Market News

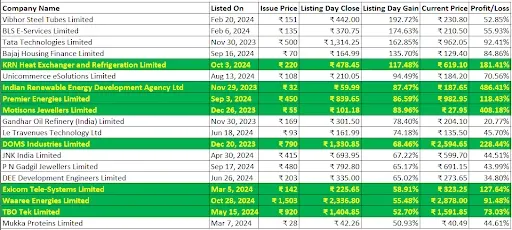

Biggest winners of India’s IPO boom: Stocks outperforming their initial gains

.png)

4 min read | Updated on November 16, 2024, 22:36 IST

SUMMARY

In the last year, several high-profile Indian IPOs saw extraordinary listing gains, with renewable energy and tech companies generally outperforming and maintaining growth, reinforcing strong investor interest.

Stock list

Biggest winners of India’s IPO boom: Stocks outperforming their initial gains

In the last year, several initial public offerings (IPO) in the Indian stock market attracted significant attention due to their extraordinary listing gains. Among these, some have continued to perform well beyond their debut, while others have seen declines. Let’s dive into these IPOs, their initial performance, and where they stand today.

We have organised the IPO performance into two categories, focusing on IPOs that provided at least a 50% listing day gain. We have also highlighted stocks that continue to outperform their listing day gains.

(source: chittorgarh)

Indian Renewable Energy Development Agency

Motisons Jewellers

Doms Industries

KRN Heat Exchanger and Refrigeration

Exicom Tele-Systems

Premier Energies

A manufacturer of integrated solar cells and panels, the stock debuted on September 3, 2024, with an 83.59% listing day gain. The stock has risen by 118.43% since its issue, achieving a market cap of ₹43,667 crore.

Waaree Energies

Listed on September 3, 2024, it is another player in solar cell and panel manufacturing. It mirrored Premier Energies’ performance with an 83.59% listing day gain and a current return of 118.43% over its issue price. The company’s market capitalisation stands at ₹43,667 crore.

TBO Tek

TBO Tek, an online B2B travel distribution platform, entered the market on May 15, 2024, with a 52.70% listing day gain. The stock has risen by 73.03% from its issue price, boasting a market cap of ₹17,017 crore.

Vibhor Steel Tubes Ltd leads this segment, listed on February 20, 2024, with an impressive 192.72% gain on the listing day, though its current return stands at 52.85% above the issue price.

BLS E-Services follows with a listing gain of 174.63% and a current return of 55.93%.

Tata Technologies IPO, launched on November 20, 2023, had an initial listing gain of 162.85% and now maintains a 92.41% return.

Bajaj Housing Finance, listed on September 16, 2024, gained 135.70% on its listing day and currently has an 84.88% return.

Unicommerce eSolutions, listed on August 13, 2024, debuted with a 94.49% gain and holds a 20.77% return.

Conclusion

The past year has been marked by remarkable IPOs, demonstrating varying performance trends in the stock market. Companies in renewable energy and technology sectors have generally outperformed, indicating a market interest aligned with industries poised for growth.

About The Author

Next Story