Market News

2025 sees a record number of IPOs, but is it the best year for IPOs? Check details

3 min read | Updated on November 21, 2025, 09:47 IST

SUMMARY

2025 saw 93 mainboard IPOs, more than the 76 seen in 2024. They raised ₹1.54 lakh crore in total, slightly surpassing the ₹1.53 lakh crore raised by mainboard IPOs last year. But barring a few exceptions like Groww and PhysicsWallah, 2025 IPOs witnessed lacklustre listing gains. Further, overall subscription numbers were also lower in 2025 as compared to 2024.

93 mainboard IPOs listed in 2025 till date, against 76 in 2024 in the same period.

Indian benchmark indices are yet to hit record-high levels, but the IPO market is buzzing with record numbers in 2025. The total number of mainboard issues till date has already crossed that seen in the previous year. Here is how data shows a different story

.png)

2025 has so far witnessed the 93 mainboard listings, including prominent names like HDB Financial Services, Tata Capital, Groww, and Lenskart, higher than 76 in the same period last year. However, the total amount raised through the 93 listings in 2025 was only slightly higher at ₹1.54 lakh crore as compared to ₹1.53 lakh crore for the same period in 2024. The record number of issues, with a modest increase in the issue size, indicates a softening of demand and a higher number of small to mid-ticket issue size IPOs.

Are investors losing excitement for IPOs

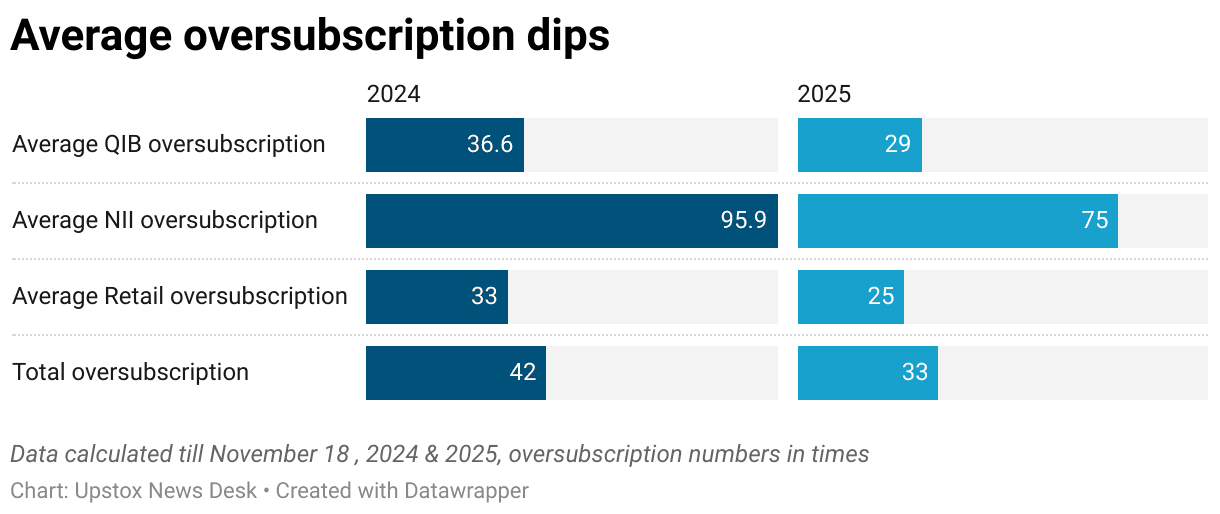

Contrary to the headlines, the enthusiasm for IPOs is showing a declining trend. The average oversubscription for 2025 has seen a significant drop from the preceding year. With 76 listings in 2024 till November, the average oversubscription figure stood at 42x, while the average oversubscription in 2025 dropped to 33x for the same period. This can primarily be attributed to a shift in investor sentiment towards the IPOs in 2025.

The 2024 IPO frenzy was driven by retail investors who flocked to every IPO, looking for a potential lottery-type gain via listings. As a result, the average oversubscription for the retail category in 2024 stood at 33x vs 25x for 2025. The lukewarm response from retail investors to the current IPO run was primarily due to multiple global and domestic headwinds and a lacklustre performance by the Indian markets in 2025.

