Market News

Bajaj Housing Finance Share Price Highlights: Stock settles at 10% upper circuit after listing at 114.2% premium on NSE

6 min read | Updated on February 16, 2026, 13:48 IST

SUMMARY

Bajaj Housing Finance Share Price Highlights: The initial public offering (IPO) was a fresh issue of shares of up to ₹3,560 crore and an offer-for-sale component of shares worth ₹3,000 crore by Bajaj Finance.

Stock list

Bajaj Housing Finance is a non-deposit-taking housing finance company (HFC) that provides financial solutions for buying and renovating residential and commercial properties.

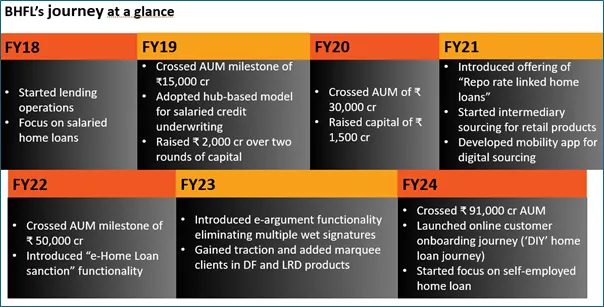

Between FY22 and FY24, Bajaj Housing Finance saw a CAGR (Compound annual growth rate) rise of 19.6% in its AUM (assets under management) and 34% in its profit. As of 30 June 2024, the gross non-performing assets (GNPA) ratio and net non-performing assets (NNPA) ratio had been at 0.28% and 0.11%, respectively. Meanwhile, around 75.5% of home loan AUM were from customers with a CIBIL score above 750 as of 30 June 2024.

- Traded volume (Lakhs): 6,325.24

- Traded value: ₹9,913.55 crore

- Total market capitalisation: ₹1,37,414.4 crore

According to Bajaj Housing Finance's red herring prospectus (RHP), the company is currently the second-largest housing finance company (HFC) in India, with assets under management (AUM) of ₹913.7 billion as of the financial year 2023-24, just behind LIC Housing Finance (₹2,868.4 billion AUM).

Bajaj Housing Finance recorded a 31% CAGR (for AUM) from 2022-2024 to become the fastest-growing HFC.

The share sale was executed to comply with the Reserve Bank of India's (RBI) regulations, which mandate upper-layer non-banking finance companies to be listed on stock exchanges by September 2025.

Bajaj Housing Finance has been identified and categorised as an "upper layer" NBFC by the RBI, and its comprehensive mortgage products include home loans, loans against property, lease rental discounting and developer financing.

- Current price: ₹157.9 (+5.3%)

- Open: ₹150

- Issue price: ₹70

- High: ₹161

- Low: ₹146

- Traded volume (Lakhs): 3,964.13

- Traded value: ₹6,114.2 crore

- Total market capitalisation: ₹1,30,442.7 crore

Proceeds from the fresh issue will be used to augment Bajaj Housing Finance's capital base to meet future capital requirements.

| Particulars | FY22 | FY23 | FY24 | Q1 FY25 |

|---|---|---|---|---|

| Revenue | ₹3,766 crore | ₹5,664 crore | ₹7,617 crore | ₹2,208 crore |

| Net Profit | ₹709 crore | ₹1,257 crore | ₹1,731 crore | ₹482 crore |

| Category | Number of times subscription |

|---|---|

| Qualified Institutional Buyers (QIBs) | 209.36 |

| Non-institutional investors | 41.51 |

| Retail Individual Investors (RIIs) | 7.04 |

| Total | 63.61 |

Bajaj Housing Finance shares will be listed on the NSE and the BSE on Monday at 10 am.

The qualified institutional buyers (QIBs) part attracted a staggering 209.36 times the subscription, while the non-institutional investors (NIIs) quota received 41.51 times the subscription. The category for retail investors (RIIs) obtained 7.04 times the subscription.

Prior to the IPO, Bajaj Housing Finance, which had set a price range of ₹66-₹70 per share, had raised ₹1,758 crore in the anchor round.

The IPO was a fresh issue of shares of up to ₹3,560 crore and an offer-for-sale (OFS) component of shares to the tune of ₹3,000 crore by parent Bajaj Finance.

The funds raised from the IPO will augment the capital base of the company to meet future capital requirements.

Bajaj Housing Finance Share Price: About the company

Bajaj Housing Finance is a non-deposit-taking housing finance company (HFC) that provides financial solutions for buying and renovating residential and commercial properties.

The book-running lead managers for the offer are SBI Capital Markets Ltd, Kotak Mahindra Capital Company Ltd, BofA Securities India Ltd, Goldman Sachs (India) Securities Private Ltd, JM Financial Ltd, and Axis Capital.

Related News

About The Author

Next Story