Market News

Adani Enterprises, Adani Ports: Adani Group's ROA hit 16.5% in FY25, among highest globally in infrastructure, says Gautam Adani

.png)

4 min read | Updated on October 14, 2025, 14:27 IST

SUMMARY

Adani Group stocks: The group's net debt-to-EBITDA ratio stood at 2.6x, reflecting a conservative leverage profile. With robust internal cash flows, Adani said the company expects to self-fund a large share of its $100 billion five-year capex plan, reducing reliance on external markets.

Stock list

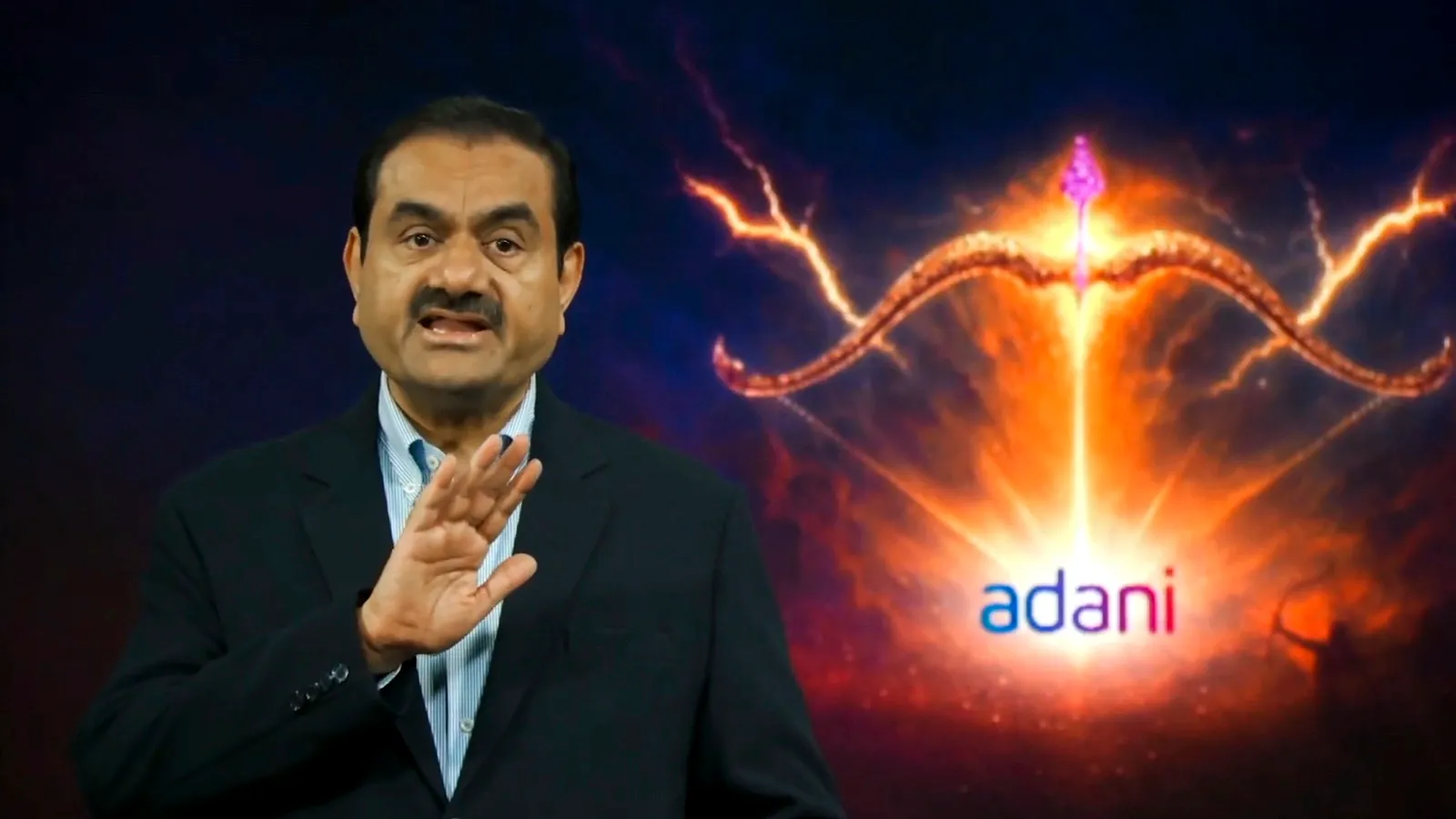

Adani Group Chairman Gautam Adani | Image: PTI

Speaking at the group's annual Shantilal Adani Lecture Series, Adani attributed the performance to disciplined growth and efficient capital deployment. "This figure demonstrates that our growth is profitable, our assets are productive, and our capital is working with precision," news agency PTI reported, quoting Gautam Adani as saying.

The group's net debt-to-EBITDA ratio stood at 2.6x, reflecting a conservative leverage profile. With robust internal cash flows, Adani said the company expects to self-fund a large share of its $100 billion five-year capex plan, reducing reliance on external markets.

"This high ROA does more than generate cash. It fortifies our credibility with lenders, deepens investor confidence, and underpins our ability to take bold bets while preserving balance sheet integrity. It is the invisible scaffolding that supports everything we build," Adani said.

Citing a $500 billion opportunity in India's electricity sector by 2032, Adani said the group is targeting a 20% share of that market.

Looking ahead, Adani outlined a 'Two-Track Organization' model as part of the group's next transformation phase, combining artificial intelligence with human judgment. "The Agentic Track will bring data-driven precision, while the Human Track will guide it with judgment and ethics," Gautam Adani said.

He also highlighted finance transformation initiatives such as the Finance Control Tower - a real-time visibility platform - and a Global Capability Center that integrates AI-led workflows for greater efficiency.

"Finance is no longer a back-office function. It is the cockpit of strategic control - where foresight meets discipline," Adani said.

The Shantilal Adani Lecture Series is an internal annual event dedicated to the memory of Shantilal Adani, bringing together senior finance and technology leaders across the Group to discuss financial strategy, governance, and innovation.

Stating that the world stands at an inflection point that is defined by the convergence of technology, capital, and human potential, Adani said his conglomerate has always believed in building at speed and scale, one that constructs the physical and digital arteries of India -- this moment is not one for caution. "It is a moment for daring, for reinvention, and for building a model that fuses intelligence with purpose."

Adani, Google join hands

In a separate development, Adani Enterprises and Google on Tuesday, October 14, announced a partnership to develop India’s largest AI data centre campus in Visakhapatnam, Andhra Pradesh.

“Google’s AI hub in Visakhapatnam is a multi-faceted investment of approximately USD 15 billion over five years (2026-2030), comprising gigawatt-scale data centre operations, supported by a robust subsea cable network and clean energy, to drive the most demanding AI workloads in India. It will be brought to life in close collaboration with ecosystem partners, including AdaniConneX and Airtel,” the company said in an exchange filing.

The companies will also co-invest in new transmission lines, clean energy generation, and energy storage systems in Andhra Pradesh. These energy initiatives are aimed at supporting the data centre’s operations while enhancing the resilience and capacity of the local electricity grid.

How Adani Group stocks are performing

At the time of writing this article, Adani Enterprises was trading around 1% lower at ₹2,504.50 on the NSE, and Adani Ports was trading at ₹1,428.30, down 0.66%. Adani Green Energy shares were trading around 2% lower at ₹1,030.70 apiece on the NSE, while Adani Energy Solutions was down 0.77% at ₹930.45.

Adani Total Gas shares were down over 1% at ₹618.15 apiece on the NSE.

Related News

About The Author

Next Story