average were expecting the company to report net profit of ₹550 crore.

The company's earnings before interest, taxes, depreciation, and amortisation (EBITDA) also known as operating profit rose 30% to ₹918.74 crore in March quarter from ₹706 crore in the same period last year. For the quarter, operating profit margin (EBITDA margin) improved to 36.94% from 36.19%.

The company's board has recommended dividend of ₹2.25 per share for financial year 2024-25.

Indian Hotels CEO and Managing Director Puneet Chhatwal said that the company will invest over ₹1,200 crore towards the continued comprehensive asset management & upgradation programme and greenfield projects with the focus on the iconic brand Taj and digital capabilities.

Indian Hotels domestic same store hotels delivered 12% consolidated revenue per available room (RevPAR) growth. Its international consolidated portfolio reported an occupancy of 73%, up 440 basis points, resulting in a RevPAR growth of 7%, the company said in a press release.

Management fee income grew by 20% to ₹562 crores on the back of not like for like growth, the company added.

The air and institutional catering business segment (TajSATS) clocked a revenue of ₹1,051 crore, 17% growth over the previous year and EBITDA margin at 25.2%. TajSATS has been consolidated during the second quarter, resulting in ₹724 crore revenue reported as a part of IHCL Consolidated revenue in FY25.

New Businesses vertical comprising of Ginger, Qmin, amã Stays & Trails and Tree of Life reported an enterprise revenue of ₹802 crore, a growth of 41% and consolidated revenue of ₹601 crore, a growth of 40%, the operator of Taj Hotels said.

“Q4 marks twelve consecutive quarters of record performance with consolidated hotel segment revenue reporting a strong growth of 13% resulting in EBITDA margin of 38.5%. Enterprise revenue for the full year stood at ₹14,836 crore, 1.6x of consolidated revenue, in line with our strategy of a balanced capital light and capital heavy portfolio. The consolidated double -digit revenue growth for the year was driven by strong same store performance, 40% increase in New Businesses and not like for like growth. IHCL set a new benchmark with 74 signings and 26 openings this fiscal and over 95% of these signings were capital light,” said Puneet Chhatwal, Managing Director & CEO of Indian Hotels.

As of 9:25 am, Indian Hotels shares traded 3.17% lower at ₹776, underperforming the NIFTY NEXT50 index which was down 0.33%.

About The Author

Next Story