Market News

Bharti Airtel Q1 results: Revenue and profit likely to see double-digit growth; check earnings preview and key technical levels

.png)

3 min read | Updated on August 05, 2025, 11:58 IST

SUMMARY

Bharti Airtel is expected to report strong Q1 FY26 results on 5 August 2025, with revenue rising 25–28% YoY to ₹48,250–48,900 crore. From the technical standpoint, Airtel remains rangebound between ₹1,900 and ₹2,045 but holds a bullish structure above its 200-day EMA.

Stock list

Bharti Airtel's open interest data for the 28 August expiry has an at-the-money (ATM) strike of 1,940.

The telecom service provider Bharti Airtel is set to unveil its first-quarter results on 5 August 2025.

According to experts, the company is expected to report strong quarterly earnings, with double-digit growth in both topline and net profit. Its Q1 revenue may increase by 25–28% year on year (YoY) to ₹48,250–48,900 crore, while its net profit could rise substantially by 55–60% YoY to ₹7,120–7,690 crore, aided by continued subscriber additions and growth in average revenue per user (ARPU).

Bharti Airtel reported revenues of ₹38,506 crore in Q1 FY25 and ₹47,876 crore in Q4 FY25. Meanwhile, its net profit was ₹4,718 crore in Q1 FY25 and ₹12,476 crore in Q4 FY25.

Experts believe Airtel's ARPU could see moderate growth to around ₹248–250 during the quarter. During the Q1 results announcement, investors and traders will be looking for updates on key metrics such as market share gains, growth in the African business, ARPU growth, and new subscriber additions.

Ahead of the Q1 results announcement on 5 August, Bharti Airtel shares were trading 1% higher at ₹1,933. So far this year, the stock has surged by over 20%.

