Market News

Premier Energies IPO Day 1: Issue fully subscribed within hours of launch; check subscription status and other key details

.png)

3 min read | Updated on August 27, 2024, 16:10 IST

SUMMARY

Premier Energies Limited IPO, a book-building offer worth ₹2,830.4 crore, consists of a fresh issue of 2.87 crore shares aimed at raising ₹1,291.4 crore and an offer-for-sale of 3.42 crore shares, amounting to ₹1,539 crore. Premier Energies IPO subscription is open from August 27 to August 29.

Premier Energies Limited IPO received bids for over 6.29 crore shares against 4.46 crore shares on offer.

Premier Energies IPO was fully subscribed within hours of launch on Tuesday, August 27, the first day of bidding, driven by high demand from retail and non-Institutional Investors.

The solar cell manufacturer's mainboard initial public offer is open for subscription from August 27 to August 29.

Premier Energies Limited IPO received bids for over 6.29 crore shares against 4.46 crore shares on offer. The issue was subscribed 1.41 times till 3:15 pm on the first day of bidding, as per the NSE data.

Non-institutional investors (NIIs) drove the demand for Premier Energies’ shares, with applications for more than 2.98 crore shares compared to 96.31 lakh shares set aside for the category. The segment was booked 3.1 times. Retail investors placed bids for more than 3.25 crore shares against 2.24 crore shares set aside for them. The retail portion was booked 1.45 times.

The employees’ portion was also booked 2.53 times with bids for over 6.23 lakh shares against 2.46 lakh shares reserved for the category.

However, the qualified institutional buyers’ (QIBs) segment saw a tepid demand with applications for only 15,411 shares compared to 1.22 crore shares set aside for the category.

If you are also looking forward to participating in the Premier Energies IPO subscription, here are the key details to check:

Premier Energies IPO offer size, price band and lot size

Premier Energies Limited IPO, a book-building offer worth ₹2,830.4 crore, consists of a fresh issue of 2.87 crore shares aimed at raising ₹1,291.4 crore and an offer-for-sale of 3.42 crore shares, amounting to ₹1,539 crore.

The Premier Energies IPO price band has been fixed at ₹427 to ₹450 per share. Retail investors interested in applying for the IPO can place bids for a minimum of a single lot size comprising 33 shares, which aggregates to an investment of ₹14,850.

Premier Energies IPO dates

The subscription window for Premier Energies IPO will close on August 29. The IPO share allotment status is likely to be finalised on August 30. Refunds will be initiated for unsuccessful bidders on September 2, and shares will be credited into the Demat accounts of allottees the same day. Shares of Premier Energies IPO will be listed on the NSE and BSE. The tentative listing date for Premier Energies Limited shares is September 3.

Premier Energies IPO: Registrar

Kfin Technologies Limited is the registrar for Premier Energies IPO, and the book-running lead managers for the issue are Kotak Mahindra Capital Company Limited, JP Morgan India Private Limited, and ICICI Securities Limited.

Premier Energies IPO objective

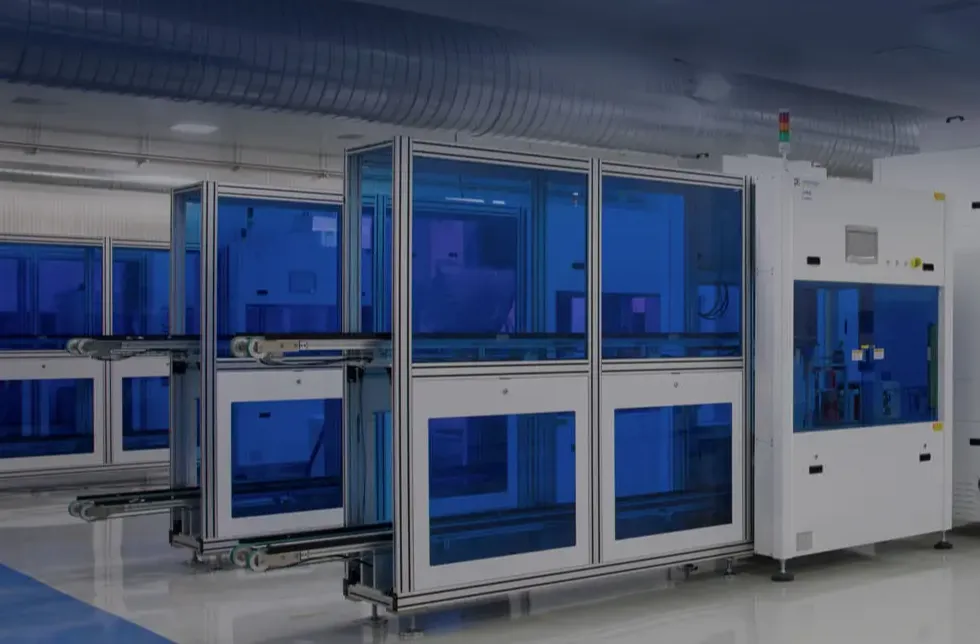

Premier Energies plans to invest the funds raised via the public issue in its subsidiary, Premier Energies Global Environment Private Limited. A portion of the funds will also be used for part-financing the establishment of a 4 GW Solar PV TOPCon Cell and 4 GW Solar PV TOPCon Module manufacturing facility in Hyderabad.

About Premier Energies Limited

Premier Energies was incorporated in 1995. It is a manufacturer of integrated solar cells and solar panels. The company's product portfolio includes cells, solar modules, EPC solutions, and O&M solutions. As of June 2024, the company had 1,447 employees and 3,278 contract labourers.

Related News

About The Author

Next Story