Quick gains vanish

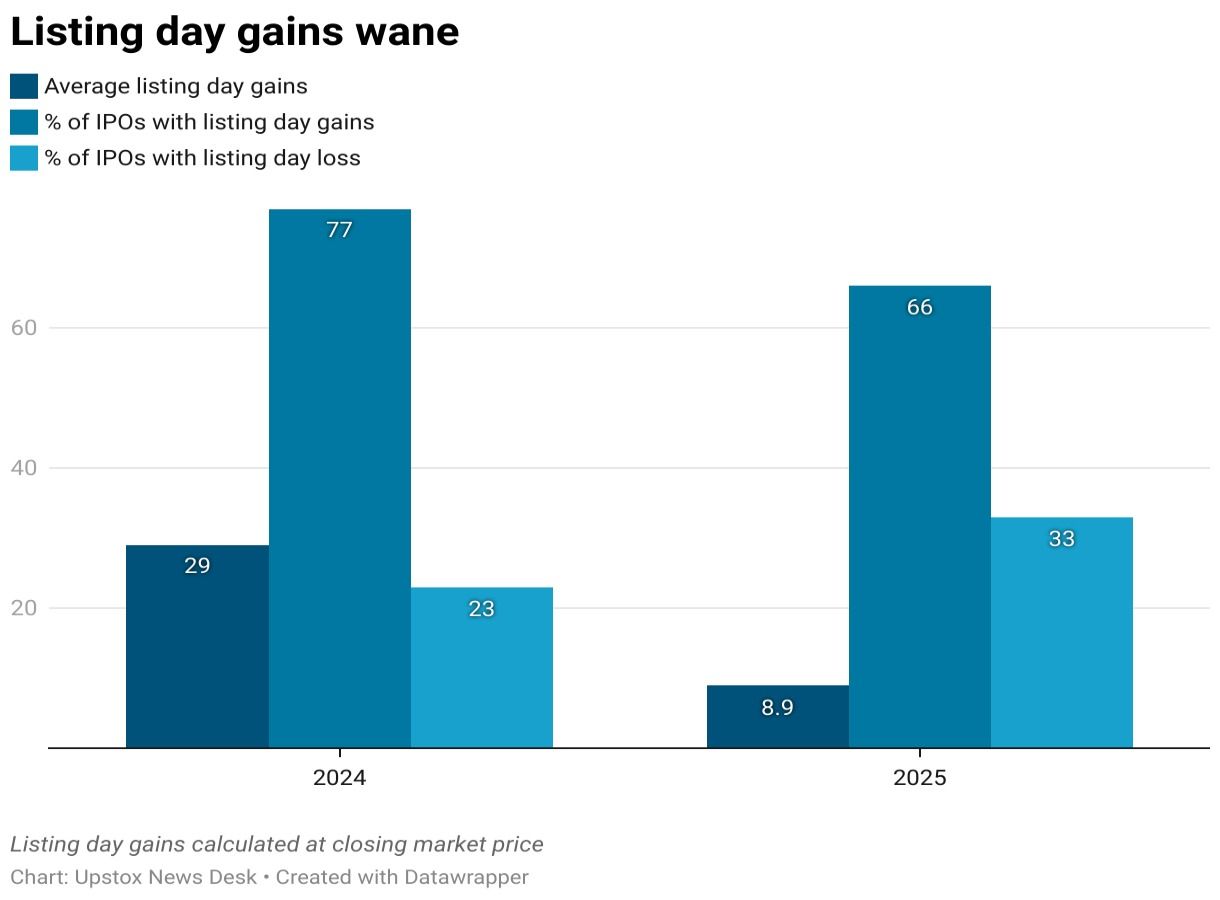

Following the sharp drop in the oversubscription numbers, investors also refrained from follow-up buying on the listing day for most IPOs in 2025. The average listing day gains for overall mainboard IPOs dropped to 8.4% from 29% in 2024. Additionally, 66% of the IPOs closed with listing day gains in 2025 vs 77% in 2024, while 33% of the IPOs closed with listing day losses vs 23% in 2024. Experts believe falling grey market premiums (GMP), a higher proportion of offer-for-sale could be contributing factors to this trend.

In conclusion

In summary, while the IPO markets look buzzing on the surface, the underlying parameters indicate a softening demand for new issues. The latest trend also shows that IPOs are becoming an easy exit for private players and promoters at rich valuations, leaving very little growth potential for incoming shareholders. Additionally, a lower share of fresh capital raising suggests slower economic expansion activity. As the 2025 IPO season comes to an end with a few more issues expected in the week ahead, investors expect the 2026 IPO season to offer a better value proposition at the right price.

About The Author

Next Story