Market News

RBI's Monetary Policy Committee keeps repo rate unchanged at 5.5%, maintains neutral stance

.png)

3 min read | Updated on October 01, 2025, 13:03 IST

SUMMARY

Governor Malhotra noted that the MPC decided to keep the policy stance neutral hinting that it is neither focused on cutting rates to boost growth nor on raising rates to control inflation.

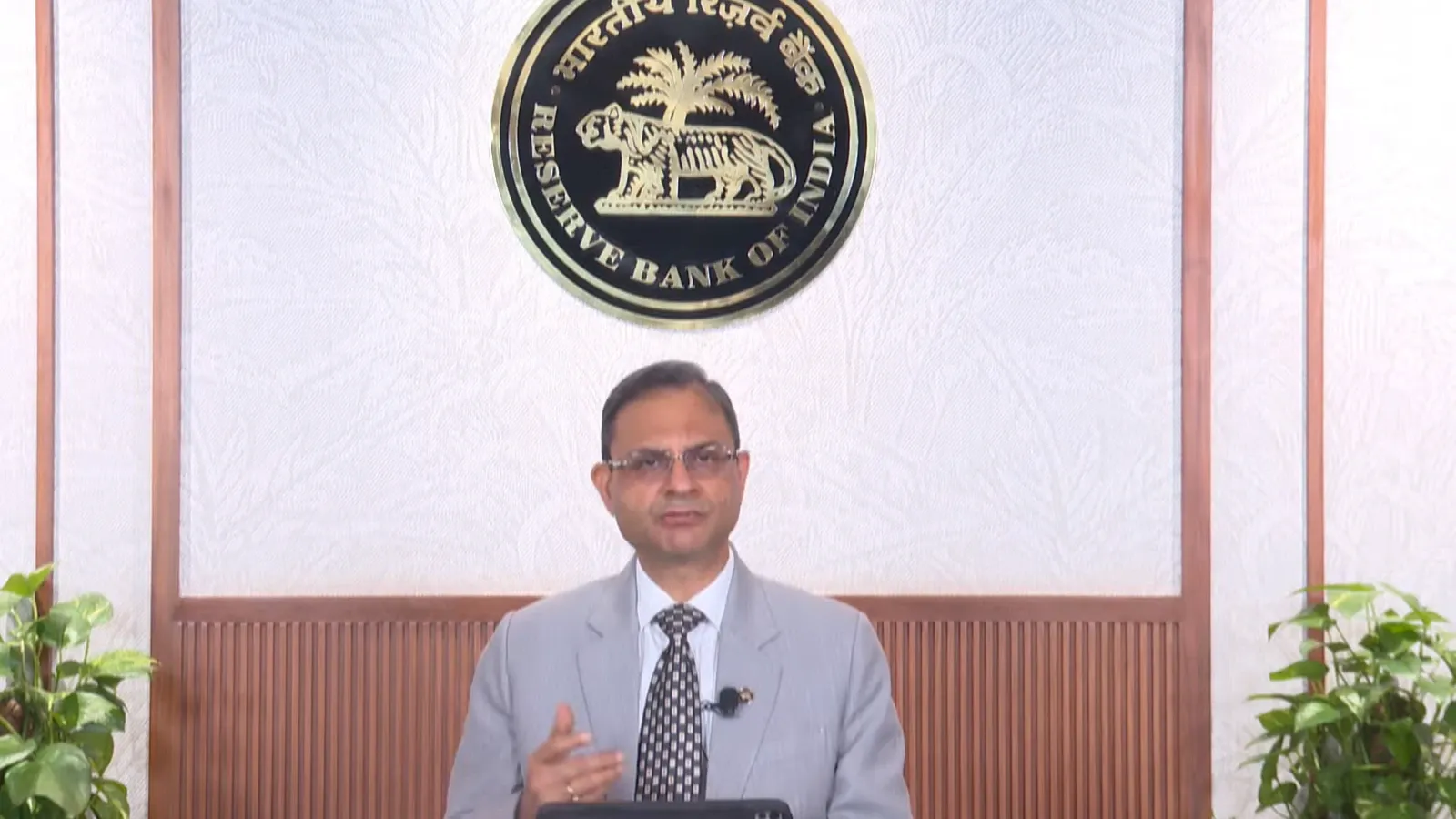

RBI Governor Sanjay Malhotra

The Reserve Bank of India's six-member Monetary Policy Committee (MPC) headed by Governor Sanjay Malhotra unanimously decided to keep repo rate unchanged at 5.5%, marking a second consecutive pause after the MPC lowered the repo rate by 100 basis points cumulatively in its February and April meetings.

Governor Malhotra noted that the MPC decided to keep the policy stance neutral, hinting that it is neither focused on cutting rates to boost growth nor on raising rates to control inflation. Instead, it signals that the central bank will keep policy flexible and data-dependent, adjusting rates up or down depending on how inflation, growth and other economic conditions evolve.

Malhotra said that while GST rate rationalisation will have a sobering impact on consumption and growth, tariff related developments may slow down the economic expansion in the second half of the current fiscal.

The RBI's MPC revised India's growth outlook on the upside while it lowered inflation projection for the current financial year.

For the current financial year, the economic growth outlook was revised upwards to 6.8% from its earlier projection of 6.5% while it lowered the inflation projection to 2.6%.

"Good progress of kharif sowing and adequate reservoir levels have further brightened prospects of agriculture and rural demand. Buoyancy in services sector coupled with steady employment conditions are supportive of demand, which is expected to get a further boost from the rationalisation of goods and services tax (GST) rates. Rising capacity utilisation, conducive financial conditions, and improving domestic demand should continue to facilitate fixed investment," the RBI said while revising economic growth outlook upwards.

"However, ongoing tariff and trade policy uncertainties will impact external demand for goods and services. Prolonged geopolitical tensions and volatility in international financial markets caused by risk-off sentiments of investors also pose downside risks to the growth outlook," the RBI added.

While lowering the inflation outlook, the RBI said that healthy progress of the southwest monsoon, higher kharif sowing, adequate reservoir levels and comfortable buffer stock of food grains should keep food prices benign. The recently implemented GST rate rationalisation would lead to a reduction in prices of several items in the CPI basket.

"Overall, the inflation outcome is likely to be softer than what was projected in the August MPC resolution, primarily on account of the GST rate cuts and benign food prices. Despite the anticipation of moderate momentum during H2, large unfavourable base effects are likely to exert upward pressure on headline CPI inflation, especially in Q4. Considering all these factors, CPI inflation for 2025-26 is now projected at 2.6% with Q2 at 1.8%; Q3 at 1.8%; and Q4 at 4.0%. CPI inflation for Q1:2026-27 is projected at 4.5%. The risks are evenly balanced," RBI said.

The equity markets reacted positively to the RBI's policy decision as the SENSEX rose as much 687 points and the NIFTY50 reclaimed its important psychological level of 24,800.

"MPC’s decision to keep the repo rate unchanged at 5.50% with a ‘Neutral’ stance was largely in line with expectations, but the underlying message has significant implications for markets, liquidity, and the broader economy," said Anil Rego, founder and fund manager at Right Horizons PMS.

"For markets, this pause coupled with dovish guidance is likely to be viewed positively. Rate-sensitive segments like auto, housing finance, real estate and consumption could see improved demand as lending rates stabilise and transmission accelerates. Equities may benefit from sustained liquidity support, benign inflation, and improving earnings visibility, while bond markets could also price in a softer rate trajectory in the coming quarters," Rego added.

About The Author

Next Story