Market News

Zomato Q2 Results Highlights: Net profit soars 389% to ₹176 crore, revenue up 68.5%

.png)

6 min read | Updated on October 22, 2024, 16:43 IST

SUMMARY

Zomato Q2 Results Highlights: Food delivery platform Zomato Ltd reported a 388.8% increase in its consolidated net profit to ₹176 crore in Q2 FY25, compared to ₹36 crore in the same quarter year ago.

Stock list

Zomato is a restaurant aggregator and food delivery company.

- Revenue: ₹4,799 crore, up 68.5% YoY

- Net profit: ₹176 crore, up 388.8% YoY

- EBITDA: ₹226 crore vs -₹47 crore in Q2 FY24

- Board approves ₹8,500 crore fundraising via QIP

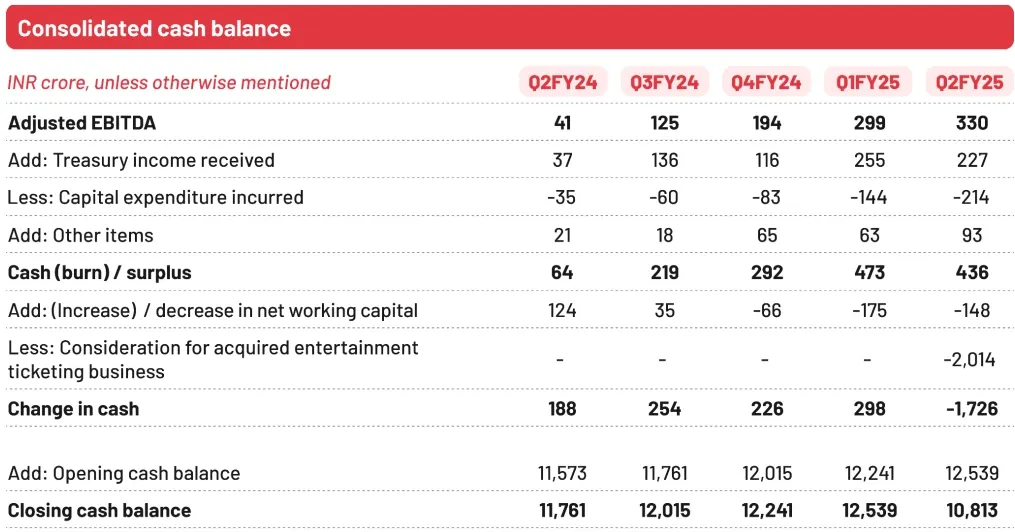

On company's plan to raise ₹8,500 crore via QIP, Zomato CEO Deepinder Goyal said, "Zomato’s consolidated annualised (quarterly*4) Adjusted Revenue has grown 4x in a period of about three years - from ₹4,640 crore at the time of our IPO in July 2021 to ₹20,508 crore now (Q2 FY25 annualised). In the same time period, our cash balance has reduced from ₹14,400 crore to about ₹10,800 crore (mainly on account of funding past quick commerce losses and some equity investments and acquisitions). While the business is now generating cash (vis-a-vis a loss-making business at the time of IPO), we believe that we need to enhance our cash balance given the competitive landscape and the much larger scale of our business today."

He reiterated that the quick commerce business continues to operate at near adjusted EBITDA break-even, food delivery business margins continue to remain steady, and there is also no plan for any minority investments or acquisitions.

"The fundraise is meant to strengthen our balance sheet at this point," Goyal said.

The food aggregator's cash balance was reduced by ₹1,726 crore compared to the previous quarter on account of the deal consideration (of ₹2,014 crore) for the acquisition of Paytm’s entertainment ticketing business.

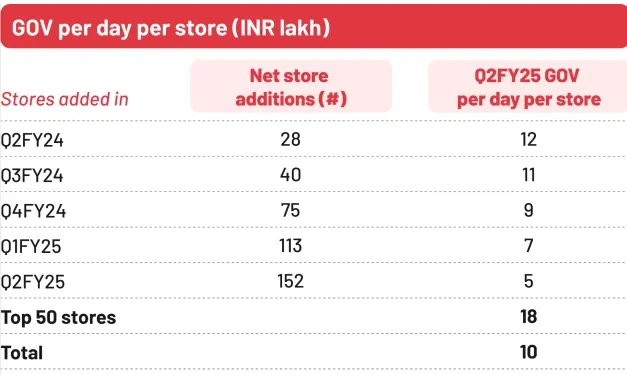

Albinder Dhindsa, co-founder and CEO of Blinkit, said, "The best metric to measure relative performance of stores is to compare the GOV per day per store. When we serve our customers well in an area, it translates into more GOV from the same store. New stores are now reaching ₹7 lakh of GOV per day in the first full quarter post launch (at which level they reach Contribution break-even)."

Akshant Goyal, CFO of Zomato, said, "Gross order value (GOV) across our B2C businesses improved to 55% YoY (14% QoQ) at ₹17,670 crore in Q2FY25. On a like-for-like basis (excluding the impact of the acquisition of Paytm’s entertainment ticketing business) GOV growth was 53% YoY (13% QoQ)."

- Food delivery GOV grew 21% YoY (5% QoQ)

- Quick commerce GOV grew 122% YoY (25% QoQ)

- Going-out GOV grew 171% YoY (46% QoQ); like-for-like GOV grew 139% YoY (29% QoQ)

On the profitability front, consolidated Adjusted EBITDA increased by ₹289 crore YoY to ₹330 crore in Q2 FY25 driven by improvement in margins across all our businesses.

- Current price: ₹254.6 (- 4.1%)

- Open: ₹267

- High: ₹270.9

- Low: ₹254.5

- Kaushik Dutta, Chairman & Independent Director

- Deepinder Goyal, Founder, MD and CEO

- Sanjeev Bikhchandani, Non-Executive Director

- Sutapa Banerjee, Independent Director

- Namita Gupta, Independent Director

- Gunjan Tilak Raj Soni, Independent Director

- Aparna Popat Ved, Independent Director

- Traded volume (Lakhs): 270.38

- Traded value: ₹721.53 crore

- Total market capitalisation: ₹2,32,476.58 crore

- Free float market cap: ₹1,63,560.73 crore

- Current price: ₹264.1 (- 0.6%)

- Open: ₹267

- High: ₹270.9

- Low: ₹263

Zomato Q2 results: Net profit, revenue expected to jump substantially

The food delivery giant is expected to report a sharp increase in revenue and net profit for the latest July-September quarter.

According to analysts, Zomato's revenue will likely surge by 65% to 80% year-on-year (YoY) between ₹4,644 crore and ₹5,111.1 crore in Q2 FY25.

The profit after tax (PAT) is expected to grow 700% YoY between ₹290 crore to ₹350 crore.

Zomato results: How the company performed in Q1 FY25

In the first quarter of the financial year 2024-25, Zomato posted a 74% YoY increase in consolidated revenue to ₹4,206 crore. Sequentially, revenue increased 18%.

Net profit stood at ₹253 crore in Q1 FY25, up from ₹2 crore reported in Q1 FY24. During the quarter, the food delivery platform's gross order value or GOV rose by 53% to ₹15,455 crore.

About The Author

Next Story