Market News

LK Mehta Polymers shares hit 5% lower circuit after listing flat at ₹71 apiece on BSE SME

.png)

3 min read | Updated on February 21, 2025, 11:14 IST

SUMMARY

LK Mehta Polymers Ltd made a flat debut on the BSE SME platform, listing at ₹71.1, slightly above its IPO price. The stock hit a 5% lower circuit to trade at ₹67.54. The ₹7.38-crore IPO was subscribed 44.6 times. The company’s revenue for FY24 grew to ₹18.87 crore.

LK Mehta Polymers shares hit 5% lower circuit after listing flat at ₹71 apiece on BSE SME | Image: Shutterstock

Shares of plastic products manufacturer LK Mehta Polymers Ltd made a quiet trading debut on Friday, February 21, with the stock listing flat on the BSE SME platform.

LK Mehta Polymers stock opened the session at ₹71.1 apiece, up 0.1% compared to its initial public offering (IPO) price of ₹71 per share. However, within minutes of the session's opening, the share price declined as much as 5% to hit the lower circuit limit of ₹67.54.

More than 4.91 lakh shares changed hands on the stock exchange by 10:20 am. The total trading value stood at ₹3.48 crore. The company’s market capitalisation reached ₹25.94 crore.

Given that the minimum bid quantity to apply for the LK Mehta Polymers IPO was 1,600 shares, successful bidders who were allotted shares in the primary issue managed tepid listing gains to the tune of ₹160 per lot (₹0.1x 1,600) as soon as the stock started trading in the secondary market.

The ₹7.38-crore LK Mehta Polymers IPO, which was open for subscription from February 13 to February 17, was oversubscribed 44.6 times during the three-day bidding window. The issue attracted bids for more than 4.39 crore shares against 9.85 lakh shares on offer.

The IPO was a fixed-price issue and was made up entirely of a fresh issuance of 10.4 lakh shares, with no offer-for-sale (OFS) component. Shares in the LK Mehta Polymers IPO were offered at a price of ₹71 apiece in a lot size of 1,600 units, translating into a minimum investment of ₹1.14 lakh for retail investors.

The company had appointed Swastika Investmart Ltd as the book-running lead manager and market maker for the issue, while Bigshare Services Pvt Ltd was the registrar.

In its Red Herring Prospectus (RHP), LK Mehta Polymers said that the company plans to use ₹5.34 crore of total IPO funds to meet working capital needs and the rest of ₹1.34 crore for general corporate purposes.

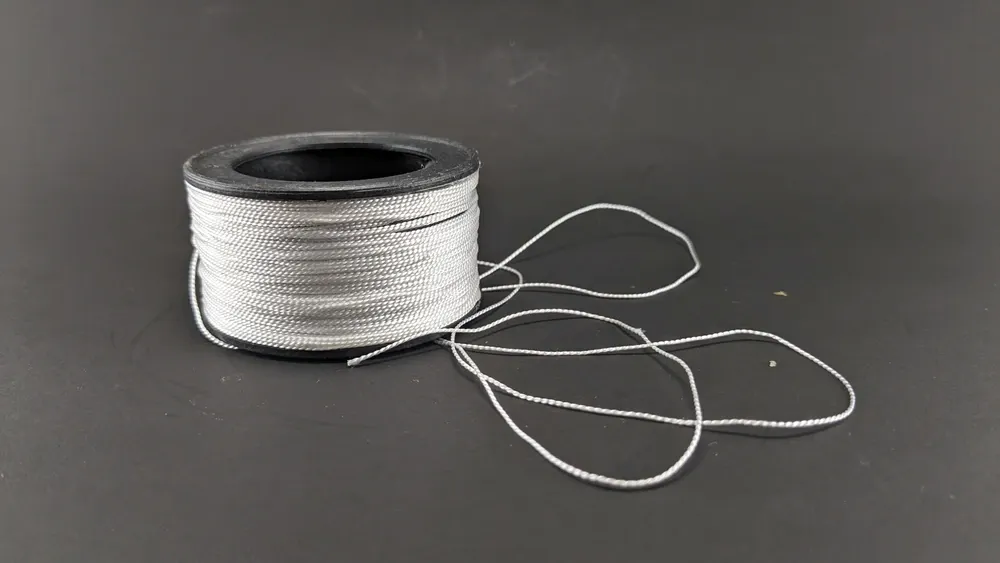

Founded in 1995, LK Mehta Polymers is engaged in the trade and manufacturing of plastic rope twine and granules.

Its product line includes a range of products like danline ropes, monofilament ropes, tape ropes, packaging twine (sutli) and baler twines.

The company sells its products under the brand name ‘Super Pack’. Its reach spreads over 20 Indian states with more than 500 trusted customers.

It is also involved in trading and reprocessing basic raw materials like polypropylene and polyethene granules for various customers.

For the nine-month period ended December 2024 of the current financial year 2024-25, LK Mehta Polymers reported revenue of ₹11.98 crore. Profit after tax (PAT) for the period was ₹42 lakh.

For the full financial year 2023-24, revenue was ₹18.87 crore compared with ₹17.14 crore in 2022-23. Meanwhile, PAT for FY24 was ₹86 lakh compared with a net loss of ₹1 lakh in FY23.

Related News

About The Author

Next Story