Market News

Planning to invest in silver ETFs? Know this key aspect about their pricing

3 min read | Updated on October 14, 2025, 14:54 IST

SUMMARY

The sharp rally in silver has led to euphoric demand for silver ETFs in India, which has spiked the premium of ETFs over their iNAVs, making the ETFs a costlier option. Experts believe the supply shortage is not a permanent phenomenon and could soon reverse, which potentially leads to losses for investors.

The net asset value of an ETF is the true accounting value of the underlying asset. Image source: Shutterstock.

Gold and Silver are the only assets that have glittered in 2025 to date, with 55% and 81% returns, respectively. The performance of precious metals in comparison to equities has been far superior, as NIFTY50 has delivered mid-single-digit returns in the same period. Naturally, investors are now turning towards gold and silver following the bumper returns. Some are piling on physical gold, while others are hoarding digital forms of assets like ETFs (Exchange Traded Fund) or active funds. The latest AMFI data showed exponential growth in ETF inflows in recent months. But is this the right time to invest in gold and silver? Are you also planning to buy gold and silver through ETFs?

How are ETFs priced?

ETFs, or exchange-traded funds, are basically funds that replicate the returns of the underlying asset. The ETFs are traded in units issued by the asset management companies or the issuer companies. These companies buy physical silver or gold from the market and deliver it to stock exchanges, and get units in return for the physical silver or gold, which are then sold to investors at the net asset value. The net asset value is the true accounting or fair value of the underlying asset, like gold or silver. The net asset value per share is the total value of the underlying assets after deducting liabilities per share. Similarly, the iNAV or the indicative net asset value per unit or share, is the estimated price of a unit at the current market price of the asset per share.

Why do ETFs trade at a premium or discount?

ETFs are tradable on the stock exchanges like shares of companies. The traded price is determined by the demand and supply of ETF units on a particular day. When there is a huge demand for ETFs, the traded price per unit goes into a premium over the iNAV.

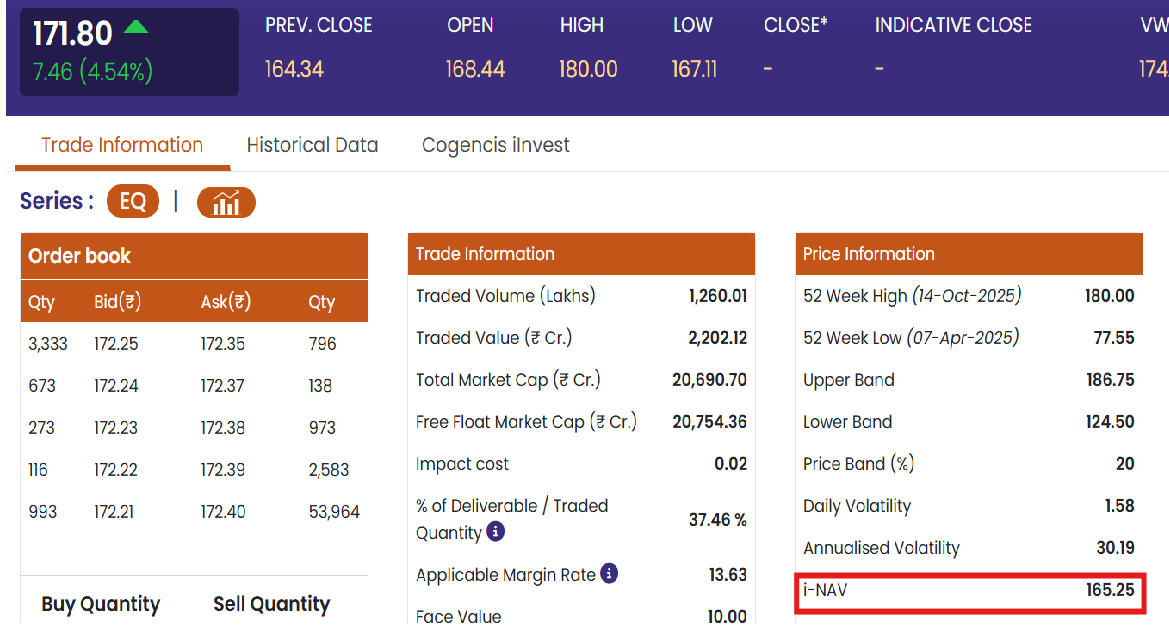

For example, the current traded price for Nippon India Silver ETF is ₹172 per unit, while the indicative net asset value of the ETF is ₹165 per unit, which indicates a huge demand for silver ETFs and less supply. Similarly, ETFs trade at a discount when there is a huge supply of units against less demand.

What should investors do while buying ETFs

Considering the sharp rally in gold and silver prices, ETFs are the cheapest way of investing in gold and silver and participating in the rally. The fear of missing out on the rally has led to a huge demand-supply gap in the ETFs, which has led to sharp premiums to the net asset value of the ETFs. The current situation for the premium in silver ETFs is due to the global shortage of physical silver. If the shortage continues, the premium in prices could continue to drive the ETF prices higher. However, the supply shortage situation does not last longer and thus the premium in the ETF prices could be reduced, and soon the prices could trade near the net asset value of the ETF, and one could end up paying an extra price for the same asset. Hence, investors must evaluate the risks associated with buying ETFs at premium price

Related News

About The Author

Next Story