Market News

CLN Energy makes muted debut, shares list at 2% premium over IPO price on BSE SME

.png)

3 min read | Updated on January 30, 2025, 10:50 IST

SUMMARY

At the listing price of ₹256 per share, the value of a single lot of shares bagged by investors in the IPO share allotment stood at ₹1,53,600 (₹256x600). Investors would have made gains of ₹3,600 per lot as the minimum investment in a single lot was ₹1,50,000 (₹250x600).

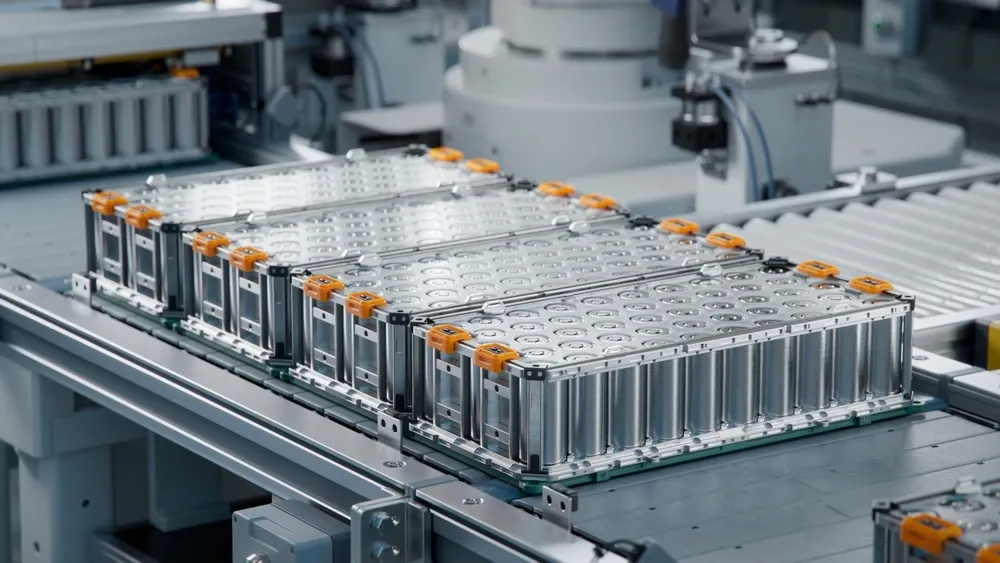

CLN Energy launched its public offer on January 23 to garner ₹72.3 crore from primary market investors. | Image: Shutterstock

Electric vehicle components maker CLN Energy made a lacklustre market debut on Thursday, January 30, with its shares listing at a premium of over 2% on the BSE SME platform.

Shares of the company opened at ₹256 apiece, up 2.4% compared to the issue price of ₹250 per unit.

After a muted debut, the stock further advanced up to 5% to hit the upper circuit limit of ₹268.80 apiece. The stock later pared some of its early gains to trade at ₹261 apiece.

More than 2.92 lakh equity shares changed hands on the bourse. The total turnover stood at ₹7.58 crore, within the initial 10 minutes of trade. CLN Energy’s market capitalisation stood at ₹270.27 crore.

At the listing price of ₹256 per share, the value of a single lot of shares bagged by investors in the IPO share allotment stood at ₹1,53,600 (₹256x600).

IPO investors would have made gains of ₹3,600 per lot as the minimum investment in a single lot was ₹1,50,000 (₹250x600).

CLN Energy IPO details

The Lithium-ion battery and EV parts manufacturer launched its public offer on January 23 to garner ₹72.3 crore from primary market investors.

The SME issue was fully subscribed within hours of launch due to high demand. The IPO consisted of a fresh issue of 28.92 lakh shares priced at ₹235 to ₹250 per share.

At the close of bidding on January 27, the SME IPO was booked more than 5.5 times. Applications for more than 1.05 crore equity shares were received against 19.15 lakh shares on offer.

The retail investors’ portion was booked more than 6.5 times as bids for over 62.72 lakh equity shares poured in compared to 9.57 lakh shares on offer. The Non-Institutional Investors (NIIs) quota was booked more than 9 times as applications for more than 36.85 lakh shares were received against 4.1 lakh shares on offer. The Qualified Institutional Buyers (QIBs) category was fully subscribed as bids for 5.87 lakh shares were received against 5.47 lakh shares on offer.

Incorporated in 2019, CLN Energy manufactures and sells products under the CLN Energy brand. It produces customised Lithium-ion batteries and motors. CLN Energy also deals in powertrain components of electric vehicles such as DC-DC converters, displays, differential, controllers and throttles, among others. The company primarily caters to electric two-wheeler, three-wheeler and four-wheeler producers.

CLN Energy has proposed using IPO proceeds to purchase machinery and equipment, meet working capital needs and for general corporate purposes.

According to its RHP, the company will use ₹9.71 crore for the purchase of machinery and equipment at its Noida facility to increase scale and in-house capabilities. It has two plants in Noida and Pune. CLN Energy would use ₹40.22 crore for funding working capital needs and the rest for general corporate purposes.

Related News

About The Author

Next Story