Market News

Canara Bank, Bank of Maharashtra, IOB: PSB consolidation to gain momentum in 2026; key points to know

.png)

5 min read | Updated on December 26, 2025, 13:05 IST

SUMMARY

PSU banks: Currently, there are 12 public sector banks, and only the country's biggest lender, State Bank of India (SBI), is among the global top 50 by assets. SBI is ranked 43rd globally by assets, followed by private-sector HDFC Bank at 73rd.

Stock list

PSBs' profitability has risen from ₹1.05 lakh crore in FY 2022–23 to ₹1.78 lakh crore in FY 2024–25. | Image: Shutterstock

The government has expressed its desire to have more big, world-class banks in the country to fuel the next phase of growth for Viksit Bharat by 2047.

Last month, Finance Minister Nirmala Sitharaman said India needs many big, world-class banks, and work in this regard has already commenced.

The government has initiated discussions with the Reserve Bank of India (RBI) and public sector banks, the FM had said, dropping enough hints about consolidation in the public sector space.

What is the current status?

Currently, there are 12 public sector banks, and only the country's biggest lender, State Bank of India (SBI), is among the global top 50 by assets. SBI is ranked 43rd globally by assets, followed by private-sector HDFC Bank at 73rd.

In a bid to create larger banks, the government previously conducted two rounds of consolidation. In the biggest consolidation exercise in the banking space, the government announced four major mergers of public sector banks in August 2019, bringing the total number down to 12 from 27 in 2017.

Effective April 1, 2020, United Bank of India and Oriental Bank of Commerce were merged with Punjab National Bank; Syndicate Bank was merged with Canara Bank; Allahabad Bank was amalgamated with Indian Bank; and Andhra Bank and Corporation Bank were consolidated with Union Bank of India.

In 2019, Dena Bank and Vijaya Bank were merged with Bank of Baroda. Prior to this, the government had merged five associate banks of SBI and Bharatiya Mahila Bank with the State Bank of India. This was done in April 2017 with the intent to make SBI much bigger.

As regards the State Bank of India, the bank's board in 2016 submitted a proposal to the government to merge its five subsidiaries, including the first women-oriented lender, Bhartiya Mahila Bank, with itself.

The merged entity, effective April 1, 2017, expanded SBI's asset base to Rs 44 lakh crore, with 22,500 branches and 58,000 ATMs.

SBI first merged the State Bank of Saurashtra with itself in 2008. Two years later, the State Bank of Indore was merged.

IDBI Bank privatisation

Besides, the government has initiated the privatisation of IDBI Bank, and Department of Investment and Public Asset Management (DIPAM) Secretary Arunish Chawla had expressed hope that the strategic sale would be concluded by March 2026.

As part of the privatisation exercise, the government in January 2019 sold its controlling 51% stake in IDBI Bank to Life Insurance Corporation of India (LIC).

PSU banks' profitability until H1FY26

As regards the profitability of public sector banks, 12 banks, which account for around 60% of the market share in total business, together reported a net profit of ₹93,675 crore during the first half of 2025–26. This is 10% higher than the ₹85,520 crore logged in the April-September period of FY25.

Going by the trend, the net profit of public sector banks is expected to cross the landmark ₹2 lakh crore mark at the end of FY26.

The previous financial year closed with PSU banks posting a record profit of ₹1.78 lakh crore, up from ₹1.41 lakh crore in FY24, a 26% growth.

Banking sector in India

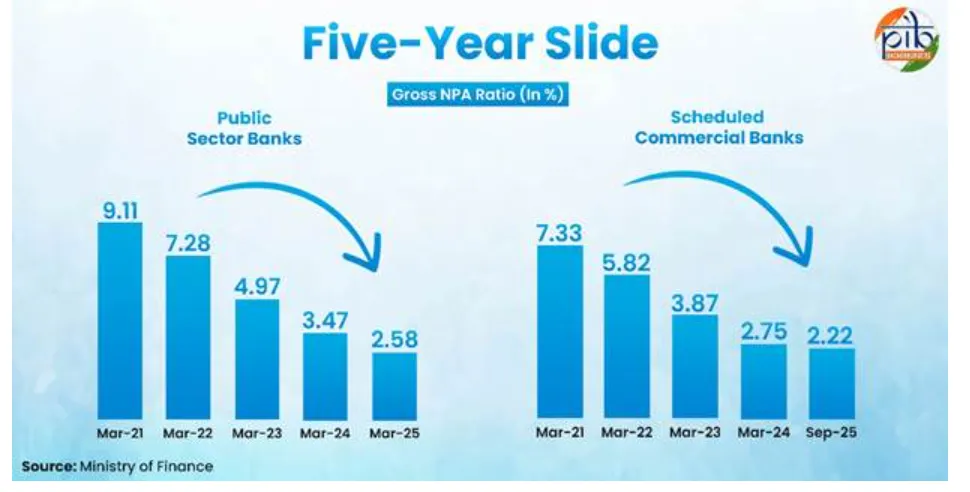

According to a recent press release by PIB, PSBs' profitability has strengthened, with net profits rising from ₹1.05 lakh crore in FY 2022–23 to ₹1.78 lakh crore in FY 2024–25, while gross non-performing assets (GNPA) have fallen from a peak of 11.46% in 2018 to 2.31% in 2025.

The press release added, "Gross NPAs of PSBs have been declining during the last five financial years – reducing from 9.11% to 2.58% between March 2021 and March 2025. Similarly, the NNPAs of PSBs declined to a multi-year low at 0.52% in FY 24-25 from 1.24% in FY 22-23."

This indicates sustained improvement in asset quality and risk management. The trend has been witnessed in scheduled commercial banks (SCBs) too, with a decline in both NPA and GNPA.

According to the press release, deposits and credit nearly tripled between 2015 and 2025.

Deposits grew from ₹88.35 lakh crore to ₹231.90 lakh crore, while credit expanded from ₹66.91 lakh crore to ₹181.34 lakh crore.

Bank profitability on the rise

The Indian banking industry has seen robust growth, driven by strong economic expansion, rising disposable incomes, growing consumerism, and easier credit access. Digital modes of payment, dominated by UPI, have grown phenomenally over the last few years.

As per the RBI, India’s banking sector is sufficiently capitalised and well-regulated. Notably, the profitability of banks improved for the sixth consecutive year in 2023-24.

-

From FY 22–23 to FY 24–25, the total Business of Public Sector Banks (PSBs) rose from ₹203 lakh crore to ₹252 lakh crore;

-

From FY 22–23 to FY 24–25, net profit increased from ₹1.05 lakh crore to ₹1.78 lakh crore;

-

Dividend payouts grew from ₹20,964 crore to ₹34,990 crore, reflecting the continued strengthening of financial performance.

PSBs' stock performance

Data show that the NIFTY PSU Bank index has risen over 25% over the past 12 months (as of afternoon deals on December 26). On a year-to-date basis, the index has rallied around 26.8%. The index has jumped nearly 19% over the past six months.

Among individual names, SBI shares have risen 19%, while Bank of Maharashtra has rallied over 8% in the past 12 months. Canara Bank shares have jumped 49% during the window, while Punjab National Bank has advanced nearly 18%.

Related News

About The Author

Next Story