Market News

ATC Energies System IPO booked 53% on Day 1: Check issue size, price band, & more

.png)

4 min read | Updated on March 25, 2025, 17:19 IST

SUMMARY

ATC Energies System aims to raise ₹63.76 crore through its 100% book-built issue. The company has fixed the price band of the issue at ₹112 to ₹118 per share. The NSE SME IPO will close for bidding on March 27.

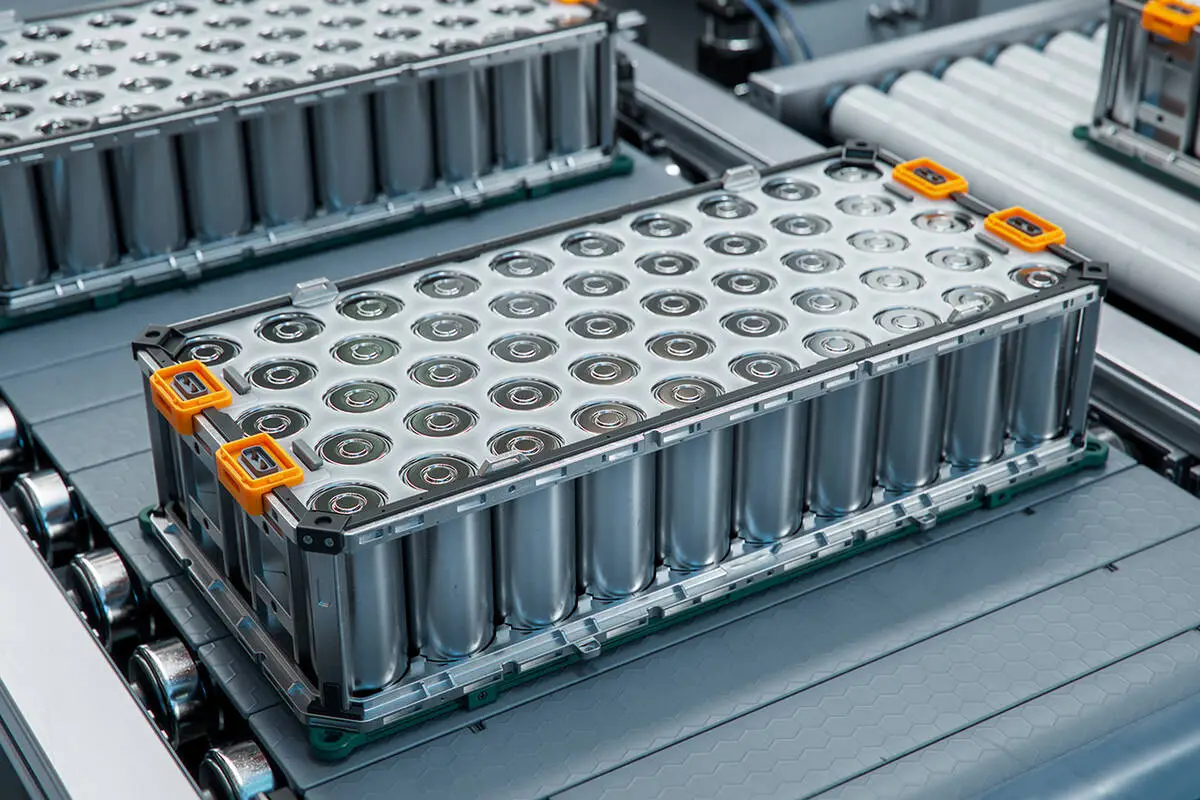

ATC Energies System raised ₹10.89 crore via its anchor investor round ahead of the IPO. | Image: Shutterstock

The initial public offering (IPO) of ATC Energies System Ltd opened for bidding on Tuesday, March 25, joining three other active issues, for which the subscription is in progress. However, the NSE SME issue witnessed a lukewarm response from investors on Day 1.

As of 5 pm on the first day, the IPO was subscribed on 53%. The IPO attracted bids for over 22 lakh shares against 42.09 lakh shares on offer, as per the NSE data.

