Market News

Parmeshwar Metal IPO Day 3: BSE SME issue booked nearly 600 times on, NIIs steal the show; check details

.png)

3 min read | Updated on January 06, 2025, 19:13 IST

SUMMARY

The copper wire and rod manufacturer aims to raise ₹24.74 crore from the primary market through its maiden share sale. The SME issue opened for bidding on Thursday, January 2. The IPO listing has been scheduled for Thursday, January 9.

Beeline Capital Advisors Private Limited is the book-running lead manager of the Parmeshwar Metal IPO

The initial public offering (IPO) of Parmeshwar Metal Limited was subscribed nearly 600 times on the last day of bidding on Monday, January 6, led by a huge demand from retail and non-institutional investors.

On the third day of bidding, the issue was booked 607.13 times, the BSE data at 5 pm showed.

The copper wire and rod manufacturer aims to raise ₹24.74 crore from the primary market through its maiden share sale. The SME issue opened for bidding on Thursday, January 2.

The IPO received bids for more than 163.65 crore shares against 26.96 lakh shares on offer.

Parmeshwar Metal received bids for over 80.48 crore shares in the retail category of the IPO against 13.48 lakh shares on offer. The retail quota of the IPO was booked 597.1 times. The Non-Institutional Investors (NIIs) segment was subscribed 1,203.13 times with applications for shares over 69.54 crore shares against 5.78 lakh shares set aside for the segment. The Qualified Institutional Buyers (QIBs) applied for more than 136.53 crore shares against 7.7 lakh shares reserved for them. The QIBs segment was booked 177.32 times.

Parmeshwar Metal IPO price band and other details

Parmeshwar Metal IPO consists of an exclusively fresh issue of 40.56 lakh shares and no offer-for-sale (OFS) component. The company has fixed the price band at ₹57 to ₹61 per share for the IPO.

The minimum lot size is 2,000 shares for retail investors, aggregating to an investment of ₹1,22,000.

Beeline Capital Advisors Private Limited is the book-running lead manager of the IPO, while Link Intime India Private Limited is the registrar for the issue.

Parmeshwar Metal IPO key dates

The IPO allotment status is expected to be finalised on Tuesday, January 7. Refunds will be issued on Wednesday, January 8, and the allottees will also receive shares in the Demat accounts on the same day.

The company has proposed to list shares on BSE on Thursday, January 9.

About Parmeshwar Metal and use of IPO proceeds

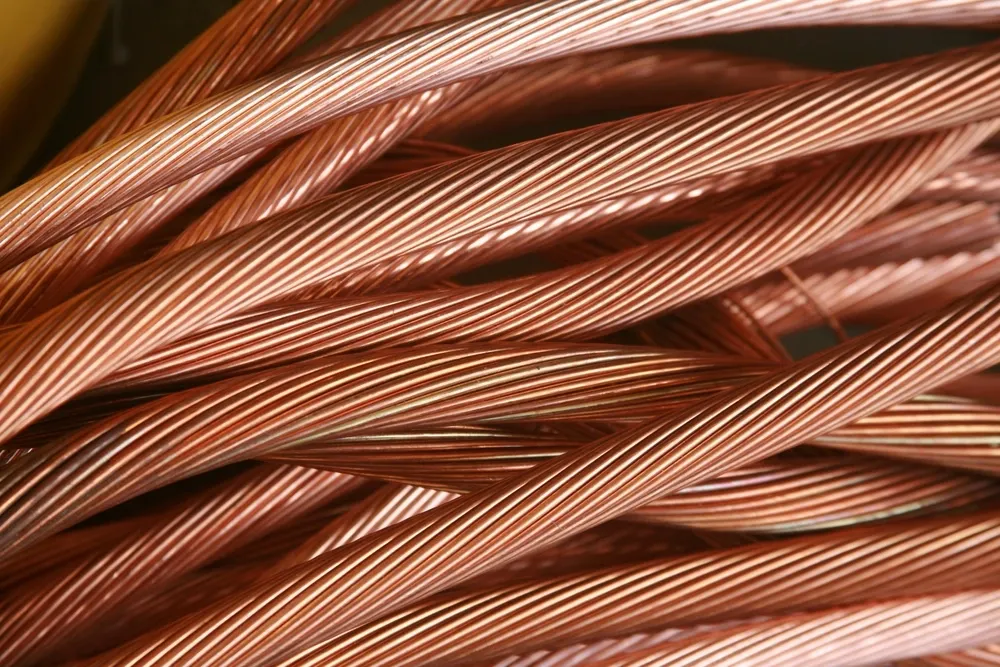

Parmeshwar Metal is a leading manufacturer of high-quality copper wire rods, serving a wide range of industries including power cables, building wires, transformers, automotive, and household cables, among others.

Looking to further expand its business, the company is set to install new manufacturing facilities at its existing site in Gujarat to produce bunched copper wire rods. These new facilities will incorporate advanced machinery such as wire drawing, bunching machines, and rod breakdown machines to improve production capacity.

The proceeds from the Fresh Issue will be allocated for setting up a new manufacturing facility at Dehgam, Gujarat, for manufacturing Bunched copper wire and 1.6 MM copper wire rods. A portion of the funds will also be used for general corporate purposes.

In the current financial year, the company reported a revenue of ₹757.3 crore for the period ended on October 31, 2024. Its net profit stood at ₹5.7 crore for the period under review. In FY24, it reported a revenue of ₹1,102.46 crore and a net profit of ₹7.22 crore.

About The Author

Next Story