Market News

Vedanta Q3 results: Net profit may surge up to 60% YoY, supported by higher metal prices; check key technical levels

.png)

4 min read | Updated on January 29, 2026, 09:05 IST

SUMMARY

Vedanta Q3 results will be announced on 29 January 2026. Earnings are expected to remain strong, driven by record production across key businesses such as aluminium and zinc. Higher output, improved operational efficiency, and favourable global metal prices are likely to contribute to a significant year-on-year increase in profits.

Stock list

Vedanta share price remains in a strong uptrend, trading above 21-day and 50-day exponential moving averages (EMAs). | Image: Shutterstock

Oil-to-metals conglomerate Vedanta Ltd is set to unveil its Q3 earnings on Thursday, 29 January 2026. Ahead of the announcement, Vedanta released its Q3 business update earlier this month.

The company reported record output across multiple businesses. In aluminium, it recorded its highest ever quarterly production at 620 kilotonnes (up 1% year on year), and alumina production at 794 kilotonnes (up 57% year on year). This high level of production was supported by the commissioning of Train II at the Lanjigarh refinery and by improved operational efficiency at the Jharsuguda facility.

Meanwhile, Zinc India reported its highest-ever third-quarter production of mined metal at 276 kilotonnes (up 4% YoY), refined metal at 270 kilotonnes (also up 4%), and saleable silver at 158 tonnes (down 1% YoY).

According to experts, Vedanta could report a rise in consolidated revenue of between 6.5% and 7.2% YoY, reaching ₹41,660 to ₹41,890 crore, while its net profit could increase by between 53% and 60% YoY, reaching ₹5,430 to ₹5,640 crore. In Q3FY25, Vedanta reported revenue of ₹39,115 crore and net profit of ₹3,547 crore.

Ahead of the Q3 results announcement, shares of Vedanta closed 4.4% higher at ₹736. So far this month, Vedanta shares have risen by over 21% amid a substantial increase in the prices of precious and base metals in global markets.

Technical outlook

Vedanta remains in a strong uptrend, with prices reaching a fresh all-time high and trading well above the 21-day and 50-day exponential moving averages (EMAs). The recent sharp momentum, ongoing buying interest, and the rising slope of the short-term moving averages confirm the strength of the short-term trend. The stock is also trading well above its 200-day EMA, which keeps the medium-term outlook positive.

On the downside, the ₹600–₹590 zone is likely to provide immediate support, with a stronger base forming near ₹535–₹540. Any dips towards these levels could prompt buying interest.

Options outlook

The at-the-money (ATM) strike for Vedanta's 24 February expiry is 740, with a combined option premium of 63. This implies that the market is anticipating a move of about ±8.6% from the closing price on 28 January.

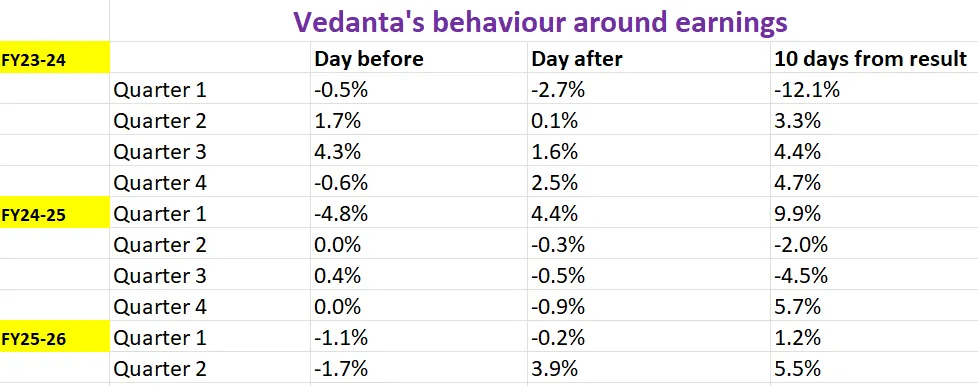

Let’s examine how Vedanta has reacted to its quarterly earnings announcements over the past two years to gain insights into its price movements.

Options strategy for Vedanta

Given the implied move of ±8.6% from the options data, traders can initiate either a long or short volatility trade, taking into account the price movement. To trade based on volatility, a trader can take a Long or Short Straddle route.

Straddles are the options strategies that are primarily used on the basis of volatility. In simple terms, in a Long Straddle, a trader can buy an ATM call and a put option of the same strike and expiry of Vedanta, looking for a move of more than ±8.6% on either side.

On the other hand, the short straddle capitalises on the fall in volatility. In a short straddle, a trader sells both the ATM call and a put option of the same strike and expiry. This strategy is deployed when the trader believes that the price of Vedanta after the earnings will be confined in a range of ±8.6%.

Additionally, traders expecting further bullish momentum can consider directional spreads such as the bull put spread and the bull call spread.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story