The retail investors submitted applications for more than 13 lakh shares against 17.96 lakh shares set aside for them. The retail quota was booked 77%. The Non-Institutional Investors (NIIs) applied for only 3.7 shares compared to 17.96 lakh shares reserved for the segment. The Qualified Institutional Buyers (QIBs) category applied for 4.6 lakh shares against the allocation of 6.16 lakh shares.

Ahead of the launch of the issue, ATC Energies System also raised ₹10.89 crore via its anchor investor round. The board of directors of the company at its meetings held on March 24 finalised the allocation of almost 9.23 lakh equity shares to a total of four anchor investors at an allocation price of ₹108 per share.

The ATC Energies System IPO will close for bidding on Thursday, March 27.

ATC Energies System IPO details

ATC Energies System aims to raise ₹63.76 crore through its 100% book-built issue. The issue is a combination of a fresh issuance of 43.24 lakh shares, aggregating to ₹51.02 crore, and an offer-for-sale (OFS) of 10.8 lakh shares, aggregating to ₹12.74 crore.

The company has fixed the price band of the issue at ₹112 to ₹118 per share. The lot size, or the minimum bid quantity to apply for the issue, has been set at 1,200 shares. This translates into a minimum investment amount of over ₹1.41 lakh for retail investors (if bids are placed at the cut-off price) and ₹2.83 lakh for high networth investors (HNIs) who need to bid for a minimum of 2 lots.

ATC Energies System has appointed Indorient Financial Services Ltd as the book-running lead manager of the IPO, while Kfin Technologies Ltd is the registrar for the issue. The market maker for the ATC Energies System IPO is Alacrity Securities Ltd.

ATC Energies System IPO: Important dates

The ATC Energies System IPO will remain open for bidding from March 25 to March 27. After the bidding is closed, the allotment of shares is expected to be finalised on March 28.

Successful bidders can expect the shares to be credited to their Demat accounts by April 1, with others receiving refunds on the same day.

ATC Energies System shares are scheduled to be listed on the NSE Emerge platform on Wednesday, April 2.

ATC Energies System IPO: Use of proceeds

ATC Energies System proposes to utilise the net proceeds from the IPO mainly towards the repayment of loans and funding the company’s expansion plans.

In its red herring prospectus (RHP) submitted to the Securities and Exchange Board of India (Sebi), the company said that it plans to use nearly ₹9.5 crore of the IPO proceeds for repayment and/or pre-payment, in full, of the borrowing availed by the company with respect to purchase of the Noida factory. It also proposed to use ₹6.7 crore for funding the capital expenditure requirements towards refurbishment, civil and upgradation works at the Noida factory.

Another ₹7.5 crore would be earmarked for funding the capital expenditure requirement towards IT upgradation at the Noida factory, Vasai factory and the registered office. Meanwhile, as much as ₹9.5 crore would be used to fund the working capital requirements of the company, while the remaining amount would be used for general corporate purposes.

ATC Energies System IPO: About the company

Established in 1998, ATC Energies System is a leading manufacturer of rechargeable batteries. Its product range includes rechargeable lithium-ion batteries, electric vehicle lithium-ion batteries, lifepo4 lithium batteries and lithium-ion batteries, among other related products.

The company’s registered office is in Mumbai, while it has factories in Vasai, Thane and Noida. These factories house advanced equipment for battery assembly, including temperature chambers, welding systems, and testers.

ATC Energies System offers integrated energy storage solutions for industries like banking, automobiles, and other end users.

ATC Energies System IPO: Company financials

For the first six months of the current financial year 2024-25 ended September 2024, ATC Energies System reported revenue of ₹22.57 crore and a profit after tax (PAT) of ₹5.77 crore.

For the financial year 2023-24, the company reported revenue of ₹51.51 crore compared to ₹33.22 crore in FY 2022-23. Its net profit jumped to ₹10.89 crore in FY24 against ₹7.76 crore in FY23.

Related News

About The Author

Next Story