Market News

Cochin Shipyard, GRSE: Defence stocks rise post Q1 concalls; check order book, execution status, and multiple opportunities

.png)

5 min read | Updated on August 20, 2025, 09:32 IST

SUMMARY

Defence stocks: Cochin Shipyard, the country's leading shipbuilding company, reported a net profit of ₹188 crore in the first quarter of the current financial year (Q1FY26), marking an increase of 8% from ₹174 crore in the same period last year.

Stock list

GRSE's order book stands at a robust ₹21,700 crore as of Q1 FY26. | Image: Company website

At the time of writing this article, Cochin Shipyard was trading 0.15% higher at ₹1,710 on the NSE.

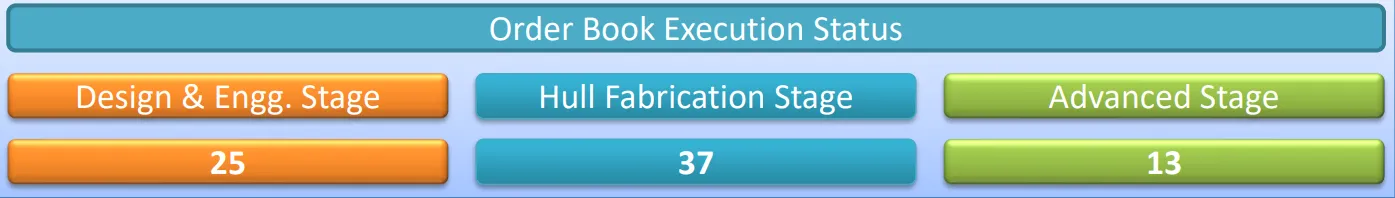

Cochin Shipyard, in its investor presentation, said its total order book at the end of the quarter under review stood at around ₹21,100 crore. Here is the breakup.

📊 Order Book Position – Rs. 21,100 Cr. (Approx.)

Order Breakdown (Rs. Crore)

| Sl. No. | Project Category | No. of Vessels | Order Value |

|---|---|---|---|

| 1. | Defence | 14 | 13,700 |

| 2. | Commercial – Domestic | 34 | 1,700 |

| 3. | Commercial – Export | 27 | 4,200 |

| TOTAL | 75 | 19,600 |

Visual Highlights

- Defence (65%) dominates the order book.

- Commercial – Export (20%) is the second largest.

- Commercial – Domestic (9%) and Ship Repair (7%) add diversification.

Commercial Segment (Green vs Conventional)

- Green Vessels: Rs. 2,300 Cr. (39%)

- Conventional Vessels: Rs. 3,600 Cr. (61%)

The PSU's shipbuilding order pipeline stands at ₹2,85,000 crore (approx.).

📊 Order Pipeline Overview

🛡 Defence – Rs. 2,20,000 Cr.

| Sl. No. | Stage | Approx. Order Value (Rs. Crs.) |

|---|---|---|

| 1. | Bid Submitted | 9,500 |

| 2. | RFP Stage | 750 |

| 3. | RFI Stage | 1,29,750 |

| 4. | Expected RFI Stage | 80,000 |

| Total | 2,20,000 |

🚢 Commercial – Rs. 65,000 Cr.

| Sl. No. | Project | Approx. Order Value (Rs. Crs.) |

|---|---|---|

| 1. | Domestic | 25,000 |

| 2. | International | 40,000 |

| Total | 65,000 |

Cochin Shipyard, the country's leading shipbuilding company, on Tuesday, August 12, reported a net profit of ₹188 crore in the first quarter of the current financial year (Q1FY26), marking an increase of 8% from ₹174 crore in the same period last year.

The company's revenue from operations in the April-June period advanced 39% to ₹1,069 crore from ₹771 crore in the year-ago period.

Cochin Shipyard reported strong operational performance as its EBITDA (earnings before interest, tax, depreciation and amortisation), also known as operating profit, advanced 37% to ₹242 crore from ₹177 crore in the corresponding period last year.

"With regard to the shipbuilding contract for the construction of 2 ships with a government customer, the contractual delivery dates (as extended) for both the vessels have already expired. At the request of the customer for reallocation of the vessel for other prospective buyers, the delivery of the ship has been abated with minor progress. The holding company has provided for LD for the delay up to 29 Apr 2023 and 30 Oct 2023 in respect of the two ships," the company said in a regulatory filing.

Garden Reach Shipbuilders & Engineers

According to publicly available information, Garden Reach Shipbuilders & Engineers Ltd (GRSE) sails into the future with a ₹21,700 crore order book. P17 Bravo is on the horizon; capacity ramp-up and green shipyard plans are driving visibility till 2040.

Garden Reach Shipbuilders & Engineers Ltd (GRSE), operating under the Ministry of Defence, is one of India’s leading and oldest shipbuilding companies, primarily catering to the Indian Navy and Indian Coast Guard while also being the first shipyard in the country to export warships.

According to a post on X by LNPR Capital, an independent equity research firm, as of June 30, 2025, the PSU's order book stands at a robust ₹21,700 crore, covering 40 marine platforms across 10 different projects, providing strong revenue visibility over the coming years.

-

Of this order book, 98% is related to shipbuilding, with a clear defence-heavy mix where 86% comes from defence shipbuilding, 14% from non-defence, 9% from ship repair, and 5% from exports.

-

Under the prestigious P 17 Alpha project, two more ships remain under construction, with the third ship currently 56% complete and scheduled for April 2026 delivery, and the last ship 82% complete and likely to be delivered by the end of calendar year 2024, ensuring full completion by August 2026.

-

In specialised research vessels, GRSE has begun construction of the Ocean Survey Vessel, Hybrid, and Treasure and has also started pre-production activities for the Acoustic Research Ship and Coastal Research Vehicle, making it the only Indian shipyard currently executing such advanced research-focused projects.

-

Other ongoing projects include the execution of 13 hybrid ferries for the Government of West Bengal, an advanced suction hopper project for the Government of Bangladesh, and eight multipurpose processors being built for a German client.

-

Over the next 18 months, GRSE is eyeing multiple RFPs, including 31 extra-large unmanned underwater vehicles, 120 interceptor crafts for the Navy, and two multipurpose vessels worth ~₹1200 crores, as well as six next-generation patrol vessels and 22 interceptor crafts for the Coast Guard.

With robust execution, deepening indigenisation, new product focus areas, and large-scale capacity expansion, GRSE maintains a strong outlook, positioning itself to capture both defence and non-defence opportunities in India and globally, the research firm added.

Related News

About The Author

Next Story