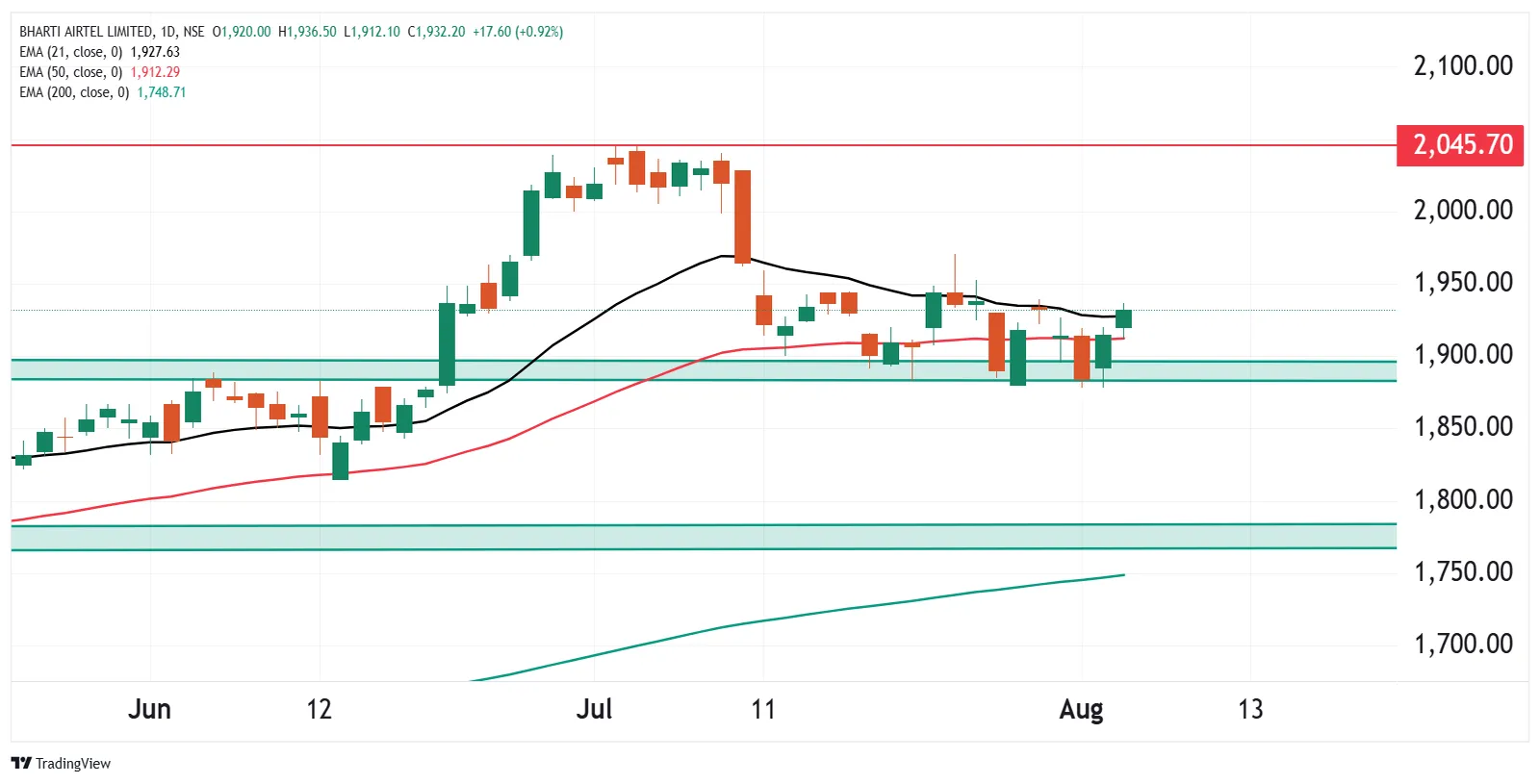

Technical view

The short-term technical structure of the Bharti Airtel remains rangebound and is consolidating around its 21-day and 50-day exponential moving averages (EMA). Meanwhile, the broader structure of the stock remains bullish as it is trading above its 200-day EMA.

For short-term clues, traders can monitor the range of ₹1,900 and ₹2,045. Unless Bharti Airtel breaks this range on a closing basis, the trend may remain sideways. A break above or below this range will provide further directional insights.

Options outlook

Bharti Airtel's open interest data for the 28 August expiry has an at-the-money (ATM) strike of 1,940. As of 5 August, the combined premium of the call and put options for Bharti Airtel is ₹73, indicating an implied movement of ±3.8% until the expiry date in August.

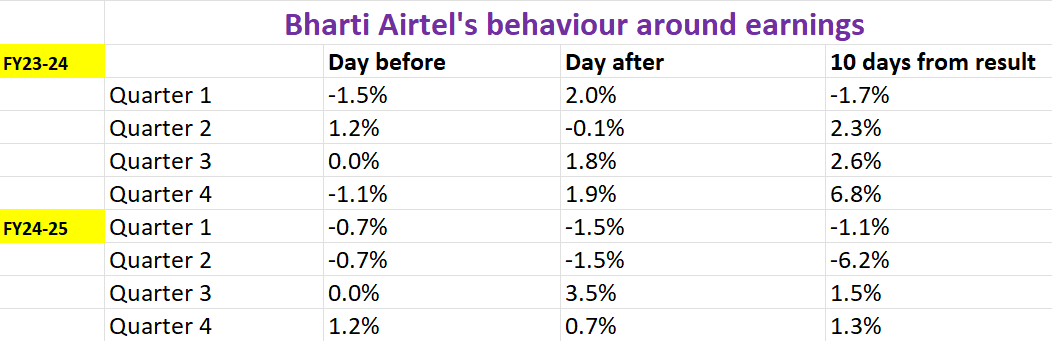

However, before planning any options strategy, it is worth taking a look at the historical price behaviour around the earnings announcement for the last eight quarters.

Options strategy for Bharti Airtel

If you expect significant movement in Bharti Airtel shares—regardless of direction—the Long Straddle strategy is well-suited. This approach involves simultaneously buying an at-the-money (ATM) call and an ATM put option (of same strike and expiry), positioning yourself to profit from sharp moves greater than ±3.8% either up or down.

In contrast, when you believe volatility will decrease and anticipate minimal price movement in Bharti Airtel following its earnings announcement, the Short Straddle may be more appropriate. In this setup, you sell both an ATM call and an ATM put with the same strike and expiry, effectively anticipating that Bharti Airtel's price will stay confined within a range of ±3.8%.

For traders expecting a breakout of ₹1,900 and ₹2,045, traders can plan bullish or bearish option strategies like bull put spread and bear call spreads. These strategies allow traders to align their positions with their expectations for both price direction and volatility, helping manage risk and potential return.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story