Market News

CLN Energy IPO allotment: How to check status online on BSE, Bigshare Services

.png)

4 min read | Updated on January 28, 2025, 12:01 IST

SUMMARY

CLN Energy IPO investors can check the IPO share allotment status on the websites of the BSE and the issue registrar, Bigshare Services Pvt Ltd. The listing date has been tentatively fixed as January 30. The company's shares will be listed on the BSE SME platform.

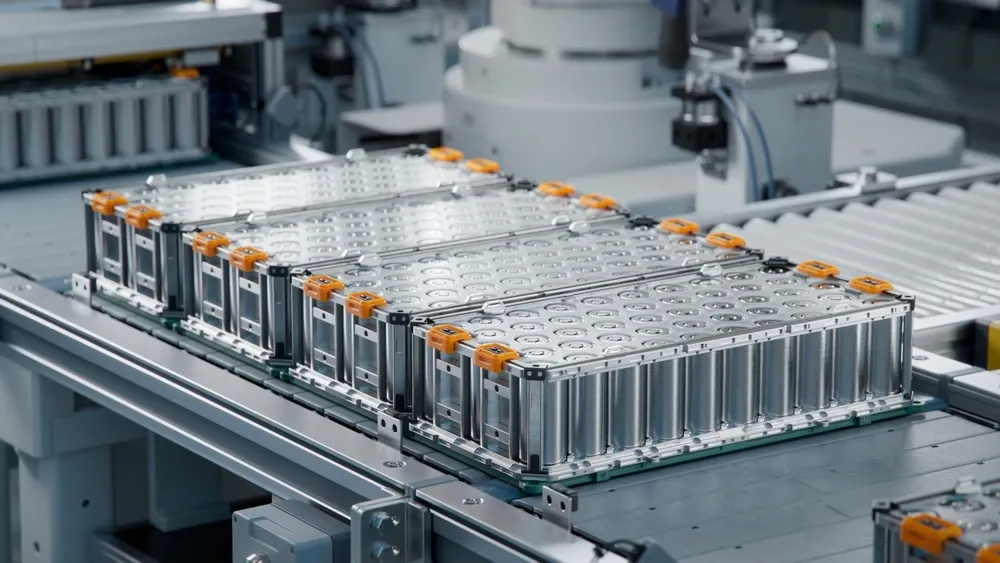

CLN Energy is a manufacturer of components for electric vehicles. | Image: Shutterstock

CLN Energy IPO allotment: The initial public offering of CLN Energy Ltd closed with a decent demand on the last day of bidding on Monday, January 27. Following the closure of the bidding window, the IPO investors are waiting for the share allotment status to be finalised by the company.

The electric vehicle (EV) components and Lithium-ion battery manufacturer launched its IPO on January 23 to raise ₹72.3 crore from public investors. The BSE SME issue was fully subscribed within hours of launch.

At the close of bidding on Monday, the SME public offer received applications for more than 1.05 crore equity shares against 19.15 lakh shares on offer. The issue was overall booked 5.5 times.

The retail investors placed applications for over 62.72 lakh equity shares compared to the allocation of 9.57 lakh shares. The retail investors’ portion was subscribed 6.55 times.

The Non-Institutional Investors (NIIs) placed bids for more than 36.85 lakh shares against their quota of 4.1 lakh shares, leading to a subscription of nearly 9 times in the category. The Qualified Institutional Buyers (QIBs) category was also fully subscribed. The QIBs applied for over 5.87 lakh shares compared to 5.47 lakh shares set aside for them.

The company in the pre-bid round, on January 22, raised ₹20.52 crore from anchor investors. It allotted 8,20,800 shares to three fund schemes at ₹250 per equity share.

CLN Energy IPO allotment status

CLN Energy is expected to finalise the share allotment status on Tuesday, January 28. Investors can check the IPO share allotment status on the websites of the BSE and the issue registrar, Bigshare Services Pvt. Ltd.

Steps to check CLN Energy IPO allotment status on Bigshare Services

- Visit Bigshare Services Pvt Ltd website (https://www.bigshareonline.com)

- Click on IPO allotment status link; a new page will open

- Choose any of the server links from three options

- Select CLN Energy Ltd from the dropdown list for company names

- Choose any of these – Application number, PAN and Beneficiary ID

- Enter details as per your selection

- Click the "Search" button to check IPO allotment status.

How to check CLN Energy IPO allotment status on BS:

- Open the IPO allotment status page on the BSE website: https://www.bseindia.com/investors/appli_check.aspx

- Click on ‘equity’ for ‘issue type’

- Select CLN Energy Ltd as the ‘issue name’ from the dropdown list

- Enter PAN details or Application Number

- Complete Captcha verification and click on ‘Search’

CLN Energy IPO details

CLN Energy is a manufacturer of components for electric vehicles. The company produces customised Lithium-ion batteries and motors under the CLN Energy brand. It is also engaged in the production of powertrain components of EVs. It offers B2B solutions for mobility applications such as electric two- and four-wheelers.

Here are the key details about CLN Energy IPO:

- The ₹72.3-crore public offer of CLN Energy comprised only a fresh issuance of 28.92 lakh shares.

- The price band for the IPO was fixed at ₹235 to ₹250 per share.

- The lot size for an application was 600 shares for retail investors, requiring a minimum investment of ₹1,50,000.

- CLN Energy will initiate refunds and transfer of shares to the Demat accounts on January 30.

- The IPO listing date has been tentatively fixed as January 30.

- CLN Energy shares will be listed on the BSE SME platform.

Use of IPO proceeds

CLN Energy has proposed to utilise IPO funds for buying machinery and equipment, meeting working capital needs and for general corporate purposes.

The company will spend ₹9.71 crore on the purchase of machinery and equipment at its Noida manufacturing facility to enhance capacities and in-house capabilities. It has two manufacturing facilities in Noida and Pune.

It has proposed to use ₹40.22 crore for funding working capital needs and the rest for general corporate purposes.

CLN Energy financials

| April-September period of FY25 | FY 2023-24 | FY 2022-23 | |

|---|---|---|---|

| Net Profit | ₹4.63 cr | ₹9.79 cr | ₹72.87 lakh |

| Revenue | ₹75.84 cr | ₹132.85 cr | ₹128.88 cr |

CLN Energy Key Performance Indicators

| KPI | Value |

|---|---|

| ROCE | 91.55% |

| ROE | 115% |

| P/E Ratio | 27 |

| PAT Margin | 7.38% |

About The Author

Next Story