Market News

Trent Q2 results: Revenue likely to see double-digit growth, profit to remain weak; check options strategy and key technical levels

.png)

4 min read | Updated on November 07, 2025, 10:48 IST

SUMMARY

Trent, the Tata Group-owned retailer behind Westside and Zudio, is set to announce its Q2 FY26 results today. Analysts are expecting steady double-digit revenue growth and a modest rise in profit. Despite store expansion and healthy topline growth, same-store sales are likely to remain flat due to sluggish discretionary demand.

Stock list

Options market for Trent implies a potential price movement of around ±6.5%. | Image: Shutterstock

Trent, the parent company of Zudio and Westside, is set to announce its Q2 FY26 results today. The company is expected to report steady, double-digit revenue growth, with net profit likely to see low single-digit growth.

In its quarterly business update, the Tata Group company reported a 17% year-on-year (YoY) increase in standalone revenue to ₹5,002 crore, and a total of 1,101 stores (261 Westside, 806 Zudio, and 34 stores across other lifestyle concepts). During the quarter, the company opened 40 Zudio stores and 13 Westside stores.

According to experts, the Tata Group-owned company could report standalone revenue growth of between 18% and 23% YoY, reaching between ₹4,800 crore and ₹5,005 crore. The company registered revenue of ₹4,036 crore in Q2 FY25, compared to ₹4,781 crore in the previous quarter.

Meanwhile, Trent's net profit could rise by 6–9% YoY to ₹449–462 crore. Trent's net profit was ₹423 crore in the September quarter of FY25, as well as in the previous quarter. Same-store sales growth (SSSG) is likely to remain flat amid weak demand, rising competition and slower discretionary spending.

Investors will be looking to key performance metrics such as same-store sales growth, EBITDA margins, and management's commentary on future growth estimates and the overall demand outlook, particularly in urban areas.

Ahead of the Q2 results announcement on 6 November, Trent ended the day 0.4% higher at ₹4,679. So far this year, Trent has fallen by over 34% due to moderation in topline growth compared to market expectations.

Technical view

Trent has been in a corrective phase following a sharp rally that peaked at around ₹7,500 earlier this year. On the weekly chart, the stock has been consolidating near the support zone between ₹4,500 and ₹4,650, an area that has provided strong support on multiple occasions. However, the downward slope of both the 21- and 50-week EMAs suggests that the short-term trend remains weak unless there is a decisive close above ₹5,300.

On the upside, the stock faces a significant supply zone between ₹5,800 and ₹6,200, a region that previously acted as a breakdown area. A sustained move above this level could signal a trend reversal. Currently, the broader structure appears to be trending sideways to bearish, with the next major support level located near the 200-week EMA at ₹3,875.

Options build-up

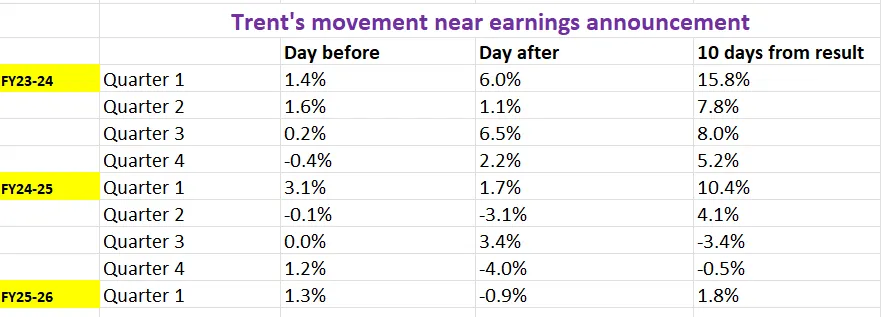

On 7 November, the options market for Trent implied a potential price movement of around ±6.5% ahead of the expiry on 25 November, as reflected by the build-up of open interest and the pricing of at-the-money straddles. This suggests that traders are anticipating increased volatility around the earnings release. Before considering option strategies to capitalise on this expected movement, let's examine how Trent has behaved historically during past earnings periods.

Options strategies for Trent

With the market anticipating a potential move of ±6.5% for Trent before 25 November, volatility-based strategies are in focus. A long straddle, buying both an at-the-money (ATM) call and put, targets big swings in either direction. If Trent breaks out beyond the ±6.5% threshold, this strategy could be profitable.

Conversely, if you expect Trent to remain stable, a short straddle could be effective. This involves selling the same at-the-money (ATM) call and put options, banking on the stock staying within that (±6.5%) range. It's an approach which anticipates decline in volatility, but it carries a higher risk if the market becomes too volatile.

If you have a directional bias, whether bullish or bearish — spreads offer a better risk profile. A bull call spread (buying a low strike call and selling a higher strike call) limits both cost and potential profit, but is suitable for steady price increases. Similarly, a bear put spread (buy a higher strike put and sell a lower strike put) limits risk and return, offering a more conservative approach.

About The Author

Next Story