Market News

Titan Q2 results: Net profit expected to rise 40% YoY on strong jewellery sales; check options strategy and key technical levels

.png)

4 min read | Updated on November 03, 2025, 10:12 IST

SUMMARY

Titan Company is set to announce its results for the September quarter (Q2 FY26) on 3 November 2025, with analysts expecting a robust performance led by its jewellery division. Investors will focus on management’s commentary regarding demand trends amid rising gold prices, same-store sales growth, and segmental margins.

Stock list

Titan has once again tested the long-term descending trendline resistance around the ₹3,780–₹3,800 zone. | Image: Shutterstock

Titan Company is set to unveil its September quarter results on 3 November 2025. The company is expected to report robust quarterly figures, driven by double-digit revenue growth across various business sectors.

According to the company's quarterly business update, the jewellery segment is expected to report a 19% year-on-year increase in revenue. This is due to substantial increases in average transaction value, which offset the marginal decline in buyer numbers caused by surging gold prices.

Meanwhile, Titan's other businesses, such as watches and eyecare, are expected to report growth of 12% and 9% respectively. During the quarter, the Tata Group company opened 55 new stores across its different verticals, bringing its total store count to 3,377.

According to experts, Titan’s standalone Q2 revenue could rise by 14–15% YoY to ₹16,640–16,790 crore, and sequentially by 1–2%. Net profit could rise by 38–43% YoY to ₹975–1,010 crore, but could fall by 7–10% compared to the previous quarter. The base quarter (Q2FY25) was impacted by one-time inventory adjustment due to custom cut.

Titan reported revenue of ₹14,534 crore in Q2 FY25, compared to ₹16,523 crore in the previous quarter. Meanwhile, its net profit was ₹704 crore in Q2 FY25 and ₹1,091 crore in Q2 FY26.

During the quarterly results announcement, investors will be watching management's commentary on the demand outlook amid a substantial rise in gold prices. Key metrics such as same-store sales growth (SSSG), revenue growth, and the margins of different segments will also be closely monitored.

Ahead of the Q2 results announcement, Titan shares ended the session at ₹3,746, down 0.1%. So far this year, Titan stock has delivered a return of over 15% to its shareholders.

Technical view

Titan has once again tested the long-term descending trendline resistance around the ₹3,780–₹3,800 zone. This level has capped the stock’s upside multiple times over the past year and formed a mild bullish candle near this key resistance zone.

The 21-week exponential moving average (EMA) (₹3,558) and the 50-week EMA (₹3,469) have both turned upwards, suggesting that medium-term momentum is strengthening. However, a decisive trend reversal would require Titan to deliver a sustained close above ₹3,800. A breakout above this level could signal strength.

On the downside, the ₹3,300–₹3,350 zone remains a strong area of support, aligning with prior swing lows and the base of the ascending channel. As long as this support holds, the overall structure will remain constructive.

Options outlook

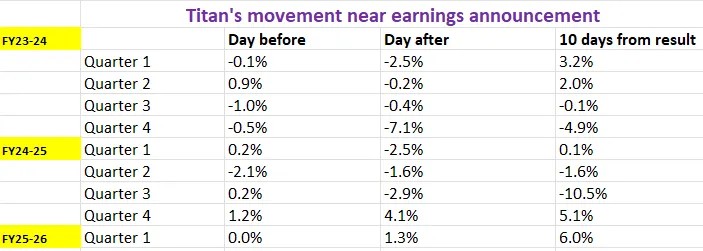

As of 2 November, the at-the-money (ATM) strike for Titan’s 25 November expiry stands at 3,760, with both the call and put options trading at ₹181. This pricing reflects an implied move of approximately ±4.8% by expiry. To assess how this expected move compares, let’s examine Titan’s stock performance around its earnings announcements over the past nine quarters.

Options strategy for Titan

The options market is anticipating a potential move of ±4.8% for Titan. Traders looking to benefit from this anticipated volatility could consider long or short volatility strategies; straddles are a popular choice here.

A long straddle involves buying both at-the-money call and put options with the same strike price and expiry date. This strategy is profitable if the stock price moves by more than 4.8%.

In contrast, a short straddle involves selling both the ATM call and put options. This approach profits when the stock remains within the implied range post-earnings, benefiting from time decay and a drop in implied volatility.

For those with a directional bias, spreads offer a more targeted approach. With resistance near ₹3,800 and support zone of ₹3,700, traders with a bullish view might consider a bull put spread, while those expecting downside break can look for a bear call spread.

About The Author

Next Story