Market News

Hindalco Industries shares rally 5% after firm reports 26% rise in Q1 net profit; check details

3 min read | Updated on August 13, 2025, 12:05 IST

SUMMARY

Operationally, the Aditya Birla Group-backed company’s earnings before interest, taxes, depreciation and amortisation (EBITDA) rose 14.2% to ₹3,138 crore from ₹2,749 crore.

Stock list

Hindalco shares touched its 52-week high of ₹772 apiece on October 3, 2024.

The company reported a standalone net profit of ₹1,826 crore for the quarter ended June 30, 2025, marking an increase of 26.6% from ₹1,471 crore in the corresponding quarter of the previous fiscal year. Hindalco’s standalone revenue from operations increased 9.5% year-on-year (YoY) to ₹24,264 crore, up from ₹22,155 crore in the same period last year.

Operationally, the Aditya Birla Group-backed company’s earnings before interest, taxes, depreciation and amortisation (EBITDA) rose 14.2% to ₹3,138 crore from ₹2,749 crore.

Its operating profit margin, or EBITDA margin, remained steady at 12.9% in Q1 FY26, compared to 12.4% in Q1 FY25.

On a consolidated basis, Hindalco’s Q1 net profit increased by 30% to ₹4,004 crore as compared to ₹3,074 crore logged in the year-ago period. Its revenue from operations for the reporting quarter came in at ₹64,232 crore as against ₹57,013 crore seen in Q1 FY25, clocking a jump of 13%.

The robust results were driven by a strong performance by the India business and a resilient performance by Novelis.

Following this, the stock opened at ₹671.10 per share. Last seen at 10:44 AM, it was trading at ₹702, rising 5.24% on the National Stock Exchange.

The stock touched its 52-week high of ₹772 apiece on October 3, 2024, while its one year low of ₹546.25 was seen on April 7, 2025.

Commenting on the earnings, Satish Pai, the Managing Director, said, “After the record profitability of FY25, Hindalco sustained its growth momentum with a strong first-quarter performance, driven by operational efficiencies, cost control, and an enhanced product mix.”

“Despite headwinds, Novelis reported a 1% increase in shipments driven by beverage can shipments, which registered a solid 8% growth over the prior year quarter,” the company added.

For the Aluminium India business, quarterly upstream revenue stood at ₹9,331 crore, up 6%, with EBITDA rising 17% to ₹4,080 crore, supported by lower input costs.

Aluminium downstream sales were 101 KT, up 6%, with revenue increasing 17% to ₹3,353 crore. Aluminium downstream EBITDA hit a record ₹229 crore, up 108%, driven by higher value addition from products such as battery enclosures, high-end extrusions from Silvassa, and premiumisation of flat-rolled products.

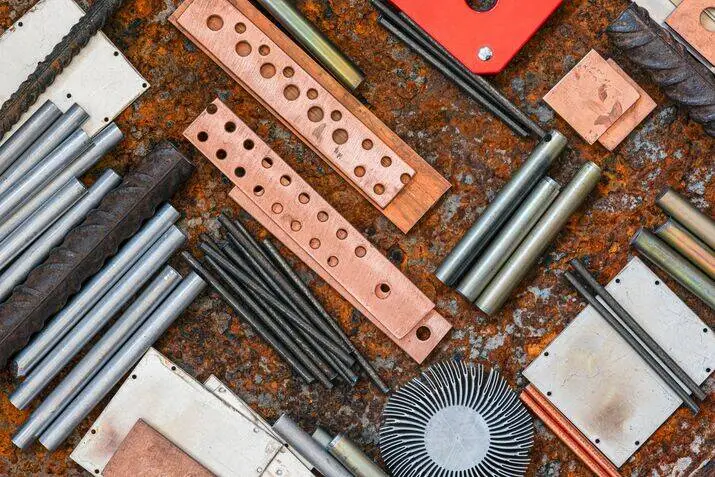

The copper metal sales rose 4% to 124 KT, while revenue was ₹14,886 crore, up 12%. For the shipment segment, the revenue was at $4.72 billion, up 13%, on the back of higher average aluminium prices.

Novelis’ cost reduction measures targeting run-rate savings of over $75 million in FY26 are now expected to result in a higher FY26 run-rate savings of over $100 million, while maintaining the $300 million target for FY28.

“We made significant progress in our downstream growth projects: the 170 KT Aditya FRP project, Aluminium AC fins, and the Copper IGT facility are under commissioning. Looking ahead, our integrated business model, strategic investments and cost discipline position us well to deliver sustained growth,” Pai further said.

About The Author

Next Story