Market News

Will Dixon Technologies deliver strong Q2 earnings? Check options strategy and key technical levels

.png)

4 min read | Updated on October 17, 2025, 09:19 IST

SUMMARY

Dixon Technologies is set to announce its results for the second quarter on 17 October 2025. Investors will be looking out for signs of margin improvement and growth across key segments. Technically, the stock remains within a broad descending channel, with resistance near ₹18,200 and support around ₹14,000.

Stock list

Dixon Technologies open interest data for 28 October expiry has the highest call and put options base at 17,000 strike.

Dixon Technologies, an electronic manufacturing services provider, will announce its results for the September quarter on Friday, 17 October 2025.

In the same quarter last year, Dixon Technologies reported revenue of ₹11,534 crore, with a net profit of ₹412 crore. In the previous quarter, the company reported revenue of ₹12,836 crore with a net profit of ₹280 crore.

Last month, Dixon Technologies entered into a share subscription and purchase agreement with Q Technology (Singapore) Private Limited and Kunshan Q Technology International Limited, acquiring a 51% stake. The ₹552.99 crore deal will be executed through a mix of share purchase and subscription agreements.

This acquisition aims to strengthen Dixon’s manufacturing capabilities in camera and fingerprint modules for mobile handsets, Internet of Things (IoT) systems, and automotive applications.

According to management, the company aims to significantly increase margins across categories. The display component segment is expected to deliver double-digit margins, while camera module margins could rise from 7–7.5% to 9–9.5% over the next two to three fiscal years.

Deeper manufacturing integration and the associated benefits of the Production Linked Incentive (PLI) and Electronic Component Manufacturing Scheme (ECMS) could support the company’s overall business.

Ahead of the Q2 results announcement on Thursday, 16 October, Dixon Technologies closed at ₹16,844, up 0.4%. So far this year, the company has delivered negative returns to investors of -6.5%.

Technical view

Dixon is trading within a broad descending channel and has repeatedly been rejected by the downward-sloping trendline near ₹17,800–₹18,200. This zone has acted as a strong supply area since early 2025, preventing a breakout.

On the downside, however, the stock continues to hold above its support around ₹14,000–₹13,500, closer to its 50-week EMA (₹15,299). Price action suggests that the stock is currently consolidating between ₹13,500 and ₹18,000, awaiting a directional move.

The weekly 21-EMA (₹16,530) is currently under test, which indicates short-term weakness following a sharp rise from the lows of mid-2025. A weekly close below ₹16,300 could lead to a pullback towards ₹15,000, whereas a breakout above ₹18,200 might trigger momentum towards ₹19,500–₹20,000.

.webp)

Options outlook

The open interest data of Dixon Technologies for 28 October expiry has the highest call and put options base at 17,000 strike, hinting at consolidation around this zone.

Meanwhile, the at-the-money strike of Dixon Technologies as of 17 October is at 17,000 strike and is priced at ₹915. This indicates that the options market is pricing a ±5.4% move ahead of 28 October expiry.

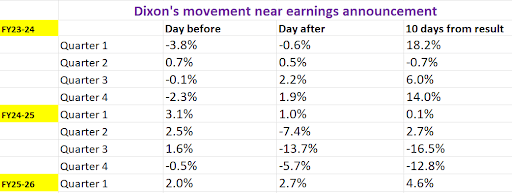

To plan an options strategy, it's important to review how Dixon Technologies has historically reacted to past earnings announcements.

Options strategy for Dixon Technologies

With the options market pricing in a potential move of ±5.4%, traders could consider straddle strategies to capitalise on the expected volatility of Dixon Technologies.

A long straddle involves buying an at-the-money (ATM) call and put option with the same strike price and expiry date. This strategy generates profits when the stock price moves sharply in either direction, beyond the implied ±5.4% range.

Conversely, a short straddle involves selling both an ATM call and put option with the same strike price and expiry date. This approach works best when the stock remains range-bound, moving by less than ±5.4% before expiry. This allows the trader to benefit from time decay and low volatility.

About The Author

Next Story